Question

On Jan 1, 2015, Petunia Corp purchased an 80% interest in the common stock of Sunflower Corp. for $350,000.00 Sunflower had the following Balance Sheet

On Jan 1, 2015, Petunia Corp purchased an 80% interest in the common stock of Sunflower Corp. for $350,000.00 Sunflower had the following Balance Sheet on the date of acquisition:

Sunflower Corporation

Balance Sheet

Jan 1, 2015

Assets: Liabilities & Equity

Accounts Receivable $40,000 Accounts Payable $40,000

Inventory 20,000 Bonds Payable $100,000

Land 35,000

Buildings 250,000 Common Stk ($10 par) $10,000

Accumulated Depreciation (50,000) Paid in Capital $90,000

Equipment $120,000 Retained Earnings $115,000.

Accumulated Depreciation (60,000)

Total $355,000 Total $355,000

Any excess is recorded as follows:

Inventory is overvalued by $4,000, Equipment is overvalued by $20,000 5-year remaining life

Building is undervalued by $50,000 10-year remaining life

Bonds Payable has a FMV of $108,000 4 year remaining life

The Balance to: Goodwill.

ADDITIONAL DATA

During 2017, the Sub sold Inventory to the parent for $55,000 and $10,000 remained unsold with a 20% mark-up. The parent started 2017 with Beginning Inventory purchased from the Sub for $10,000 with a 25% mark-up.

On Jan 1, 2015, the Parent sold a Building to the Sub for $100,000, Cost $60,000, and included a $40,000 gain. The building had a 10-year remaining useful life.

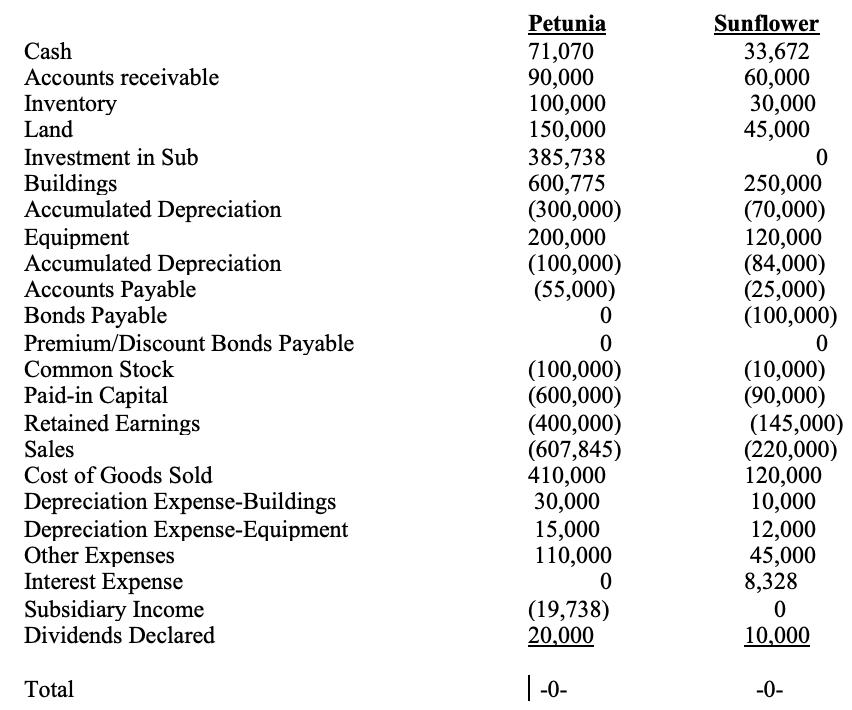

Petunia and Sunflower had the following Trial Balances on Dec 31, 2017

Prepare the worksheet necessary to produce the Consolidated Financial Statements for Petunia and Sunflower for the year ended Dec 31, 2017. Include the Determination and Distribution of Excess Schedule.

Prepare the worksheet necessary to produce the Consolidated Financial Statements for Petunia and Sunflower for the year ended Dec 31, 2017. Include the Determination and Distribution of Excess Schedule.

Cash Accounts receivable Inventory Land Investment in Sub Buildings Accumulated Depreciation Equipment Accumulated Depreciation Accounts Payable Bonds Payable Premium/Discount Bonds Payable Common Stock Paid-in Capital Retained Earnings Sales Cost of Goods Sold Depreciation Expense-Buildings Depreciation Expense-Equipment Other Expenses Interest Expense Subsidiary Income Dividends Declared Total Petunia 71,070 90,000 100,000 150,000 385,738 600,775 (300,000) 200,000 (100,000) (55,000) 0 0 (100,000) (600,000) (400,000) (607,845) 410,000 30,000 15,000 110,000 0 (19,738) 20,000 | -0- Sunflower 33,672 60,000 30,000 45,000 0 250,000 (70,000) 120,000 (84,000) (25,000) (100,000) 0 (10,000) (90,000) (145,000) (220,000) 120,000 10,000 12,000 45,000 8,328 0 10,000 -0-

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started