Answered step by step

Verified Expert Solution

Question

1 Approved Answer

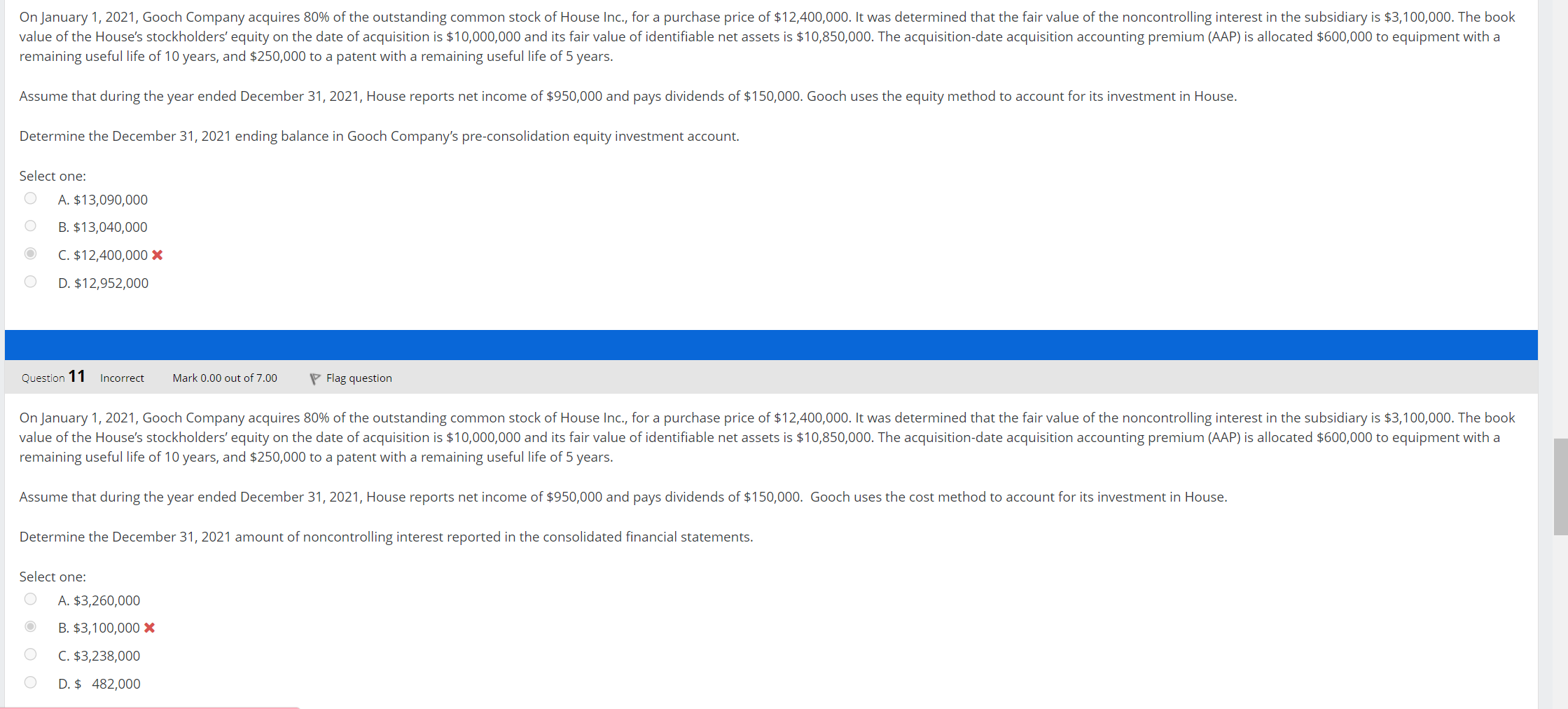

On January 1 , 2 0 2 1 , Gooch Company acquires 8 0 % of the outstanding common stock of House Inc., for a

On January Gooch Company acquires of the outstanding common stock of House Inc., for a purchase price of $ It was determined that the fair value of the noncontrolling interest in the subsidiary is $ The book value of the Houses stockholders equity on the date of acquisition is $ and its fair value of identifiable net assets is $ The acquisitiondate acquisition accounting premium AAP is allocated $ to equipment with a remaining useful life of years, and $ to a patent with a remaining useful life of years.

Determine the December ending balance in Gooch Company's preconsolidation equity investment account.

Select one:

A $

B $ x

C $

D $

On January Gooch Company acquires of the outstanding common stock of House Inc., for a purchase price of $ It was determined that the fair value of the noncontrolling interest in the subsidiary is $ The book value of the Houses stockholders equity on the date of acquisition is $ and its fair value of identifiable net assets is $ The acquisitiondate acquisition accounting premium AAP is allocated $ to equipment with a remaining useful life of years, and $ to a patent with a remaining useful life of years.

Assume that during the year ended December House reports net income of $ and pays dividends of $ Gooch uses the cost method to account for its investment in House.

Determine the December amount of noncontrolling interest reported in the consolidated financial statements.

Select one:

A $ x

B $

C $

D $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started