Question

On February 28, 2017, Rural Tech Support purchased a copy machine for $ 53,400. Rural Tech Support expects the machine to last for six years

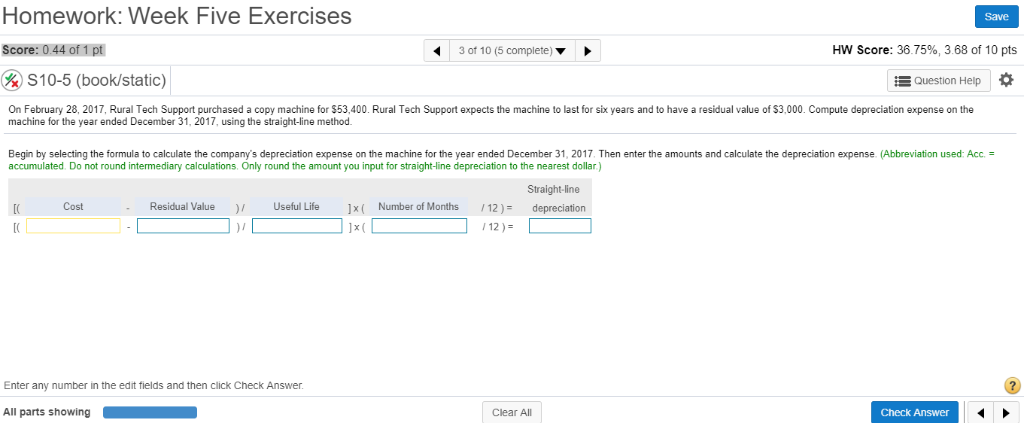

On February 28, 2017, Rural Tech Support purchased a copy machine for $ 53,400. Rural Tech Support expects the machine to last for six years and to have a residual value of $ 3,000. Compute depreciation expense on the machine for the year ended December 31, 2017, using the straight-line method. Begin by selecting the formula to calculate the company's depreciation expense on the machine for the year ended December 31, 2017. Then enter the amounts and calculate the depreciation expense. (Abbreviation used: Acc. = accumulated. Do not round intermediary calculations. Only round the amount you input for straight-line depreciation to the nearest dollar.)

[(Cost-Residual Value)/Useful Life] x (Number of Months / 12 ) = straight-line depreciation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started