Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1 , 2 0 2 2 , Monica Company acquired 8 0 percent of Young Company s outstanding common stock for $ 8

On January Monica Company acquired percent of Young Companys outstanding common stock for $ The fair value of the noncontrolling interest at the acquisition date was $

Young reported stockholders equity accounts on that date as follows:

Common stock$ par value $

Additional paidin capital

Retained earnings

In establishing the acquisition value, Monica appraised Young's assets and ascertained that the accounting records undervalued a building with a fiveyear remaining life by $ Any remaining excess acquisitiondate fair value was allocated to a franchise agreement to be amortized over years.

During the subsequent years, Young sold Monica inventory at a percent gross profit rate. Monica consistently resold this merchandise in the year of acquisition or in the period immediately following. Transfers for the three years after this business combination was created amounted to the following:

Year Transfer Price Inventory Remaining at YearEnd at transfer price

$ $

In addition, Monica sold Young several pieces of fully depreciated equipment on January for $ The equipment had originally cost Monica $ Young plans to depreciate these assets over a fiveyear period.

In Young earns a net income of $ and declares and pays $ in cash dividends. These figures increase the subsidiary's Retained Earnings to a $ balance at the end of During this same year, Monica reported dividend income of $ and an investment account containing the initial value balance of $ No changes in Young's common stock accounts have occurred since Monica's acquisition.

Required:

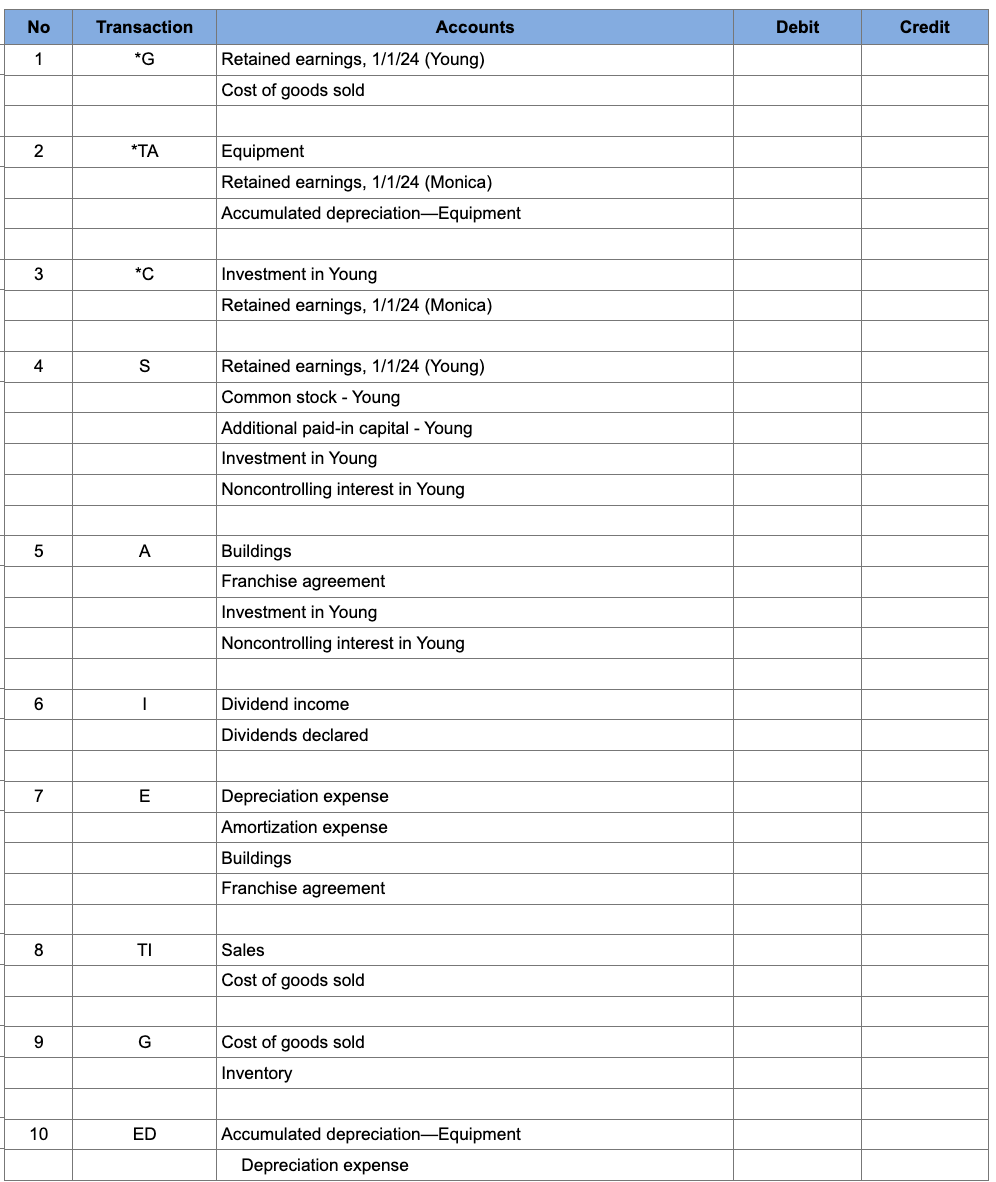

Prepare the consolidation worksheet entries for Monica and Young.

Compute the net income attributable to the noncontrolling interest for

G Retained earnings, Young

Cost of goods sold

TA Equipment

Retained earnings, Monica

Accumulated depreciationEquipment

C Investment in Young

Retained earnings, Monica

S Retained earnings, Young

Common stock Young

Additional paidin capital Young

Investment in Young

Noncontrolling interest in Young

A Buildings

Franchise agreement

Investment in Young

Noncontrolling interest in Young

I Dividend income

Dividends declared

E Depreciation expense

Amortization expense

Buildings

Franchise agreement

TI Sales

Cost of goods sold

G Cost of goods sold

Inventory

ED Accumulated depreciationEquipment

Depreciation expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started