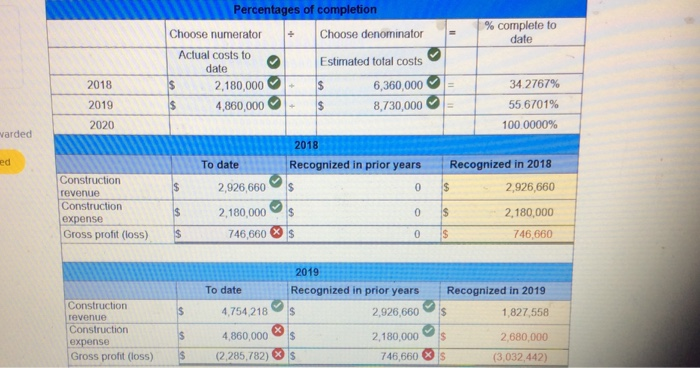

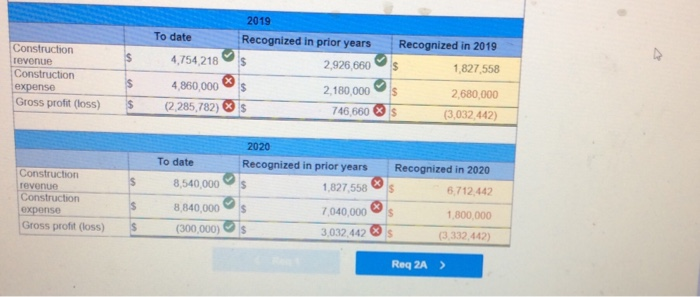

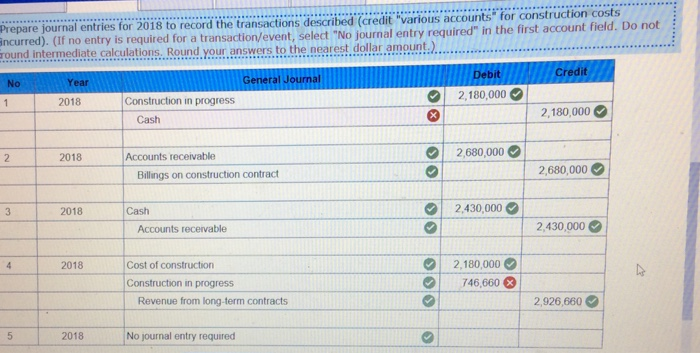

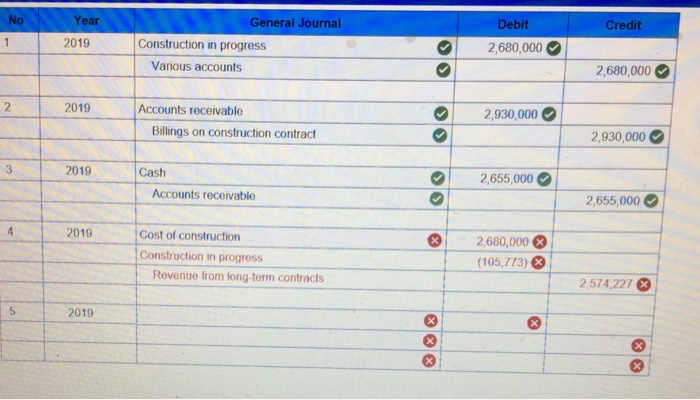

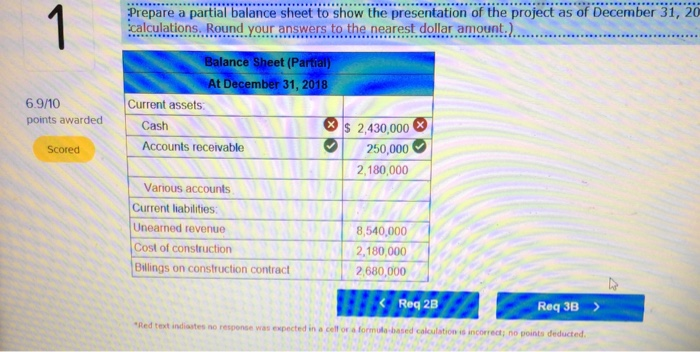

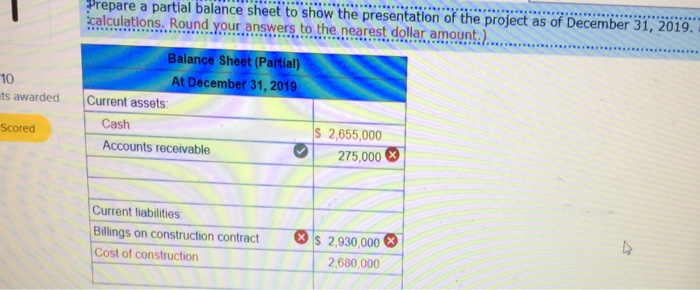

On February 1.2018, Arrow Construction Company entered into a three-year construction contract to build a bridge for a of $8.540,000. During 2018, costs of $2.180,000 were incurred with estimated costs of $4,180,000 yet to be incurre Billings of $2.680,000 were sent, and cash collected was $2.430,000 In 201 9, costs Incurred were $2.680,000 with remaining costs estimated to be $3,870,000. 2019 billings were $2.930,000 and $2.65 5,000 cash was collected. The project was completed in 2020 after additional costs of $3,980,000 were incurred, The company's fiscal year-end is December 31. Arrow recognizes revenue over time according to percentage of completion Required ompute the amount of revenue and gross profit or loss to be recognized in 2018, 2019, and 2020 using the percentage s of completion method? 20. Prepare journal entries for 2018 to record the transactions described (credit various accounts" for construction costs incurred) 2b. Prepare journal entrie incurred) 3n. Prepare a partial s for 2019 to record the transactions described (credit "various accounts" for construction costs balance sheet to show the oresentation of the prolect as of December 31. 2018. Required: 1. Compute the amount of revenue and gross profit or loss to be recognized in 2018, 2019, and 2020 using the percentage of completion method? 2a. Prepare journal entries for 2018 to record the transactions described (credit 'various accounts" for construction costs incurred). 2b, Prepare journal entries for 2019 to record the transactions described (credit various accounts' for construction costs incurred) 3a. Prepare a partial balance sheet to show the presentation of the project as of December 31, 2018 3b. Prepare a partial balance sheet to show the presentation of the project as of December 31, 2019 Percentages of completion % complete to date Choose numerator | | Choose denominator I Estimated total costs 6,360,000 |= Actual costs toEstimated to date 2018 2019 2020 $ 2,180,000 S 4,860,000S 34 276796 556701% 100 000096 4,000,0000- s 8,730,000 arded 2018 ed To date Construction revenue Construction expense Gross profit (loss) $ 2,926,660S 2,180,000s 746,660 S Recognized in prior yearsRecognized in 2018 2,926,660 2,180,000 746,660 2019 Recognized in prior years To date Construction revenue Construction expense Gross profit (loss) ,754218s 4,860,000S (2,285,782) s Recognized in 2019 1,827,558 2,680,000 (3,032,442) 2,926,660S 2,180,000 746,660 2019 Recognized in 2019 1,827,558 2,680,000 (3,032,442) To date Recognized in prior years Construction revenue Construction 754,218 2926,660s 4,860,000 180,000S Gross profit (loss) (2,285,782)s 746,660 s 2020 Recognized in 2020 6,712,442 1,800,000 3,332 442) To date Recognized in prior years Construction revenue Construction expense Gross profit (loss) 8,540,000 8,840,000 Gross proft loss)(300,000) 827,558s 040,000s 3032 442 3s Req 2A p ibed (credit ivarious accounts for construction costs Prepare journal entries for 2018 to record the transactions dec no entry is required for a transaction/event, select "No journal entry required in the first account field. Do not ntermediate calculations. Round your.answers,to the nearest dollar.amount.) Debit Credit No Year Gerneral Journal 2,180,000 2018 Construction in progress 2,180,000 Cash 2 680,000 C 2018 Accounts receivable Billings on construction contract 2,680,000 2,430,000 ol 2018 Cash Accounts receivable 2,430,000 2,180,000 746,660 2018 Cost of construction Construction in progress Revenue from long-term contracts 2,926,660 2018 No journal entry required Debit Credit No Year General Journal 2019 Construction in progress 2,680,000 2680,000 Various accounts 2 2019 Accounts receivable 2,930,000 2,930,000 Billings on construction contract 2019 Cash 01 2,655,000 Accounts receivable 2,655,000 3 2,680,000 (105,773) 2019 Cost of construction Construction in progress 574,227 Revenue from long-tern contracts 2019 rptial balance sheet to show the presentation of the project as of December 3i, 20 Balance Sheet (Partial) At December 31, 2018 6.9/10 points awarded Current assets S 2,430,000 250,000 2,180,000 Cash Scored Accounts receivable Various accounts Current liabilities Unearned revenue Cost of construction Bilings on construction contract 8,540,000 2,180,000 2,680,000 Req 2B Req 3B text indiastes no response was expected in a celf or a formula-based calculation it incorrect, no points deducted repare a partial balance sheet to show the presentation of the project as of December 31, 2019. Balance Sheet (Partial) At December 31,2019 10 ts awarded Current assets: Scored Cash Accounts receivable S 2,655,000 275,000 Current liabilities Billings on construction contract Cost of construction 2,930,000 8 2,680,000