Answered step by step

Verified Expert Solution

Question

1 Approved Answer

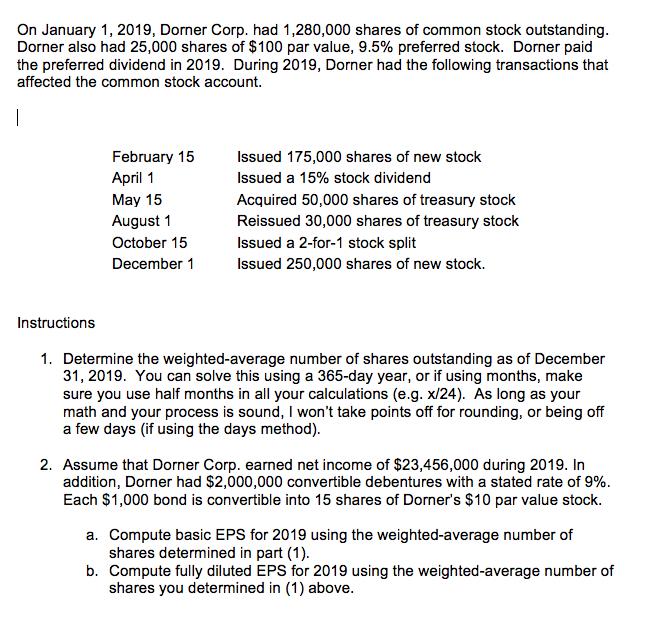

On January 1, 2019, Dorner Corp. had 1,280,000 shares of common stock outstanding. Dorner also had 25,000 shares of $100 par value, 9.5% preferred

On January 1, 2019, Dorner Corp. had 1,280,000 shares of common stock outstanding. Dorner also had 25,000 shares of $100 par value, 9.5% preferred stock. Dorner paid the preferred dividend in 2019. During 2019, Dorner had the following transactions that affected the common stock account. | Instructions February 15 April 1 May 15 August 1 October 15 December 1 Issued 175,000 shares of new stock Issued a 15% stock dividend Acquired 50,000 shares of treasury stock Reissued 30,000 shares of treasury stock Issued a 2-for-1 stock split Issued 250,000 shares of new stock. 1. Determine the weighted-average number of shares outstanding as of December 31, 2019. You can solve this using a 365-day year, or if using months, make sure you use half months in all your calculations (e.g. x/24). As long as your math and your process is sound, I won't take points off for rounding, or being off a few days (if using the days method). 2. Assume that Dorner Corp. earned net income of $23,456,000 during 2019. In addition, Dorner had $2,000,000 convertible debentures with a stated rate of 9%. Each $1,000 bond is convertible into 15 shares of Dorner's $10 par value stock. a. Compute basic EPS for 2019 using the weighted-average number of shares determined in part (1). b. Compute fully diluted EPS for 2019 using the weighted-average number of shares you determined in (1) above.

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

1 calculation of weighted average number of shares outstan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started