Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On February 20, 2012, Angel AG acquired all common stock of Mark AG. The book value of Mark AG's net assets was equal to

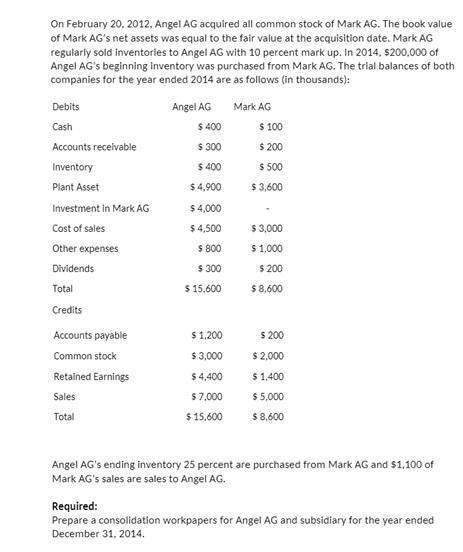

On February 20, 2012, Angel AG acquired all common stock of Mark AG. The book value of Mark AG's net assets was equal to the fair value at the acquisition date. Mark AG regularly sold inventories to Angel AG with 10 percent mark up. In 2014, $200,000 of Angel AG's beginning inventory was purchased from Mark AG. The trial balances of both companies for the year ended 2014 are as follows (in thousands): Debits Cash Accounts receivable Inventory Plant Asset Investment in Mark AG Cost of sales Other expenses Dividends Total Credits Accounts payable Common stock Retained Earnings Sales Total Angel AG $ 400 $ 300 $ 400 $4,900 $ 4,000 $4,500 $ 800 $ 300 $ 15,600 $ 1,200 $ 3,000 $ 4,400 $ 7,000 $15,600 Mark AG $ 100 $.200 $ 500 $3,600 $ 3,000 $ 1,000 $ 200 $ 8,600 $ 200 $ 2,000 $1,400 $ 5,000 $ 8,600 Angel AG's ending inventory 25 percent are purchased from Mark AG and $1,100 of Mark AG's sales are sales to Angel AG. Required: Prepare a consolidation workpapers for Angel AG and subsidiary for the year ended December 31, 2014.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Opening inventories mark uploal Retained Balance Mark up on inventory Balance Calc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started