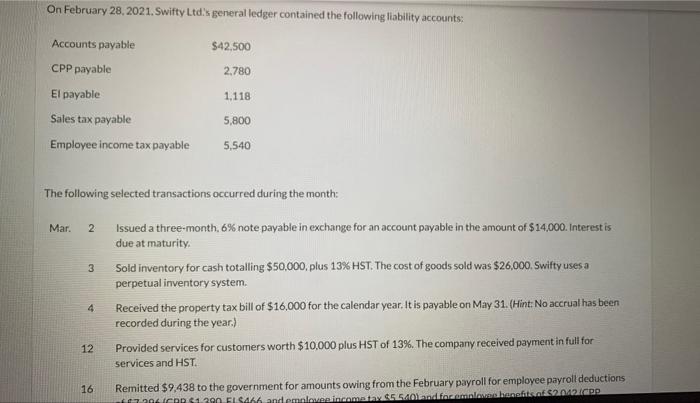

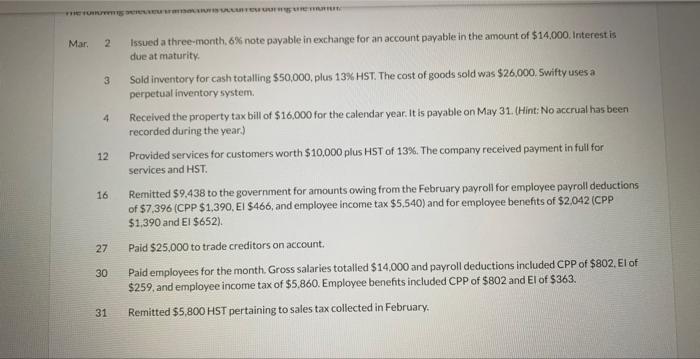

On February 28, 2021. Swifty Ltdi's general ledger contained the following liability accounts: The following selected transactions occurred during the month: Mar. 2 Issued a three-month, 6% note payable in exchange for an account payable in the amount of $14,000. Interest is due at maturity. 3 Sold inventory for cash totalling $50,000, plus 13% HST. The cost of goods sold was $26,000. Swifty uses a perpetual inventory system. 4 Received the property tax bill of $16,000 for the calendar year. It is payable on May 31 . (Hint: No accrual has been recorded during the year.) 12 Provided services for customers worth $10,000 plus HST of 13%. The company received payment in full for services and HST. 16 Remitted $9,438 to the government for amounts owing from the February payroll for employee payroll deductions Mar. 2 Issued a three-month, 6% note payable in exchange for an account payable in the amount of $14,000. Interest is due at maturity. 3 Sold inventory for cash totalling $50,000, plus 13% HST. The cost of goods sold was $26,000,5 wifty uses a. perpetual inventory system. 4 Recelved the property tax bill of $16,000 for the calendar year. It is payable on May 31 . (Hint: No accrual has been recorded during the year.) 12. Provided services for customers worth $10,000 plus HST of 13%. The company received payment in full for services and HST. 16 Remitted $9,438 to the government for amounts owing from the February payroll for employee payroll deductions of $7,396 (CPP $1,390, El $466, and employee income tax $5,540 ) and for employee benefits of $2,042 (CPP $1,390 and EI$652) 27 Paid $25,000 to trade creditors on account. 30 Paid employees for the month. Gross salaries totalled $14,000 and payroll deductions included CPP of $802, El of $259, and emplayee income tax of $5,860. Employee benefits included CPP of $802 and El of $363. 31 Remitted $5,800 HST pertaining to sales tax collected in February. On February 28, 2021. Swifty Ltdi's general ledger contained the following liability accounts: The following selected transactions occurred during the month: Mar. 2 Issued a three-month, 6% note payable in exchange for an account payable in the amount of $14,000. Interest is due at maturity. 3 Sold inventory for cash totalling $50,000, plus 13% HST. The cost of goods sold was $26,000. Swifty uses a perpetual inventory system. 4 Received the property tax bill of $16,000 for the calendar year. It is payable on May 31 . (Hint: No accrual has been recorded during the year.) 12 Provided services for customers worth $10,000 plus HST of 13%. The company received payment in full for services and HST. 16 Remitted $9,438 to the government for amounts owing from the February payroll for employee payroll deductions Mar. 2 Issued a three-month, 6% note payable in exchange for an account payable in the amount of $14,000. Interest is due at maturity. 3 Sold inventory for cash totalling $50,000, plus 13% HST. The cost of goods sold was $26,000,5 wifty uses a. perpetual inventory system. 4 Recelved the property tax bill of $16,000 for the calendar year. It is payable on May 31 . (Hint: No accrual has been recorded during the year.) 12. Provided services for customers worth $10,000 plus HST of 13%. The company received payment in full for services and HST. 16 Remitted $9,438 to the government for amounts owing from the February payroll for employee payroll deductions of $7,396 (CPP $1,390, El $466, and employee income tax $5,540 ) and for employee benefits of $2,042 (CPP $1,390 and EI$652) 27 Paid $25,000 to trade creditors on account. 30 Paid employees for the month. Gross salaries totalled $14,000 and payroll deductions included CPP of $802, El of $259, and emplayee income tax of $5,860. Employee benefits included CPP of $802 and El of $363. 31 Remitted $5,800 HST pertaining to sales tax collected in February