Answered step by step

Verified Expert Solution

Question

1 Approved Answer

To the expert: I don't know what you mean by more requirements, cut it The requirements are A, B C and D 4. Inventory transactions

To the expert: I don't know what you mean by "more requirements, cut it"

The requirements are A, B C and D

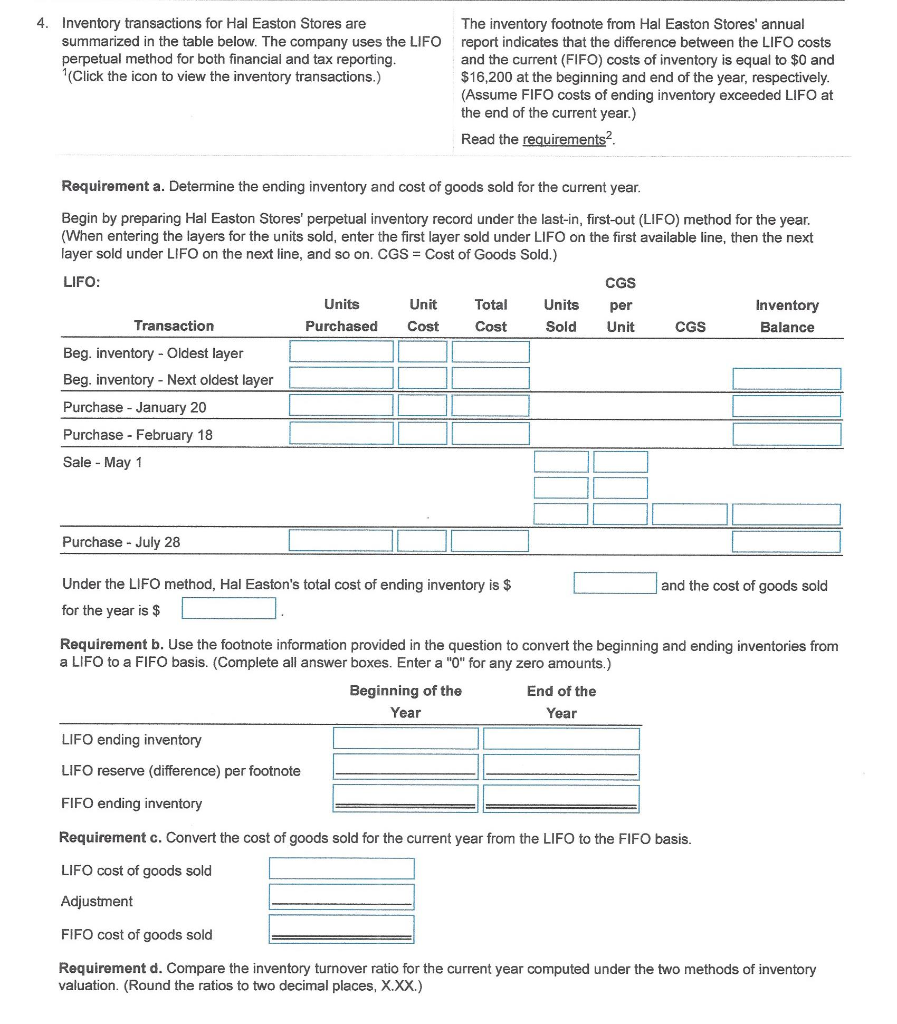

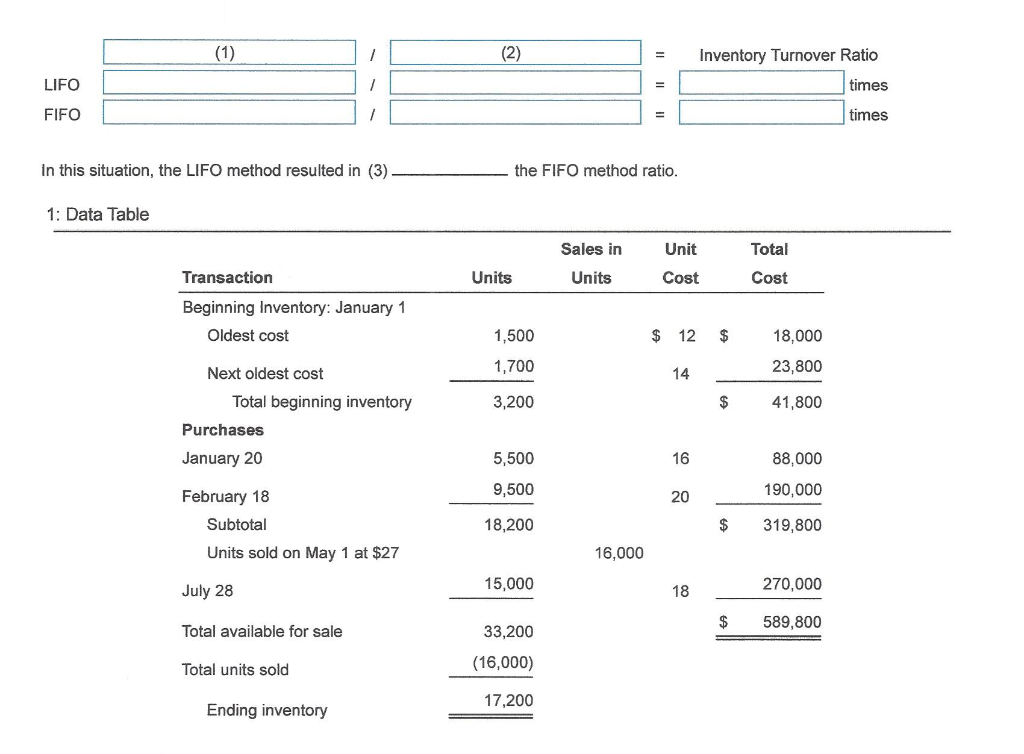

4. Inventory transactions for Hal Easton Stores are summarized in the table below. The company uses the LIFO perpetual method for both financial and tax reporting. (Click the icon to view the inventory transactions.) The inventory footnote from Hal Easton Stores' annual report indicates that the difference between the LIFO costs and the current (FIFO) costs of inventory is equal to $0 and $16,200 at the beginning and end of the year, respectively. (Assume FIFO costs of ending inventory exceeded LIFO at the end of the current year.) Read the requirements2. Requirement a. Determine the ending inventory and cost of goods sold for the current year. Begin by preparing Hal Easton Stores' perpetual inventory record under the last-in, first-out (LIFO) method for the year. (When entering the layers for the units sold, enter the first layer sold under LIFO on the first available line, then the next layer sold under LIFO on the next line, and so on. CGS Cost of Goods Sold.) LIFO: CGS Units Unit Total Units Inventory per Transaction Purchased Cost Cost Sold Unit CGS Balance Beg. inventory Oldest layer Beg. inventory - Next oldest layer Purchase January 20 Purchase February 18 Sale May Purchase - July 28 Under the LIFO method, Hal Easton's total cost of ending inventory is $ and the cost of goods sold for the year is $ Requirement b. Use the footnote information provided in the question to convert the beginning and ending inventories from a LIFO to a FIFO basis. (Complete all answer boxes. Enter a "0" for any zero amounts.) Beginning of the End of the Year Year LIFO ending inventory LIFO reserve (difference) per footnote FIFO ending inventory Requirement c. Convert the cost of goods sold for the current year from the LIFO to the FIFO basis. LIFO cost of goods sold Adjustment FIFO cost of goods sold Requirement d. Compare the inventory turnover ratio for the current year computed under the two methods of inventory valuation. (Round the ratios to two decimal places, X.XX.) unbay (1) (2) Inventory Turnover Ratio LIFO times FIFO times In this situation, the LIFO method resulted in (3) the FIFO method ratio. 1: Data Table Sales in Unit Total Transaction Units Units Cost Cost Beginning Inventory: January 1 Oldest cost 1,500 12 $ 18,000 1,700 23,800 Next oldest cost 14 Total beginning inventory 3,200 41,800 Purchases January 20 5,500 16 88,000 9,500 190,000 February 18 20 18,200 Subtotal $ 319,800 Units sold on May 1 at $27 16,000 15,000 270,000 July 28 18 589,800 Total available for sale 33,200 (16,000) Total units sold 17,200 Ending inventoryStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started