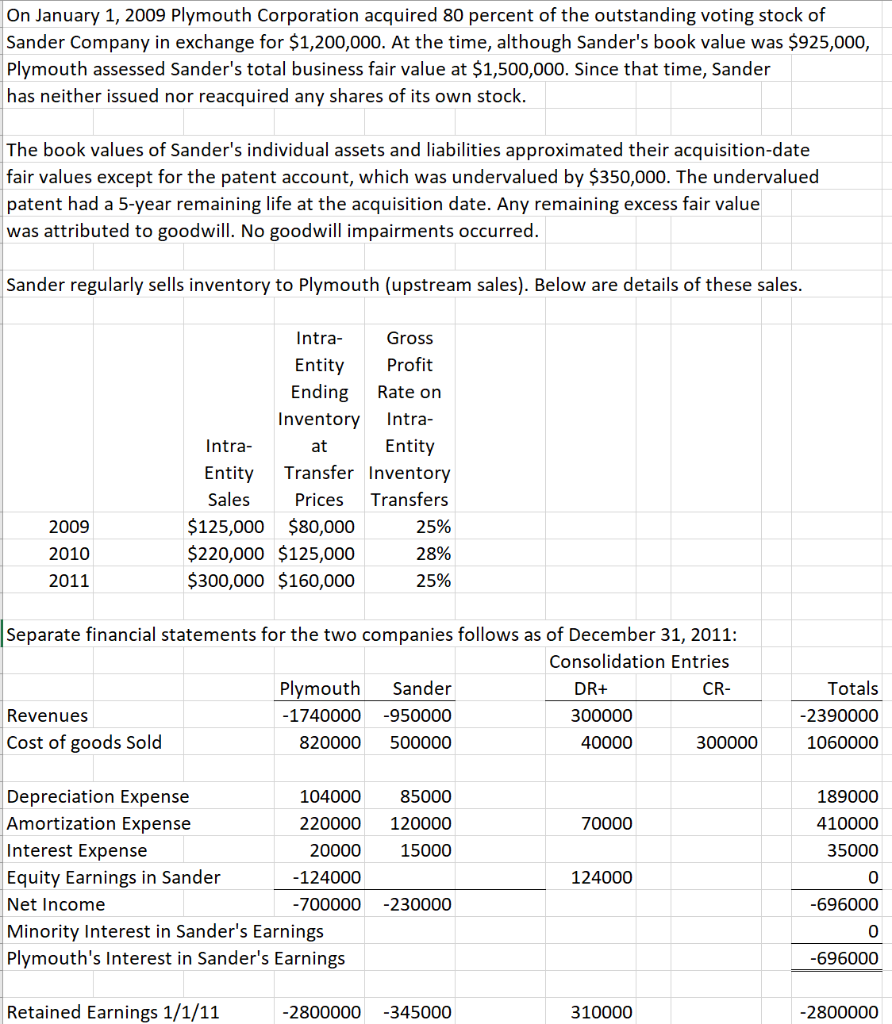

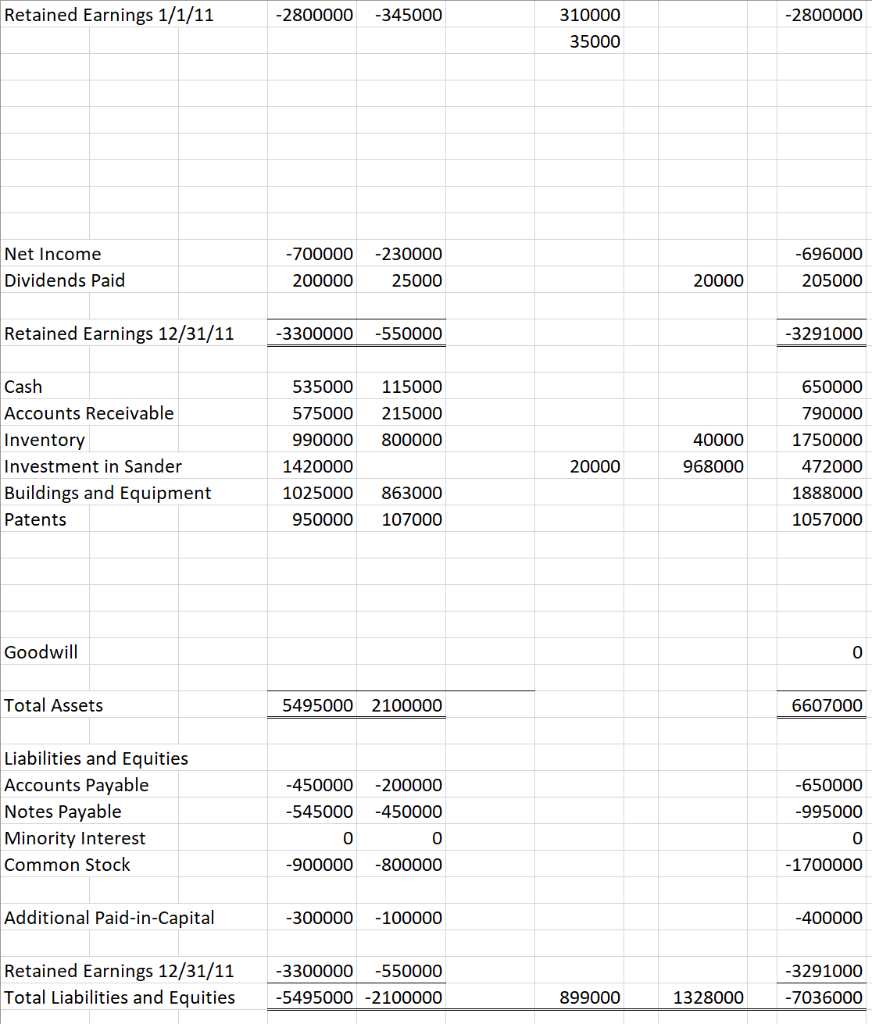

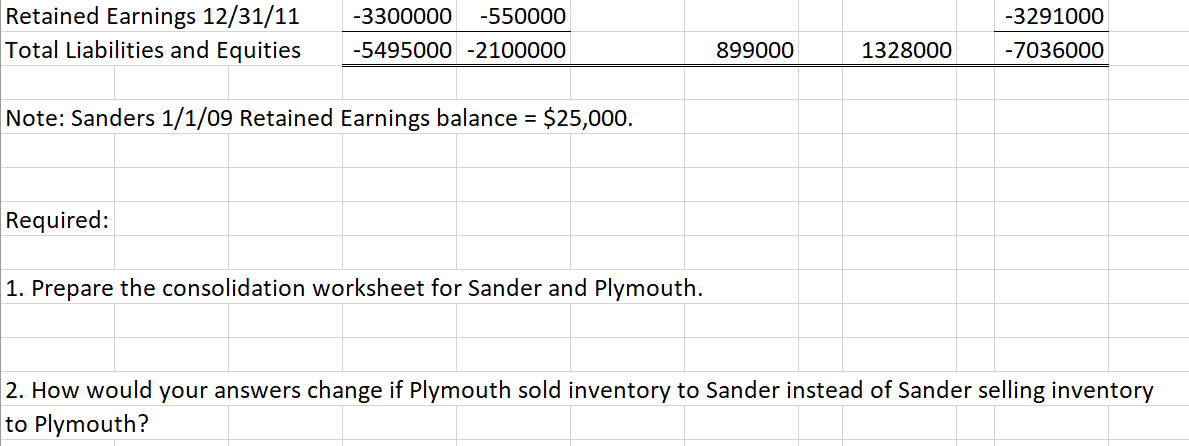

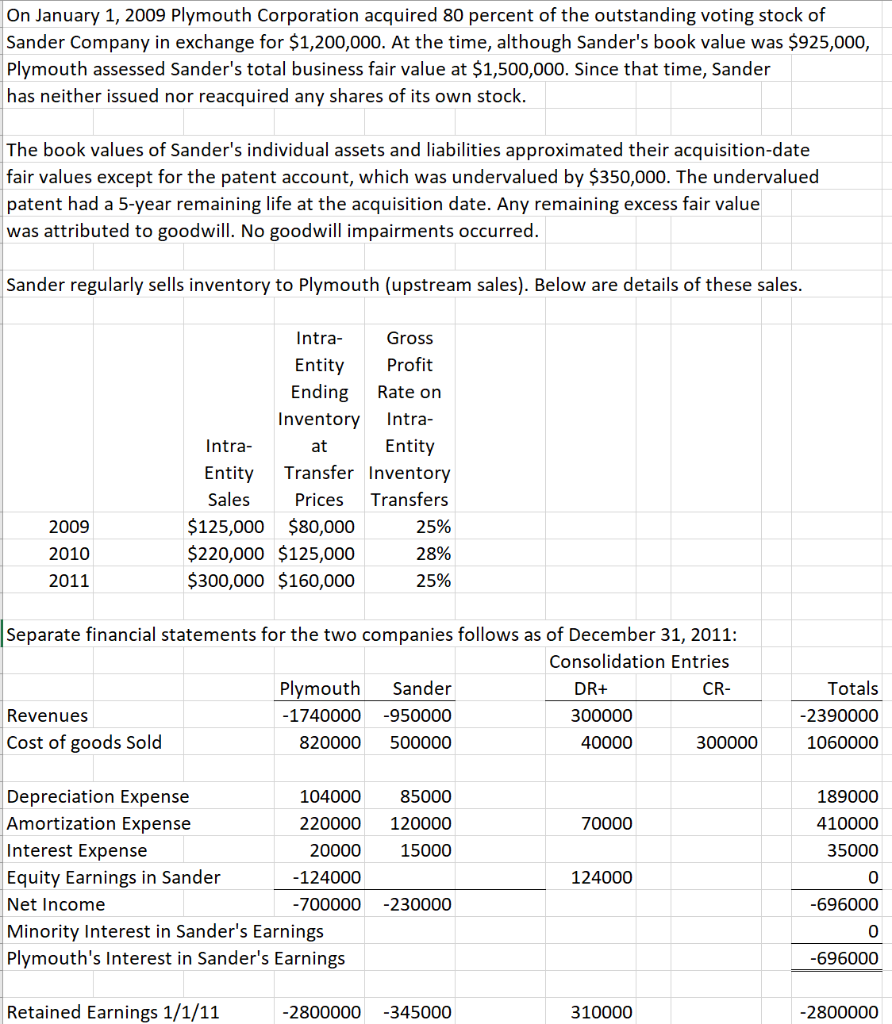

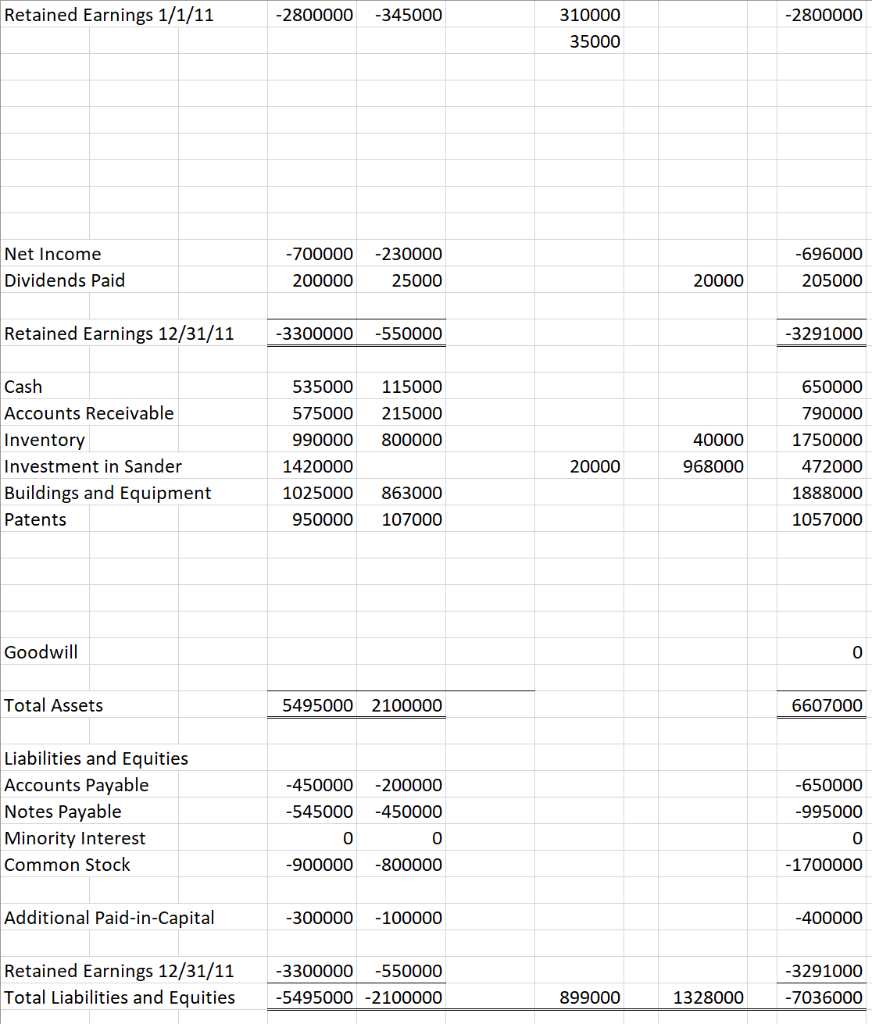

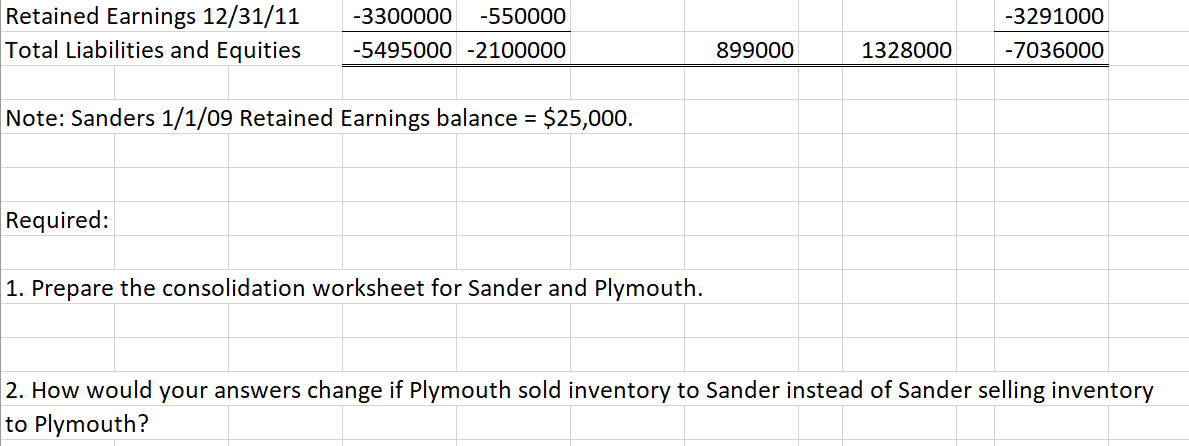

On January 1, 2009 Plymouth Corporation acquired 80 percent of the outstanding voting stock of Sander Company in exchange for $1,200,000. At the time, although Sander's book value was $925,000, Plymouth assessed Sander's total business fair value at $1,500,000. Since that time, Sander has neither issued nor reacquired any shares of its own stock. The book values of Sander's individual assets and liabilities approximated their acquisition-date fair values except for the patent account, which was undervalued by $350,000. The undervalued patent had a 5-year remaining life at the acquisition date. Any remaining excess fair value was attributed to goodwill. No goodwill impairments occurred. Sander regularly sells inventory to Plymouth (upstream sales). Below are details of these sales. Intra- Gross Entity Profit Ending Rate on Inventory Intra- Intra- at Entity Entity Transfer Inventory Sales Prices Transfers $125,000 $80,000 25% $220,000 $125,000 28% $300,000 $160,000 25% 2009 2010 2011 Separate financial statements for the two companies follows as of December 31, 2011: Consolidation Entries Plymouth Sander DR+ CR- Revenues -1740000 -950000 300000 Cost of goods Sold 820000 500000 40000 300000 Totals -2390000 1060000 85000 120000 70000 189000 410000 35000 15000 Depreciation Expense 104000 Amortization Expense 220000 Interest Expense 20000 Equity Earnings in Sander -124000 Net Income -700000 Minority Interest in Sander's Earnings Plymouth's Interest in Sander's Earnings 124000 0 -230000 -696000 0 -696000 Retained Earnings 1/1/11 -2800000 -345000 310000 -2800000 Retained Earnings 1/1/11 -2800000 -345000 310000 -2800000 35000 -696000 Net Income Dividends Paid -700000 200000 -230000 25000 20000 205000 Retained Earnings 12/31/11 -3300000 -550000 -3291000 115000 215000 800000 40000 Cash Accounts Receivable Inventory Investment in Sander Buildings and Equipment Patents 535000 575000 990000 1420000 1025000 950000 650000 790000 1750000 472000 1888000 1057000 20000 968000 863000 107000 Goodwill 0 Total Assets 5495000 2100000 6607000 Liabilities and Equities Accounts Payable Notes Payable Minority Interest Common Stock -450000 -545000 0 -900000 -200000 -450000 0 -650000 -995000 0 -800000 -1700000 Additional Paid-in-Capital -300000 -100000 -400000 Retained Earnings 12/31/11 Total Liabilities and Equities -3300000 -550000 -5495000 -2100000 -3291000 -7036000 899000 1328000 Retained Earnings 12/31/11 Total Liabilities and Equities -3300000 -550000 -5495000 -2100000 -3291000 -7036000 899000 1328000 Note: Sanders 1/1/09 Retained Earnings balance = $25,000. Required: 1. Prepare the consolidation worksheet for Sander and Plymouth. 2. How would your answers change if Plymouth sold inventory to Sander instead of Sander selling inventory to Plymouth