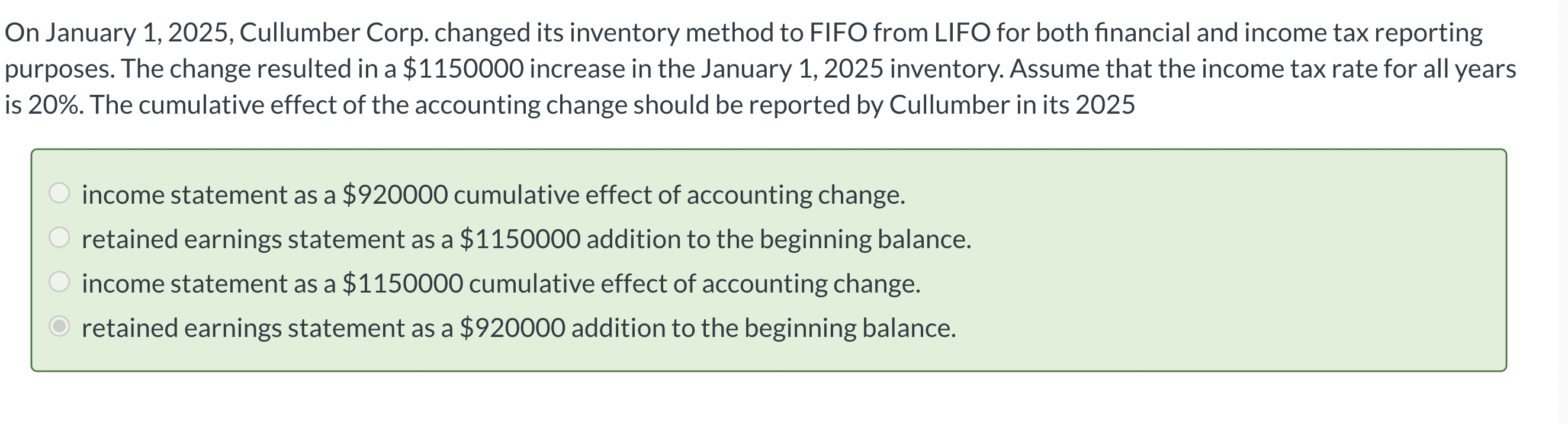

Question: On January 1 , 2 0 2 5 , Cullumber Corp. changed its inventory method to FIFO from LIFO for both financial and income tax

On January Cullumber Corp. changed its inventory method to FIFO from LIFO for both financial and income tax reporting purposes. The change resulted in a $ increase in the January inventory. Assume that the income tax rate for all years is The cumulative effect of the accounting change should be reported by Cullumber in its income statement as a $ cumulative effect of accounting change.retained earnings statement as a $ addition to the beginning balance.income statement as a $ cumulative effect of accounting change.retained earnings statement as a $ addition to the beginning balance.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock