On February 12, 2020, Mr. Josh, Ms. Lori, and Mr. New entered into a partnership together. Respectively, Mr. Josh contributed 100K, Ms. Lori 250K,

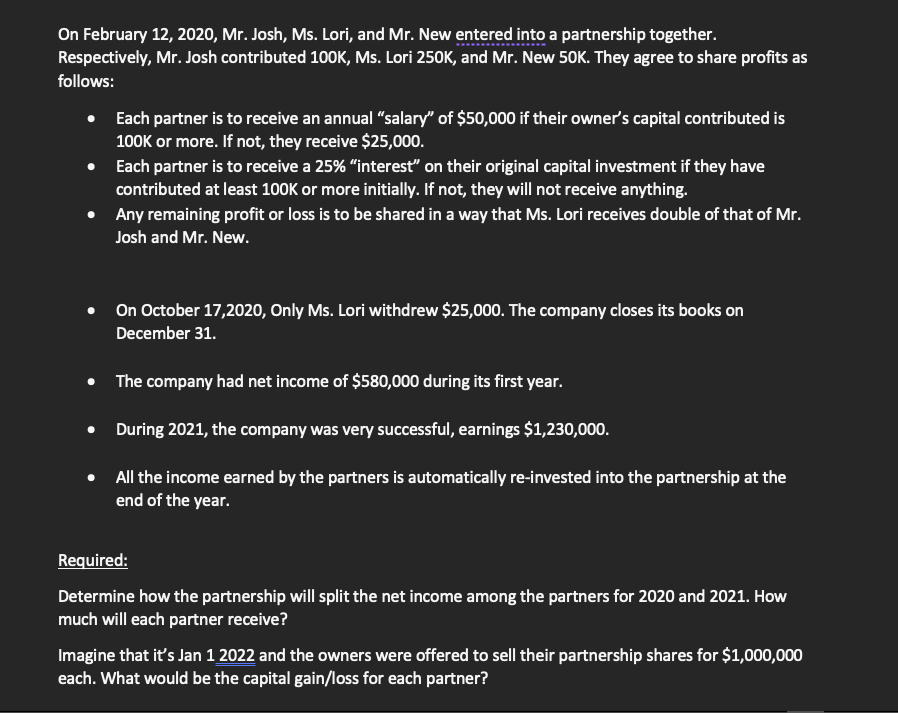

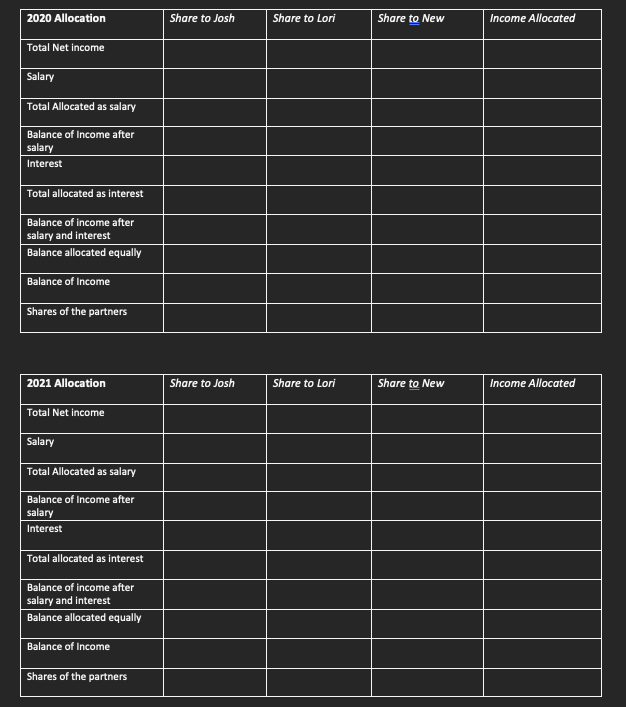

On February 12, 2020, Mr. Josh, Ms. Lori, and Mr. New entered into a partnership together. Respectively, Mr. Josh contributed 100K, Ms. Lori 250K, and Mr. New 50K. They agree to share profits as follows: Each partner is to receive an annual "salary" of $50,000 if their owner's capital contributed is 100K or more. If not, they receive $25,000. Each partner is to receive a 25% "interest" on their original capital investment if they have contributed at least 100K or more initially. If not, they will not receive anything. Any remaining profit or loss is to be shared in a way that Ms. Lori receives double of that of Mr. Josh and Mr. New. On October 17,2020, Only Ms. Lori withdrew $25,000. The company closes its books on December 31. The company had net income of $580,000 during its first year. During 2021, the company was very successful, earnings $1,230,000. All the income earned by the partners is automatically re-invested into the partnership at the end of the year. Required: Determine how the partnership will split the net income among the partners for 2020 and 2021. How much will each partner receive? Imagine that it's Jan 1 2022 and the owners were offered to sell their partnership shares for $1,000,000 each. What would be the capital gain/loss for each partner? 2020 Allocation Total Net income Salary Total Allocated as salary Balance of Income after salary Interest Total allocated as interest Balance of income after salary and interest Balance allocated equally Balance of Income Shares of the partners 2021 Allocation Total Net income Salary Total Allocated as salary Balance of Income after salary Interest Total allocated as interest Balance of income after salary and interest Balance allocated equally Balance of Income Shares of the partners Share to Josh Share to Josh Share to Lori Share to Lori Share to New Share to New Income Allocated Income Allocated c) Tracking Owner's Capital Initial Investment Net income of 2020 (from part a) Withdrawals Balance at Jan 1 2021 Net income 2021 (from part b) Withdrawals Balance at of Jan 1 2022 Josh Lori New Total On February 12, 2020, Mr. Josh, Ms. Lori, and Mr. New entered into a partnership together. Respectively, Mr. Josh contributed 100K, Ms. Lori 250K, and Mr. New 50K. They agree to share profits as follows: Each partner is to receive an annual "salary" of $50,000 if their owner's capital contributed is 100K or more. If not, they receive $25,000. Each partner is to receive a 25% "interest" on their original capital investment if they have contributed at least 100K or more initially. If not, they will not receive anything. Any remaining profit or loss is to be shared in a way that Ms. Lori receives double of that of Mr. Josh and Mr. New. On October 17,2020, Only Ms. Lori withdrew $25,000. The company closes its books on December 31. The company had net income of $580,000 during its first year. During 2021, the company was very successful, earnings $1,230,000. All the income earned by the partners is automatically re-invested into the partnership at the end of the year. Required: Determine how the partnership will split the net income among the partners for 2020 and 2021. How much will each partner receive? Imagine that it's Jan 1 2022 and the owners were offered to sell their partnership shares for $1,000,000 each. What would be the capital gain/loss for each partner? 2020 Allocation Total Net income Salary Total Allocated as salary Balance of Income after salary Interest Total allocated as interest Balance of income after salary and interest Balance allocated equally Balance of Income Shares of the partners 2021 Allocation Total Net income Salary Total Allocated as salary Balance of Income after salary Interest Total allocated as interest Balance of income after salary and interest Balance allocated equally Balance of Income Shares of the partners Share to Josh Share to Josh Share to Lori Share to Lori Share to New Share to New Income Allocated Income Allocated c) Tracking Owner's Capital Initial Investment Net income of 2020 (from part a) Withdrawals Balance at Jan 1 2021 Net income 2021 (from part b) Withdrawals Balance at of Jan 1 2022 Josh Lori New Total

Step by Step Solution

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a 2020 Allocation Total Net income 580000 Salary Josh and Lori 50000 New 25000 Total Salary 50000 50000 25000 125000 Balance after salary 580...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started