Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On February 4, 2018, Jackie purchased and placed in service a car she purchased for $20,400. The car was used exclusively for business. Compute Jackie's

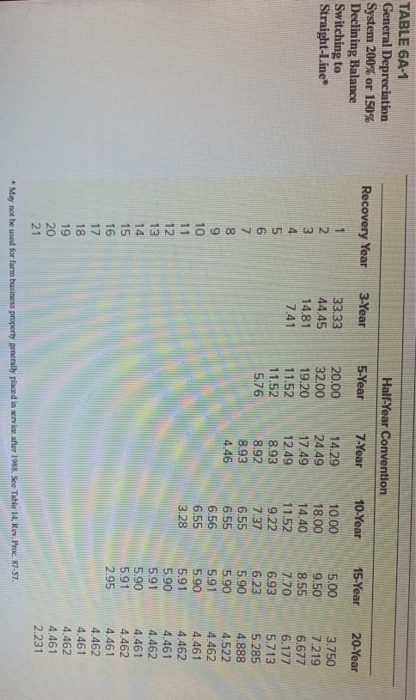

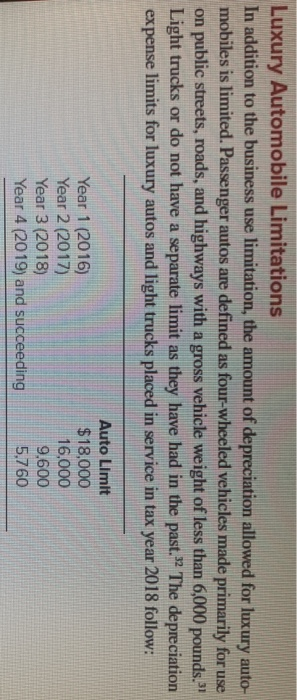

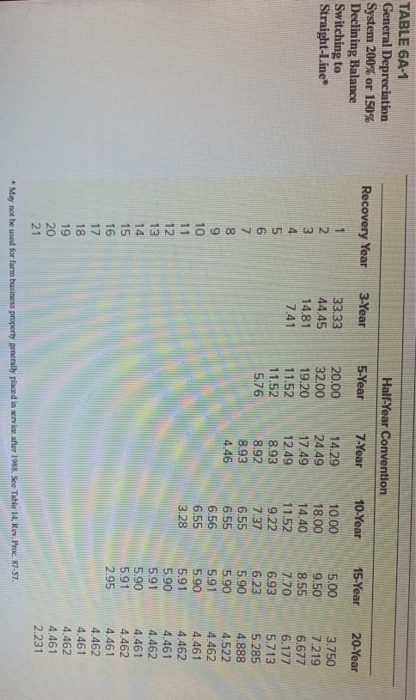

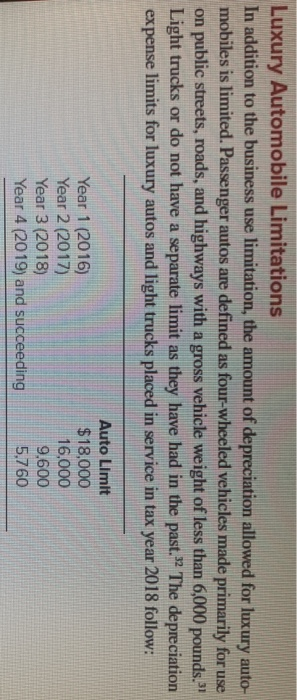

On February 4, 2018, Jackie purchased and placed in service a car she purchased for $20,400. The car was used exclusively for business. Compute Jackie's cost recovery deduction in 2018 assuming no s179 expense but the bonus was taken: (Use Table 6A-1 and Luxury Automobile Depreciation)

On February 4, 2018, Jackie purchased and placed in service a car she purchased for $20,400. The car was used exclusively for her business. Compute Jackie's cost recovery deduction in 2018 assuming no 6179 expense but the bonus was taken: (Use Table 6A1 and Luxury Automobile Depreciation Jackie's cost recovery deduction TABLE 6A-1 General Depreciation System 200% or 150% Declining Balance Switching to Straight-Line Recovery Year 3-Year 10-Year 33.33 44.45 14.81 7.41 Half-Year Convention 5-Year 7-Year 20.00 14.29 32.00 24.49 19.20 17.49 11.52 12.49 11.52 8.93 5.76 8.92 8.93 4.46 10.00 18.00 14.40 15-Year 5.00 9.50 8.55 OOOO NOTEN DOO VOU AWN- NT UT UT on huo 00 20-Year 3.750 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2.231 May not be used for farm business property generally placed in service er 1988. See Table 4. Rex. Pro 17-57. Luxury Automobile Limitations In addition to the business use limitation, the amount of depreciation allowed for luxury auto- mobiles is limited. Passenger autos are defined as four-wheeled vehicles made primarily for use on public streets, roads, and highways with a gross vehicle weight of less than 6,000 pounds." Light trucks or do not have a separate limit as they have had in the past." The depreciation expense limits for luxury autos and light trucks placed in service in tax year 2018 follow: Year 1 (2016) Year 2 (2017) Year 3 (2018) Year 4 (2019) and succeeding Auto Limit $18,000 16,000 9.600 5.760

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started