Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On February 1, 2021, Nikawi Ltd. issued a 4.5%, 8-year bond with a face value of $450,000. The semi-annual interest (coupon) payments are made on

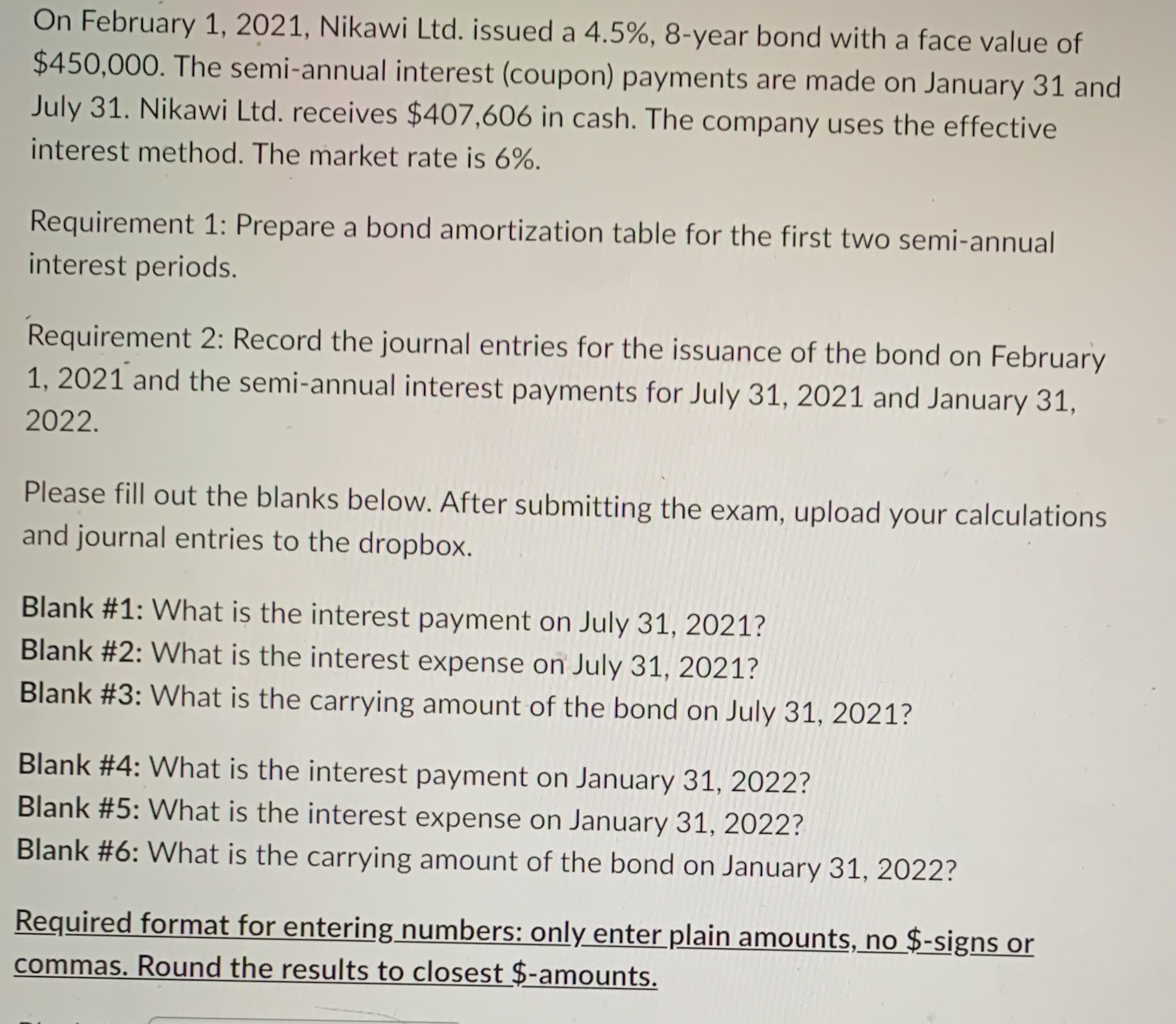

On February 1, 2021, Nikawi Ltd. issued a 4.5\%, 8-year bond with a face value of $450,000. The semi-annual interest (coupon) payments are made on January 31 and July 31. Nikawi Ltd. receives $407,606 in cash. The company uses the effective interest method. The market rate is 6%. Requirement 1: Prepare a bond amortization table for the first two semi-annual interest periods. Requirement 2: Record the journal entries for the issuance of the bond on February 1, 2021 and the semi-annual interest payments for July 31, 2021 and January 31, 2022. Please fill out the blanks below. After submitting the exam, upload your calculations and journal entries to the dropbox. Blank \#1: What is the interest payment on July 31, 2021? Blank \#2: What is the interest expense on July 31, 2021? Blank \#3: What is the carrying amount of the bond on July 31, 2021? Blank \#4: What is the interest payment on January 31, 2022? Blank \#5: What is the interest expense on January 31, 2022? Blank \#6: What is the carrying amount of the bond on January 31, 2022? Required format for entering numbers: only enter plain amounts, no $-signs or commas. Round the results to closest $-amounts

On February 1, 2021, Nikawi Ltd. issued a 4.5\%, 8-year bond with a face value of $450,000. The semi-annual interest (coupon) payments are made on January 31 and July 31. Nikawi Ltd. receives $407,606 in cash. The company uses the effective interest method. The market rate is 6%. Requirement 1: Prepare a bond amortization table for the first two semi-annual interest periods. Requirement 2: Record the journal entries for the issuance of the bond on February 1, 2021 and the semi-annual interest payments for July 31, 2021 and January 31, 2022. Please fill out the blanks below. After submitting the exam, upload your calculations and journal entries to the dropbox. Blank \#1: What is the interest payment on July 31, 2021? Blank \#2: What is the interest expense on July 31, 2021? Blank \#3: What is the carrying amount of the bond on July 31, 2021? Blank \#4: What is the interest payment on January 31, 2022? Blank \#5: What is the interest expense on January 31, 2022? Blank \#6: What is the carrying amount of the bond on January 31, 2022? Required format for entering numbers: only enter plain amounts, no $-signs or commas. Round the results to closest $-amounts Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started