Answered step by step

Verified Expert Solution

Question

1 Approved Answer

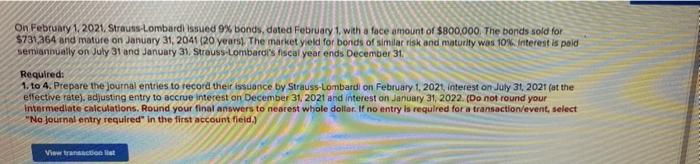

On February 1, 2021 Strauss-Lombardi issued 9% bonds, doted February 1, with a face amount of $800,000. The bonds sold for $731364 and mature on

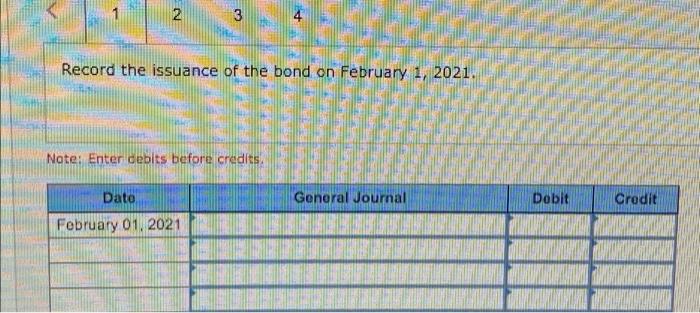

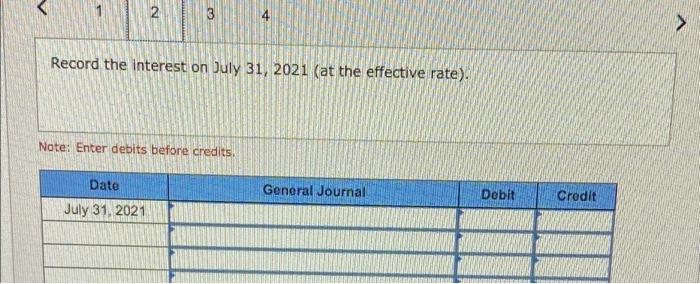

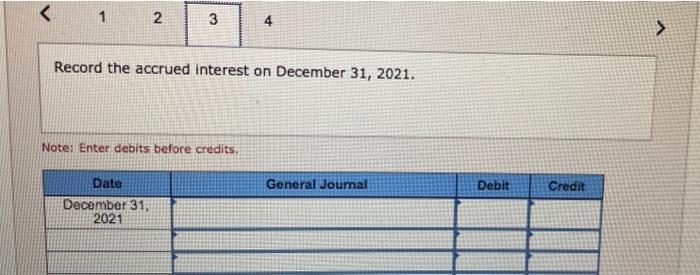

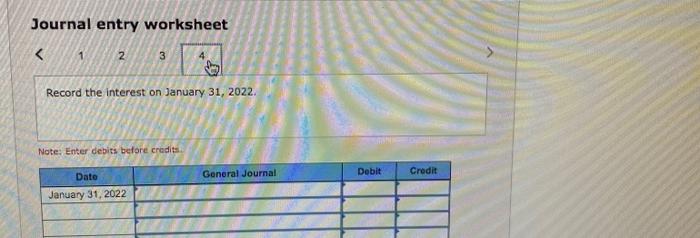

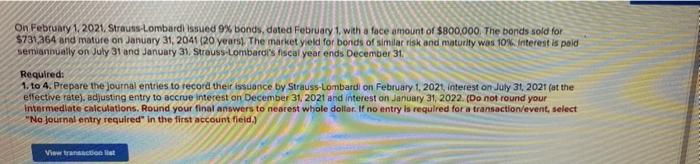

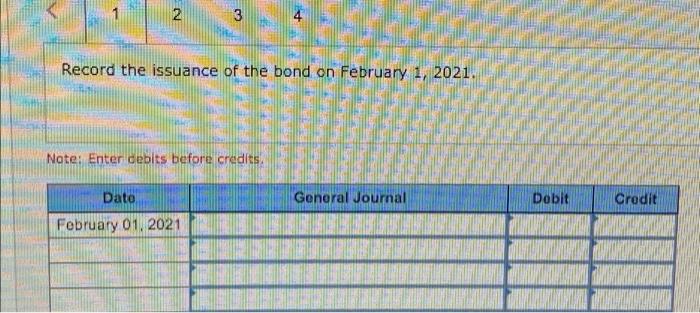

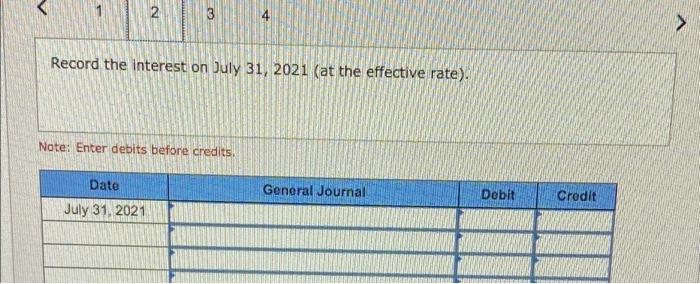

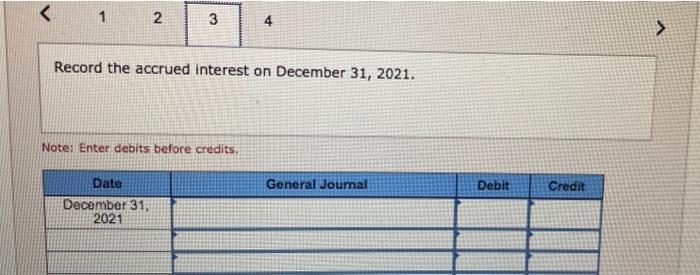

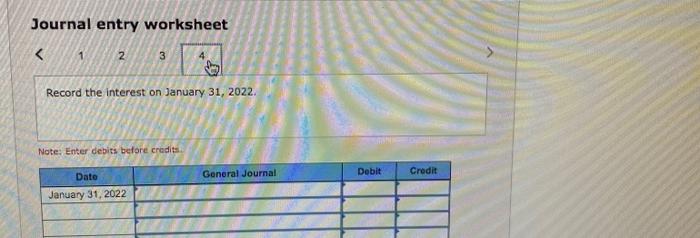

On February 1, 2021 Strauss-Lombardi issued 9% bonds, doted February 1, with a face amount of $800,000. The bonds sold for $731364 and mature on January 31, 2041 20 years. The market yield for bonds of similar risk and maturity was 10%. Interest is paid semiannually on July 31 and January 31, Strauss-Lombard's fiscal year ends December 31 Required: 1. to 4. Prepare the Journal entries to record their issuance by Strauss-Lombard on February 1, 2021, interest on July 31, 2021 (at the effective rate). adjusting entry to accrue interest on December 31, 2021 and interest on January 31, 2022. (Do not round your intermediate calculations. Round your final answers to nearest whole dollar. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transactions N 3 Record the issuance of the bond on February 1, 2021. Note: Enter debits before credits. Dato General Journal Dobit Credit February 01, 2021 N 2 3 Record the interest on July 31, 2021 (at the effective rate). Note: Enter debits before credits Date General Journal Dobit Credit July 31, 2021 Record the accrued interest on December 31, 2021. Note: Enter debits before credits, General Journal Debit Credit Date December 31, 2021 Journal entry worksheet

On February 1, 2021 Strauss-Lombardi issued 9% bonds, doted February 1, with a face amount of $800,000. The bonds sold for $731364 and mature on January 31, 2041 20 years. The market yield for bonds of similar risk and maturity was 10%. Interest is paid semiannually on July 31 and January 31, Strauss-Lombard's fiscal year ends December 31 Required: 1. to 4. Prepare the Journal entries to record their issuance by Strauss-Lombard on February 1, 2021, interest on July 31, 2021 (at the effective rate). adjusting entry to accrue interest on December 31, 2021 and interest on January 31, 2022. (Do not round your intermediate calculations. Round your final answers to nearest whole dollar. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transactions N 3 Record the issuance of the bond on February 1, 2021. Note: Enter debits before credits. Dato General Journal Dobit Credit February 01, 2021 N 2 3 Record the interest on July 31, 2021 (at the effective rate). Note: Enter debits before credits Date General Journal Dobit Credit July 31, 2021 Record the accrued interest on December 31, 2021. Note: Enter debits before credits, General Journal Debit Credit Date December 31, 2021 Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started