Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 Pan Company purchased 500(exclusive VAT 10%) of merchandise from Lan company, FOB destination, freight cost: 20(exclusive VAT 10%) was paid by cash in

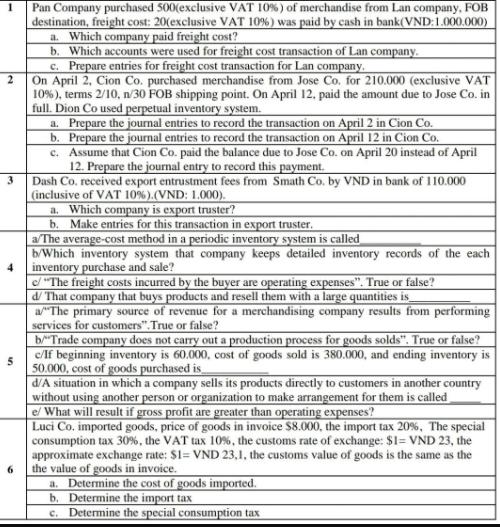

1 Pan Company purchased 500(exclusive VAT 10%) of merchandise from Lan company, FOB destination, freight cost: 20(exclusive VAT 10%) was paid by cash in bank(VND:1.000.000) a. Which company paid freight cost? b. Which accounts were used for freight cost transaction of Lan company. c. Prepare entries for freight cost transaction for Lan company. On April 2, Cion Co. purchased merchandise from Jose Co. for 210.000 (exclusive VAT 10% ), terms 2/10, n/30 FOB shipping point. On April 12. paid the amount due to Jose Co. in full. Dion Co used perpetual inventory system. a. Prepare the journal entries to record the transaction on April 2 in Cion Co. b. Prepare the journal entries to record the transaction on April 12 in Cion Co. c. Assume that Cion Co. paid the balance due to Jose Co. on April 20 instead of April 12. Prepare the journal entry to record this payment. Dash Co. received export entrustment fees from Smath Co. by VND in bank of 110.000 (inclusive of VAT 10%).(VND: 1.000). a. Which company is export truster? b. Make entries for this transaction in export truster. a/The average-cost method in a periodic inventory system is called b/Which inventory system that company keeps detailed inventory records of the each inventory purchase and sale? c/"The freight costs incurred by the buyer are operating expenses". True or false? d/ That company that buys products and resell them with a large quantities is "The primary source of revenue for a merchandising company results from performing services for customers".True or false? bTrade company does not carry out a production process for goods solds". True or false? Af beginning inventory is 60.000, cost of goods sold is 380.000, and ending inventory is 50.000, cost of goods purchased is d/A situation in which a company sells its products directly to customers in another country without using another person or organization to make arrangement for them is called e/ What will result if gross profit are greater than operating expenses? Luci Co, imported goods, price of goods in invoice S8.000, the import tax 20%, The special consumption tax 30%, the VAT tax 10%, the customs rate of exchange: $1= VND 23, the approximate exchange rate: $1= VND 23,1, the customs value of goods is the same as the the value of goods in invoice. a. Determine the cost of goods imported. b. Determine the import tax c. Determine the special consumption tax 2. 3 6.

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

You can se...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started