Answered step by step

Verified Expert Solution

Question

1 Approved Answer

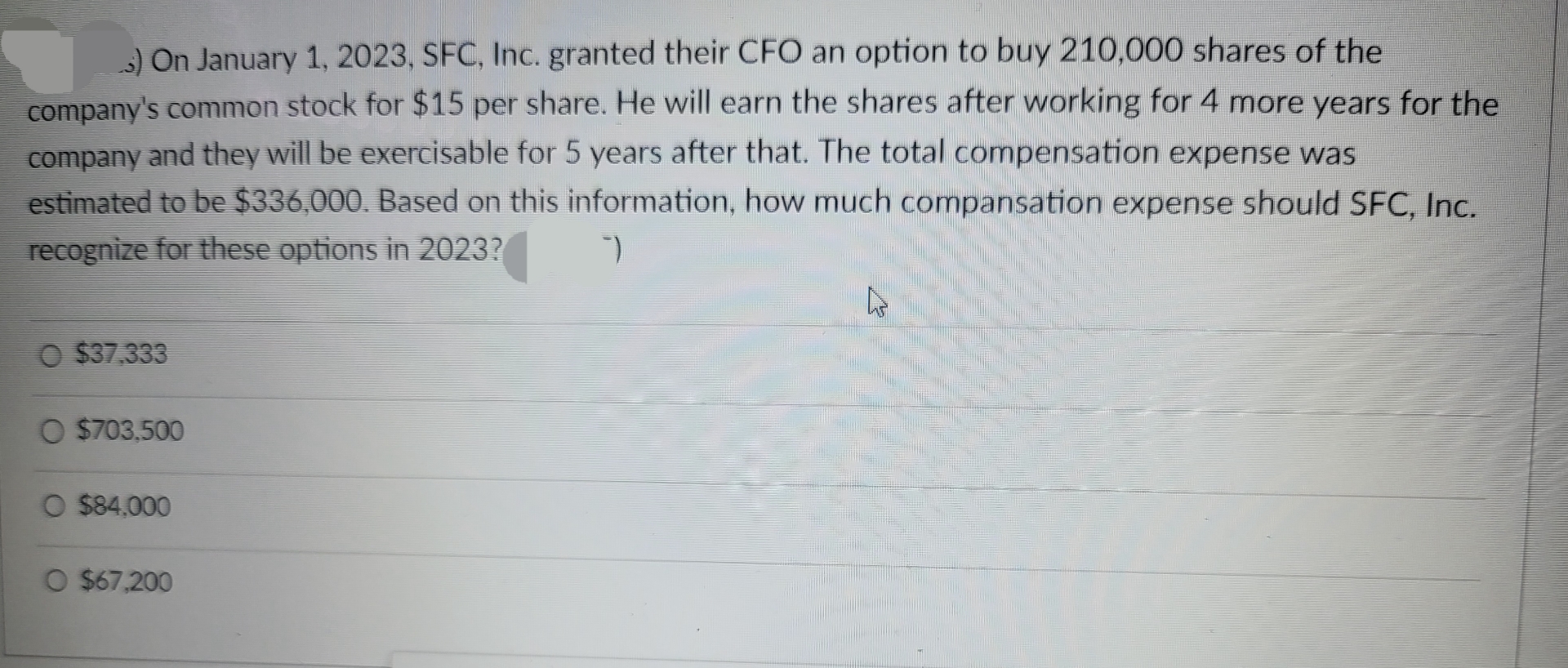

On January 1 , 2 0 2 3 , SFC , Inc. granted their CFO an option to buy 2 1 0 , 0 0

On January SFC Inc. granted their CFO an option to buy shares of the company's common stock for $ per share. He will earn the shares after working for more years for the company and they will be exercisable for years after that. The total compensation expense was estimated to be $ Based on this information, how much compansation expense should SFC Inc. recognize for these options in

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started