Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1 , 2 0 2 2 , Lion provides a loan for $ 3 , 5 0 0 , 0 0 0 to

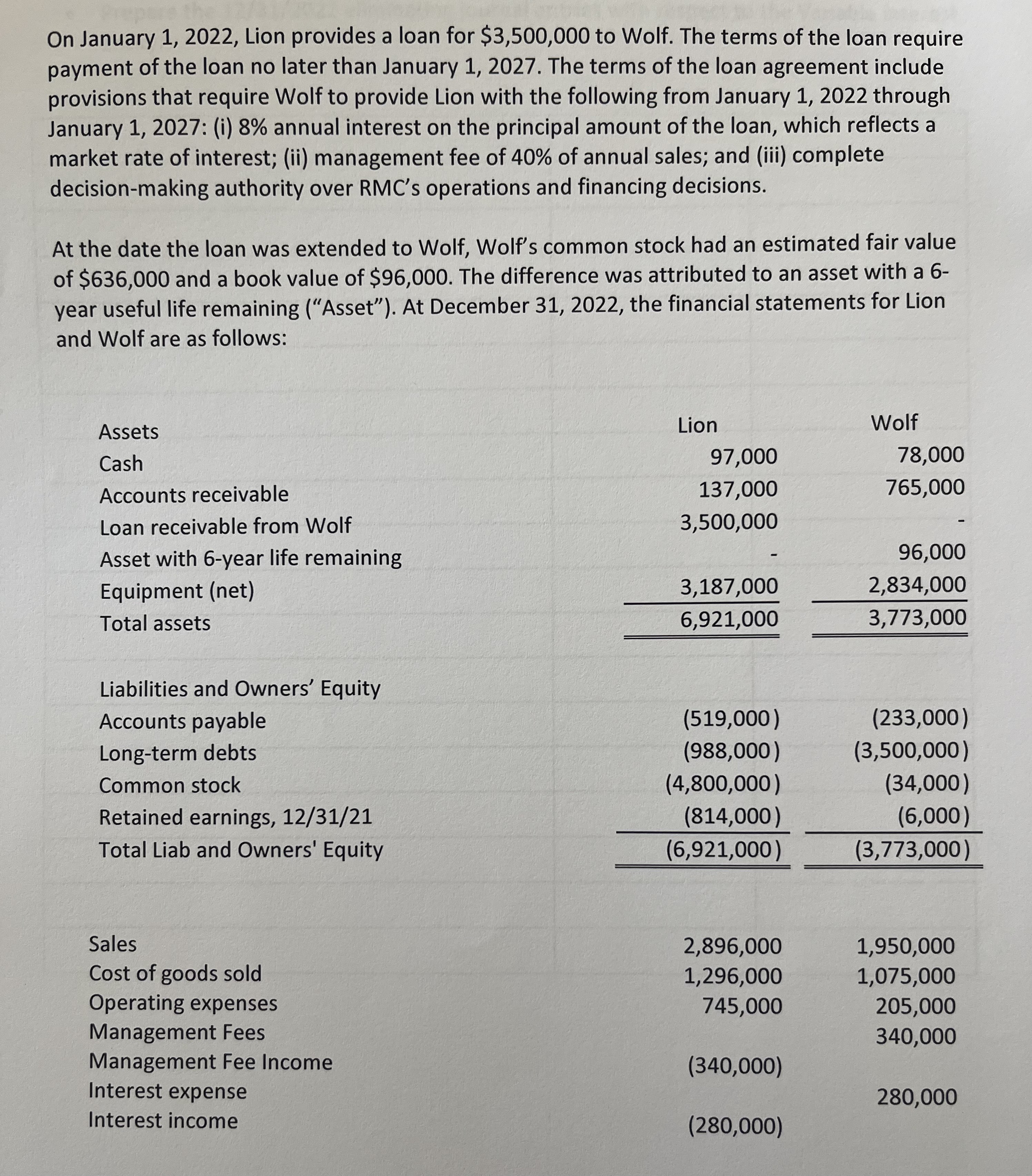

On January Lion provides a loan for $ to Wolf. The terms of the loan require payment of the loan no later than January The terms of the loan agreement include provisions that require Wolf to provide Lion with the following from January through January : i annual interest on the principal amount of the loan, which reflects a market rate of interest; ii management fee of of annual sales; and iii complete decisionmaking authority over RMCs operations and financing decisions.

At the date the loan was extended to Wolf, Wolf's common stock had an estimated fair value of $ and a book value of $ The difference was attributed to an asset with a year useful life remaining Asset At December the financial statements for Lion and Wolf are as follows:

Assets

Lion

Wolf

Cash

Accounts receivable

Loan receivable from Wolf

Asset with year life remaining

Equipment net

Total assets

Liabilities and Owners' Equity

Accounts payable

Longterm debts

Common stock

Retained earnings,

Total Liab and Owners' Equity

Sales

Cost of goods sold

Operating expenses

Management Fees

Management Fee Income

Interest expense

Interest income

Prepare the eliminating journal entries with respect to the variable interest entity. On January Lion provides a loan for $ to Wolf. The terms of the loan require payment of the loan no later than January The terms of the loan agreement include provisions that require Wolf to provide Lion with the following from January through January : i annual interest on the principal amount of the loan, which reflects a market rate of interest; ii management fee of of annual sales; and iii complete decisionmaking authority over RMCs operations and financing decisions.

At the date the loan was extended to Wolf, Wolf's common stock had an estimated fair value of $ and a book value of $ The difference was attributed to an asset with a year useful life remaining Asset At December the financial statements for Lion and Wolf are as follows:

Sales

Cost of goods sold

Operating expenses

Management Fees

Management Fee Income

Interest expense

Interest income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started