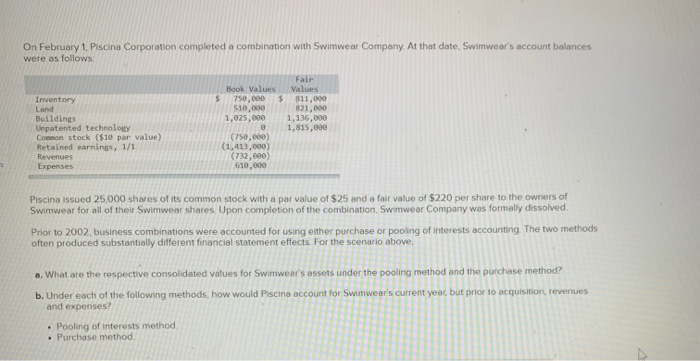

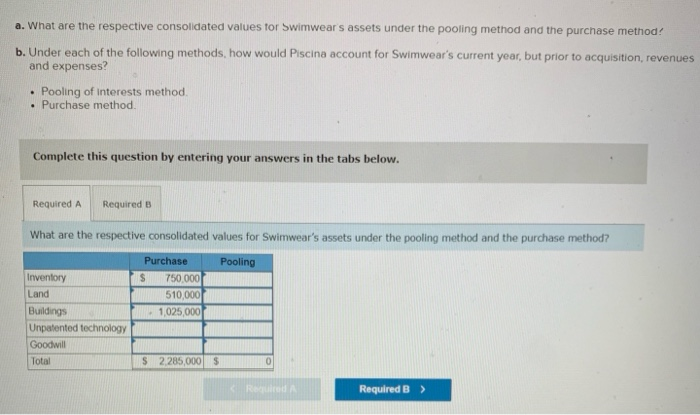

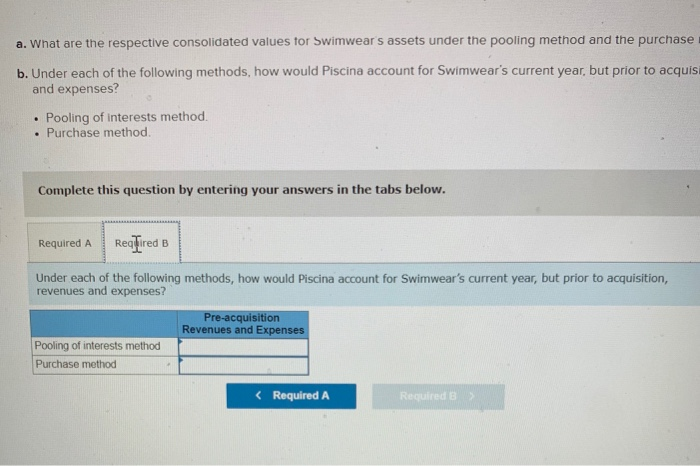

On February 1, Piscina Corporation completed a combination with Swimwear Company At that date. Swimwear's account balances were as follows Inventory Land Buildings Unpatented technology Common stock ($10 par value) Retained earnings, 1/1 Revenues Expenses Fair Book Values Values $ 750,000 $ 811.000 510,000 821,000 1,025,000 1,136,000 1,815,000 (750,000) (1,413,600) (732,000) 610,000 Piscina issued 25,000 shares of its common stock with a par value of $25 and a fair value of $220 per share to the owners of Swimwear for all of their Swimwear shares. Upon completion of the combination, Swimwear Company was formally dissolved. Prior to 2002, business combinations were accounted for using either purchase or pooling of interests accounting. The two methods often produced substantially different financial statement effects. For the scenario above, a. What are the respective consolidated values for Swimwear's assets under the pooling method and the purchase method? b. Under each of the following methods, how would Piscina account for Swimwear's current year, but prior to acquisition, revenues and expenses? Pooling of interests method Purchase method a. What are the respective consolidated values for Swimwear's assets under the pooling method and the purchase method b. Under each of the following methods, how would Piscina account for Swimwear's current year, but prior to acquisition, revenues and expenses? Pooling of interests method Purchase method . . Complete this question by entering your answers in the tabs below. Required A Required B What are the respective consolidated values for Swimwear's assets under the pooling method and the purchase method? Pooling Purchase $ 750.000 510,000 - 1,025,000 Inventory Land Buildings Unpatented technology Goodwill Total S 2.285,000 $ 0 RO Required B > a. What are the respective consolidated values for Swimwear's assets under the pooling method and the purchase b. Under each of the following methods, how would Piscina account for Swimwear's current year, but prior to acquis and expenses? Pooling of interests method. Purchase method . Complete this question by entering your answers in the tabs below. Required A Required B Under each of the following methods, how would Piscina account for Swimwear's current year, but prior to acquisition, revenues and expenses? Pre-acquisition Revenues and Expenses Pooling of interests method Purchase method