Answered step by step

Verified Expert Solution

Question

1 Approved Answer

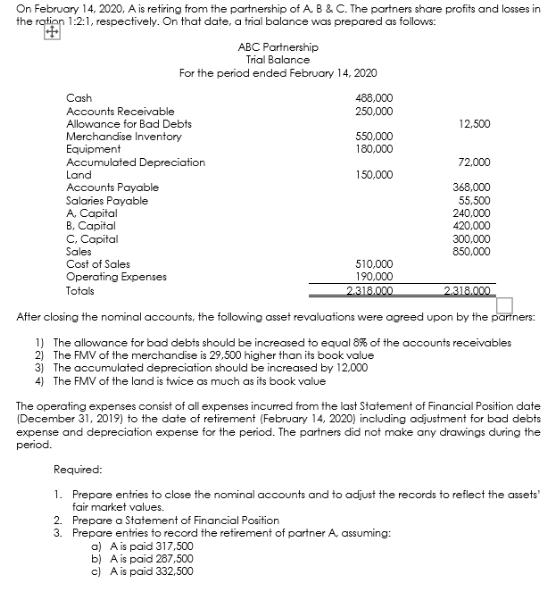

On February 14, 2020, A is retiring from the partnership of A. B & C. The partners share profits and losses in ABC Partnership

On February 14, 2020, A is retiring from the partnership of A. B & C. The partners share profits and losses in ABC Partnership Trial Balance For the period ended February 14, 2020 Cash 488,000 250,000 Accounts Receivable Allowance for Bad Debts Merchandise Inventory Equipment Accumulated Depreciation Land 12.500 550,000 180,000 72,000 150,000 Accounts Payable Salaries Payable A, Capital B, Capital C, Copital Sales Cost of Sales Operating Expenses Totals 368,000 55,500 240,000 420.000 300,000 850,000 510,000 190,000 2.318.000 2.318.000 After closing the nominal accounts, the following asset revaluations were agreed upon by the partners: 1) The allowance for bad debts should be increased to equal 8% of the accounts receivables 2) The FMV of the merchandise is 29,500 higher than its book value 3) The accumulated depreciation should be increased by 12,000 4) The FMV of the land is twice as much as its book value The operating expenses consist of all expenses incurred from the last Statement of Financial Position date (December 31, 2019) to the date of retirement (February 14, 2020) including adjustment for bad debts expense and depreciation expense for the period. The partners did not make any drawings during the period. Required: 1. Prepare entries tao close the nominal accounts and to adjust the records to reflect the assets' fair market values. 2. Prepare a Statement of Financial Position 3. Prepare entries to record the retirement of partner A assuming: a) Ais paid 317,500 b) A is paid 287,500 c) Ais paid 332,500

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

DISCUSSION This problem is an example of Partnership Dissolution due to a withdrawal of an existing ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started