Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On Jan. 1, 2022, you acquire Co. M for $ 34,200,000 when Co. M's book value was $ 5,400,000. M's book value equals fair

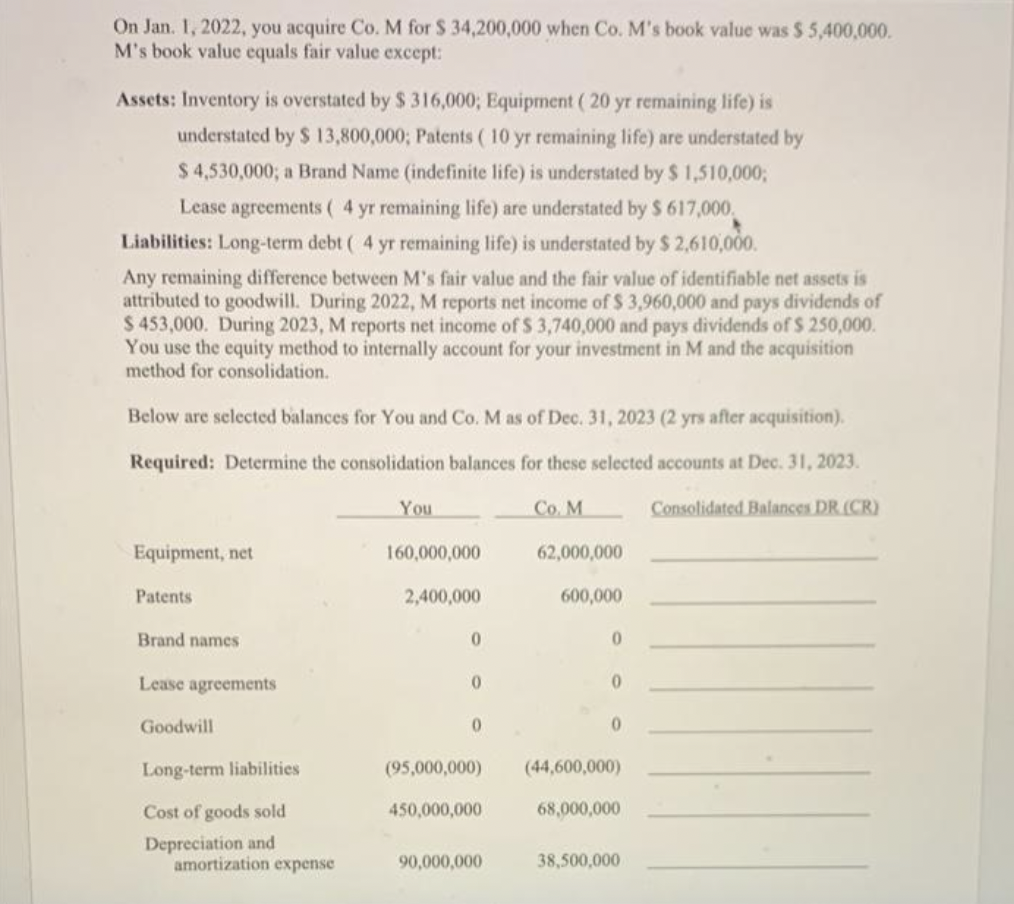

On Jan. 1, 2022, you acquire Co. M for $ 34,200,000 when Co. M's book value was $ 5,400,000. M's book value equals fair value except: Assets: Inventory is overstated by $ 316,000; Equipment ( 20 yr remaining life) is understated by $ 13,800,000; Patents (10 yr remaining life) are understated by $ 4,530,000; a Brand Name (indefinite life) is understated by $ 1,510,000; Lease agreements ( 4 yr remaining life) are understated by $ 617,000. Liabilities: Long-term debt ( 4 yr remaining life) is understated by $ 2,610,000. Any remaining difference between M's fair value and the fair value of identifiable net assets is attributed to goodwill. During 2022, M reports net income of $ 3,960,000 and pays dividends of $ 453,000. During 2023, M reports net income of $ 3,740,000 and pays dividends of $ 250,000. You use the equity method to internally account for your investment in M and the acquisition method for consolidation. Below are selected balances for You and Co. M as of Dec. 31, 2023 (2 yrs after acquisition). Required: Determine the consolidation balances for these selected accounts at Dec. 31, 2023. You Co. M Consolidated Balances DR (CR) Equipment, net 160,000,000 62,000,000 Patents 2,400,000 600,000 Brand names 0 0 Lease agreements 0 0 Goodwill 0 Long-term liabilities (95,000,000) (44,600,000) Cost of goods sold 450,000,000 68,000,000 Depreciation and amortization expense 90,000,000 38,500,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started