Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On February 15, 2023, Lakefront Corp, with a year-end of December 31, purchssed 325,000 of the voting common shares in Ski Boat Co. for $2,800,000.

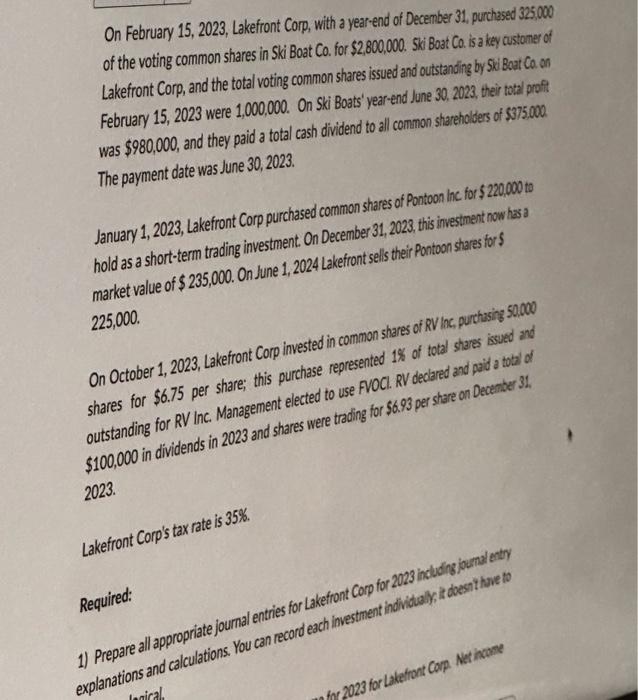

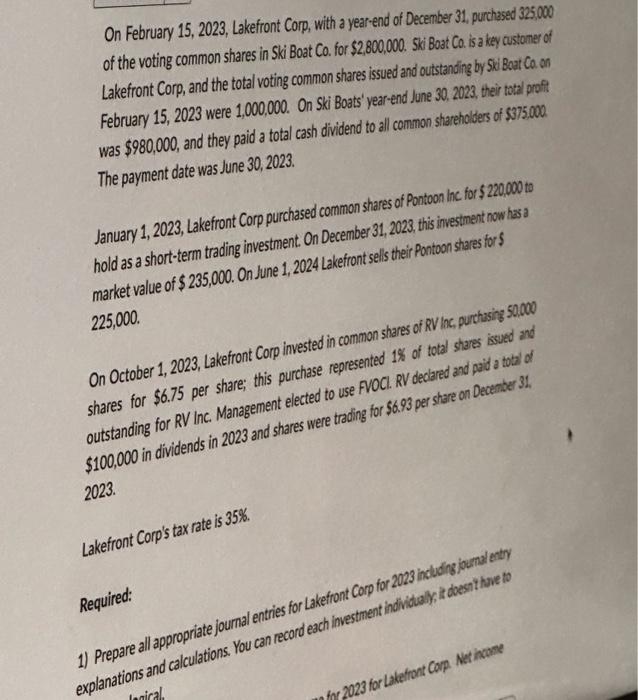

On February 15, 2023, Lakefront Corp, with a year-end of December 31, purchssed 325,000 of the voting common shares in Ski Boat Co. for $2,800,000. Ski Boat Co. is a key custoner of Lakefront Corp, and the total voting common shares issued and outstanding by 5 Bat Co. on February 15, 2023 were 1,000,000. On Ski Boats' year-end June 30, 2023, their total preit was $980,000, and they paid a total cash dividend to all common sharehalders of $375,000. The payment date was June 30,2023. January 1, 2023, Lakefront Corp purchased common shares of Pontoon inc for $220,000 to hold as a short-term trading investment. On December 31,2023 , this investment now has a market value of $235,000. On June 1,2024 lakefront sells their Pontoon shares for $ On October 1, 2023, Lakefront Corp invested in common shares of RV Inc, purchasing 50,000 225,000 . shares for $6.75 per share; this purchase represented 1% of total shares issued and outstanding for RV Inc. Management elected to use FVOCI. RV decared and paid a tobal of $100,000 in dividends in 2023 and shares were trading for $6.93 per share on Decenther 31. 2023. Lakefront Corp's tax rate is 35%. 1) Prepare all appropriate joumal entries for Lakefront corp for 2023 induding jounal ontor explanations and calculations. You can record each investment individualy, in doessit the to Required: On February 15, 2023, Lakefront Corp, with a year-end of December 31, purchssed 325,000 of the voting common shares in Ski Boat Co. for $2,800,000. Ski Boat Co. is a key custoner of Lakefront Corp, and the total voting common shares issued and outstanding by 5 Bat Co. on February 15, 2023 were 1,000,000. On Ski Boats' year-end June 30, 2023, their total preit was $980,000, and they paid a total cash dividend to all common sharehalders of $375,000. The payment date was June 30,2023. January 1, 2023, Lakefront Corp purchased common shares of Pontoon inc for $220,000 to hold as a short-term trading investment. On December 31,2023 , this investment now has a market value of $235,000. On June 1,2024 lakefront sells their Pontoon shares for $ On October 1, 2023, Lakefront Corp invested in common shares of RV Inc, purchasing 50,000 225,000 . shares for $6.75 per share; this purchase represented 1% of total shares issued and outstanding for RV Inc. Management elected to use FVOCI. RV decared and paid a tobal of $100,000 in dividends in 2023 and shares were trading for $6.93 per share on Decenther 31. 2023. Lakefront Corp's tax rate is 35%. 1) Prepare all appropriate joumal entries for Lakefront corp for 2023 induding jounal ontor explanations and calculations. You can record each investment individualy, in doessit the to Required

On February 15, 2023, Lakefront Corp, with a year-end of December 31, purchssed 325,000 of the voting common shares in Ski Boat Co. for $2,800,000. Ski Boat Co. is a key custoner of Lakefront Corp, and the total voting common shares issued and outstanding by 5 Bat Co. on February 15, 2023 were 1,000,000. On Ski Boats' year-end June 30, 2023, their total preit was $980,000, and they paid a total cash dividend to all common sharehalders of $375,000. The payment date was June 30,2023. January 1, 2023, Lakefront Corp purchased common shares of Pontoon inc for $220,000 to hold as a short-term trading investment. On December 31,2023 , this investment now has a market value of $235,000. On June 1,2024 lakefront sells their Pontoon shares for $ On October 1, 2023, Lakefront Corp invested in common shares of RV Inc, purchasing 50,000 225,000 . shares for $6.75 per share; this purchase represented 1% of total shares issued and outstanding for RV Inc. Management elected to use FVOCI. RV decared and paid a tobal of $100,000 in dividends in 2023 and shares were trading for $6.93 per share on Decenther 31. 2023. Lakefront Corp's tax rate is 35%. 1) Prepare all appropriate joumal entries for Lakefront corp for 2023 induding jounal ontor explanations and calculations. You can record each investment individualy, in doessit the to Required: On February 15, 2023, Lakefront Corp, with a year-end of December 31, purchssed 325,000 of the voting common shares in Ski Boat Co. for $2,800,000. Ski Boat Co. is a key custoner of Lakefront Corp, and the total voting common shares issued and outstanding by 5 Bat Co. on February 15, 2023 were 1,000,000. On Ski Boats' year-end June 30, 2023, their total preit was $980,000, and they paid a total cash dividend to all common sharehalders of $375,000. The payment date was June 30,2023. January 1, 2023, Lakefront Corp purchased common shares of Pontoon inc for $220,000 to hold as a short-term trading investment. On December 31,2023 , this investment now has a market value of $235,000. On June 1,2024 lakefront sells their Pontoon shares for $ On October 1, 2023, Lakefront Corp invested in common shares of RV Inc, purchasing 50,000 225,000 . shares for $6.75 per share; this purchase represented 1% of total shares issued and outstanding for RV Inc. Management elected to use FVOCI. RV decared and paid a tobal of $100,000 in dividends in 2023 and shares were trading for $6.93 per share on Decenther 31. 2023. Lakefront Corp's tax rate is 35%. 1) Prepare all appropriate joumal entries for Lakefront corp for 2023 induding jounal ontor explanations and calculations. You can record each investment individualy, in doessit the to Required

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started