Answered step by step

Verified Expert Solution

Question

1 Approved Answer

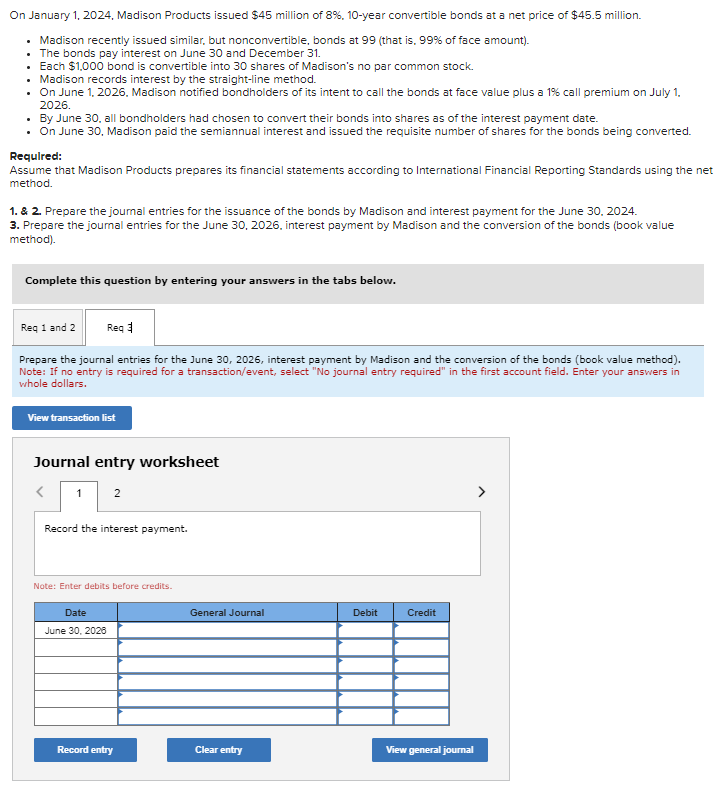

On January 1 , 2 0 2 4 , Madison Products issued $ 4 5 million of 8 % , 1 0 - year convertible

On January Madison Products issued $ million of year convertible bonds at a net price of $ million.

Madison recently issued similar, but nonconvertible, bonds at that is of face amount

The bonds pay interest on June and December

Each $ bond is convertible into shares of Madison's no par common stock.

Madison records interest by the straightline method.

On June Madison notified bondholders of its intent to call the bonds at face value plus a call premium on July

By June all bondholders had chosen to convert their bonds into shares as of the interest payment date.

On June Madison paid the semiannual interest and issued the requisite number of shares for the bonds being converted.

Requlred:

Assume that Madison Products prepares its financial statements according to International Financial Reporting Standards using the net

method.

& Prepare the joumal entries for the issuance of the bonds by Madison and interest payment for the June

Prepare the joumal entries for the June interest payment by Madison and the conversion of the bonds book value

method

Complete this question by entering your answers in the tabs below.

Prepare the journal entries for the June interest payment by Madison and the conversion of the bonds book value method

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field. Enter your answers in

whole dollars.

Journal entry worksheet

Record the interest payment.

Note: Enter debits before credits.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started