Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1 , 2 0 2 6 , Sandhill Corp. had 2 , 8 4 7 , 0 0 0 shares of common stock

On January Sandhill Corp. had shares of common stock issued and outstanding. During it had the following

transactions that related to common stock.

Mar. Issued shares in exchange for land

Apr. Acquired shares of treasury stock

July Issued a stock dividend

Sept. Reissued shares of treasury stock

adjusted for stock dividend

Oct. Issued a for stock split

a

Your answer has been saved. See score details after the due date.

Determine the weightedaverage number of shares outstanding as of December

The weightedaverage number of shares outstanding

Attempts: of used

b

Assume that Sandhill Corp. earned net income of $ during In addition, it had shares of $ par

value nonconvertible, cumulative preferred stock outstanding for the entire year. Because of liquidity considerations, however,

the company did not declare and pay a preferred dividend in Compute earnings per share for using the weighted

average number of shares determined in part aRound answers to decimal places, eg

Earnings per share $

Attempts: of used

c

The parts of this question must be completed in order. This part will be available when you complete the part above.

d

The parts of this question must be completed in order. This part will be available when you complete the part above.

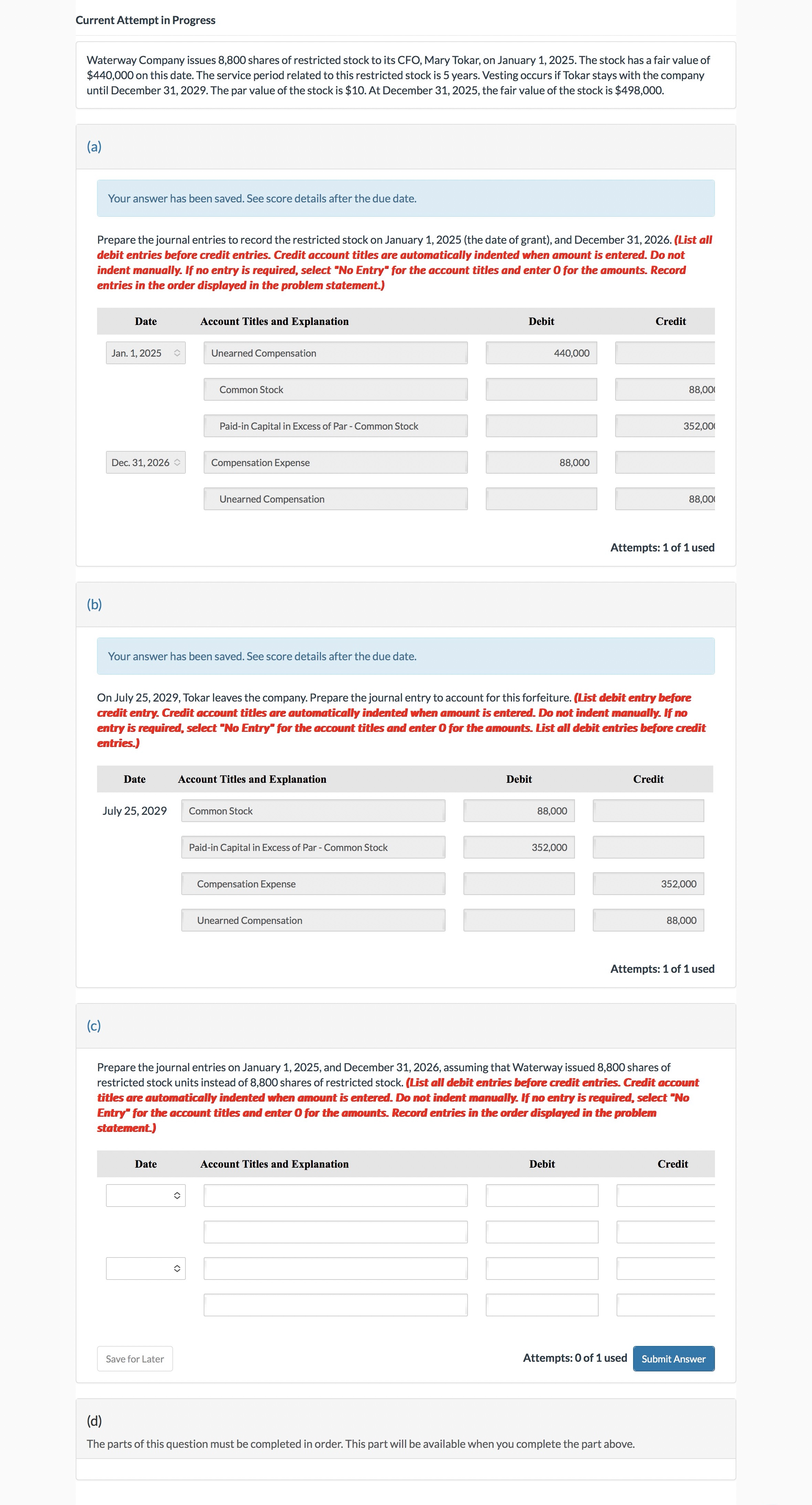

Current Attempt in Progress

Waterway Company issues shares of restricted stock to its CFO, Mary Tokar, on January The stock has a fair value of

$ on this date. The service period related to this restricted stock is years. Vesting occurs if Tokar stays with the company

until December The par value of the stock is $ At December the fair value of the stock is $

a

Your answer has been saved. See score details after the due date.

Prepare the journal entries to record the restricted stock on January the date of grant and December List all

debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not

indent manually. If no entry is required, select No Entry" for the account titles and enter for the amounts. Record

entries in the order displayed in the problem statement.

Attempts: of used

b

Your answer has been saved. See score details after the due date.

On July Tokar leaves the company. Prepare the journal entry to account for this forfeiture. List debit entry before

credit entry. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no

entry is required, select No Entry" for the account titles and enter for the amounts. List all debit entries before credit

entries.

Attempts: of used

c

Prepare the journal entries on January and December assuming that Waterway issued shares of

restricted stock units instead of shares of restricted stock. List all debit entries before credit entries. Credit account

titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select No

Entry" for the account titles and enter for the amounts. Record entries in the order displayed in the problem

statement.

d

The parts of this question must be completed in order. This part will be available when you complete the part above.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started