Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1 , 2 0 2 4 , Ithaca Corporation purchases Cortland Incorporated bonds that have a face value of $ 3 4 0

On January Ithaca Corporation purchases Cortland Incorporated bonds that have a face value of $ The Cortland bonds have a stated interest rate of Interest is paid semiannually on June and December and the bonds mature in years. For bonds of similar risk and maturity, the market yield on particular dates is as follows:

Note: Use tables, Excel, or a financial calculator. FV of $ PV of $ FVA of $ PVA of $ FVAD of $ and PVAD of $

January

June

December

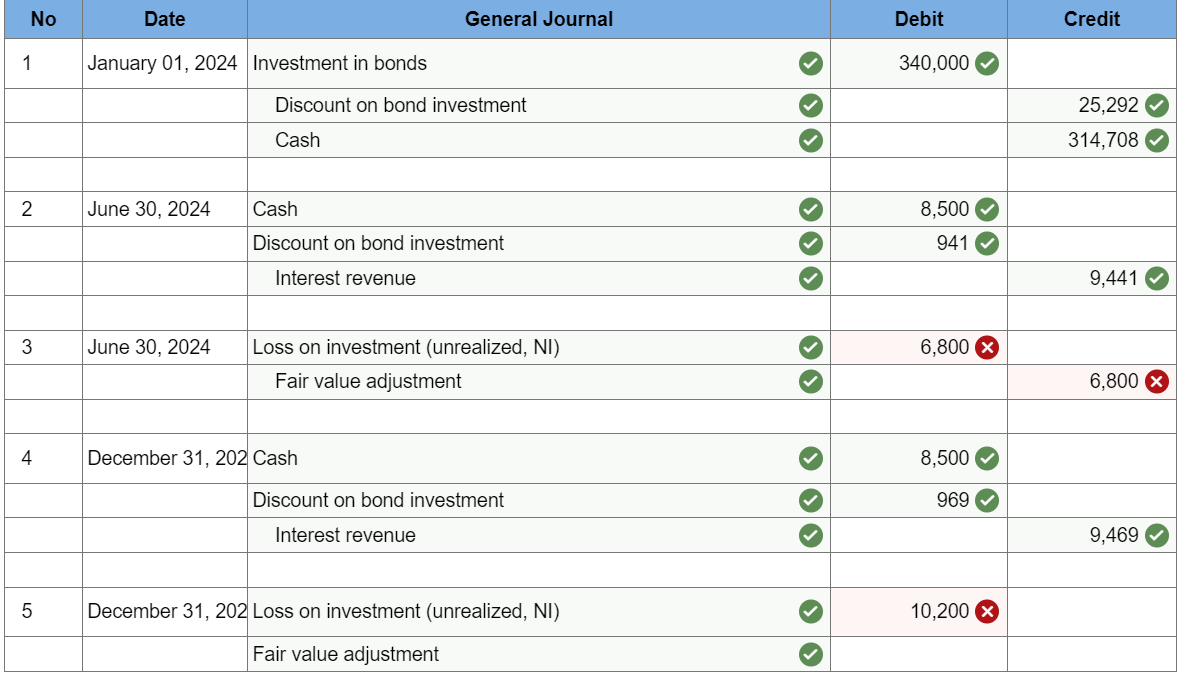

Part C: Record the fair value adjustment when the market yield is

Part E: Record the fair value adjustment when the market yield is

tableNoDate,General Journal,Debit,CreditJanuary Investment in bonds,Discount on bond investment,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started