Answered step by step

Verified Expert Solution

Question

1 Approved Answer

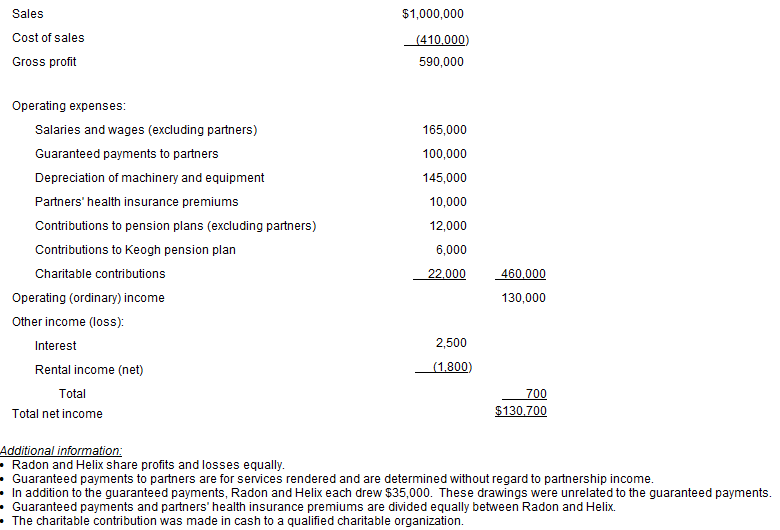

On Jan.1 of the current year, Mr. Radon and Mr. Helix established operations of their partnership Smackey Technologies, a manufacturer of electronic components. Both partners

On Jan.1 of the current year, Mr. Radon and Mr. Helix established operations of their partnership Smackey Technologies, a manufacturer of electronic components. Both partners actively participate equally. Smackeys income statement for the current calendat year, is presented below.

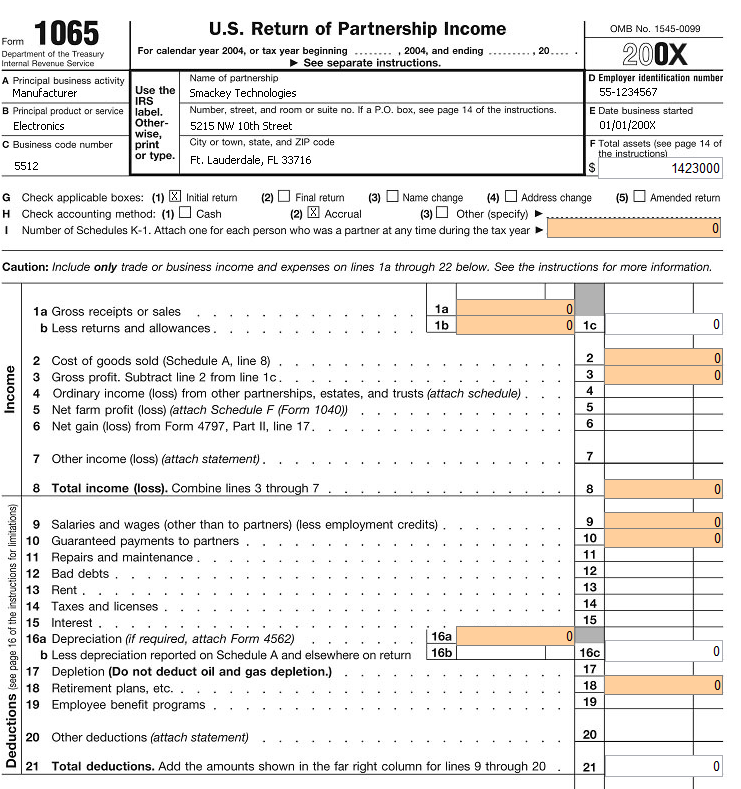

Question 1: Enter the appropriate values in the 1065 tax form below.

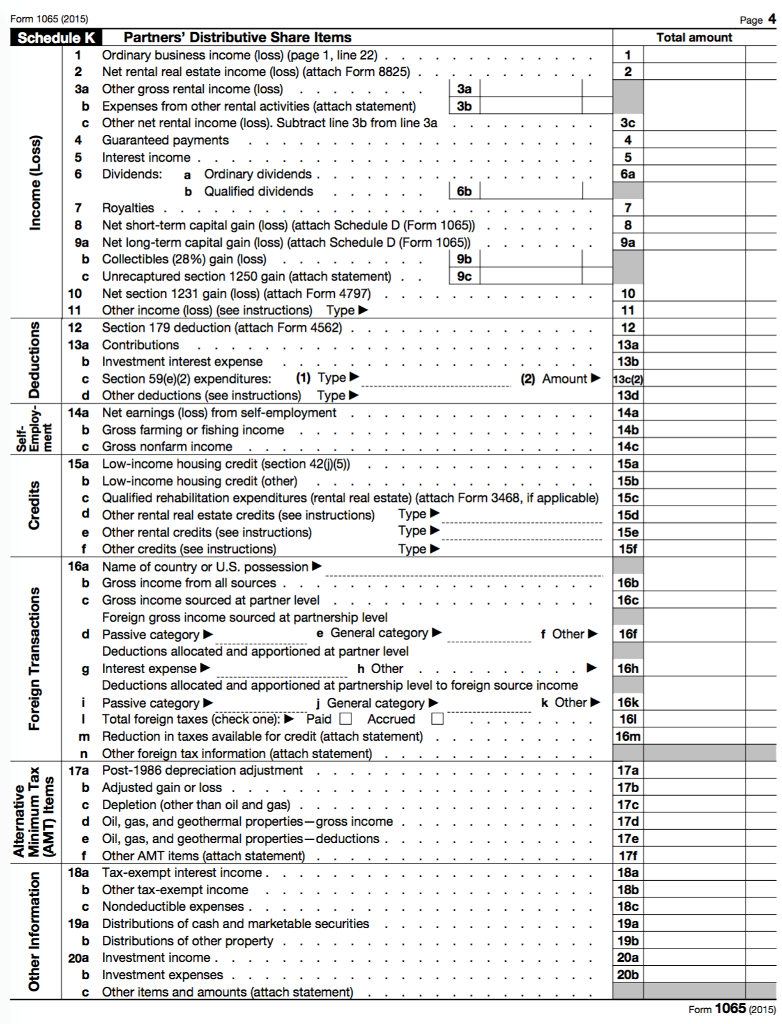

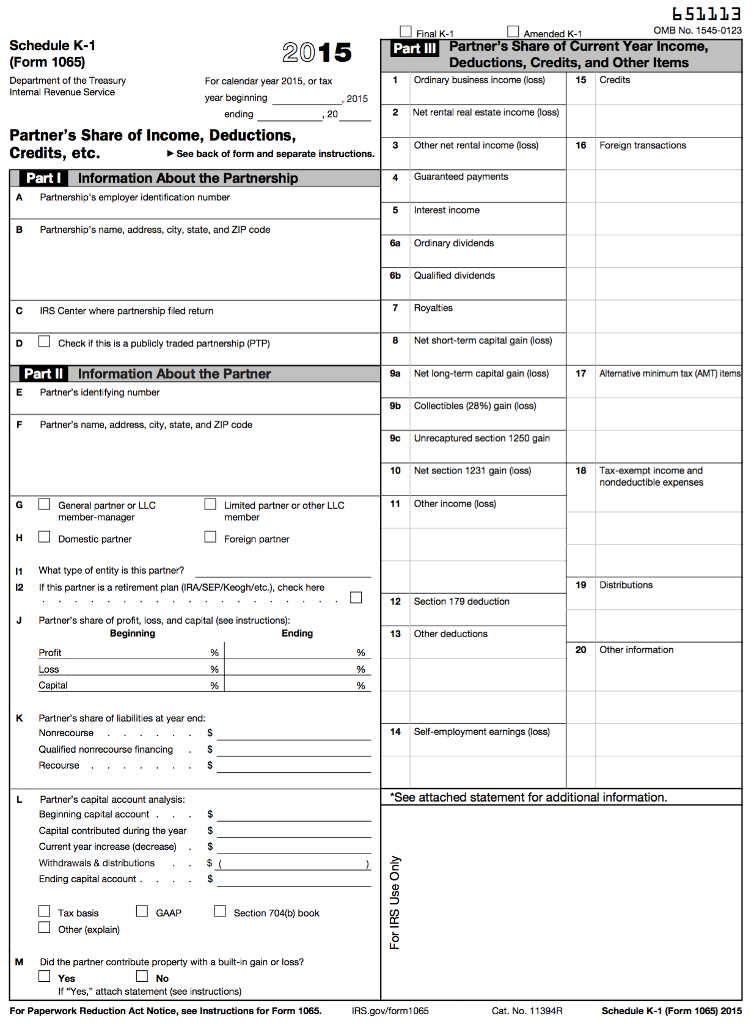

Question 2:

Using the data provided in the tab titled Information, enter the approriate values in the schedule K and K-1 below.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started