Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2010, Gordon Company purchased 150,000 of the 200,000 issued and outstanding voting shares of Kevin Company for $1,200,000 in cash. Both companies

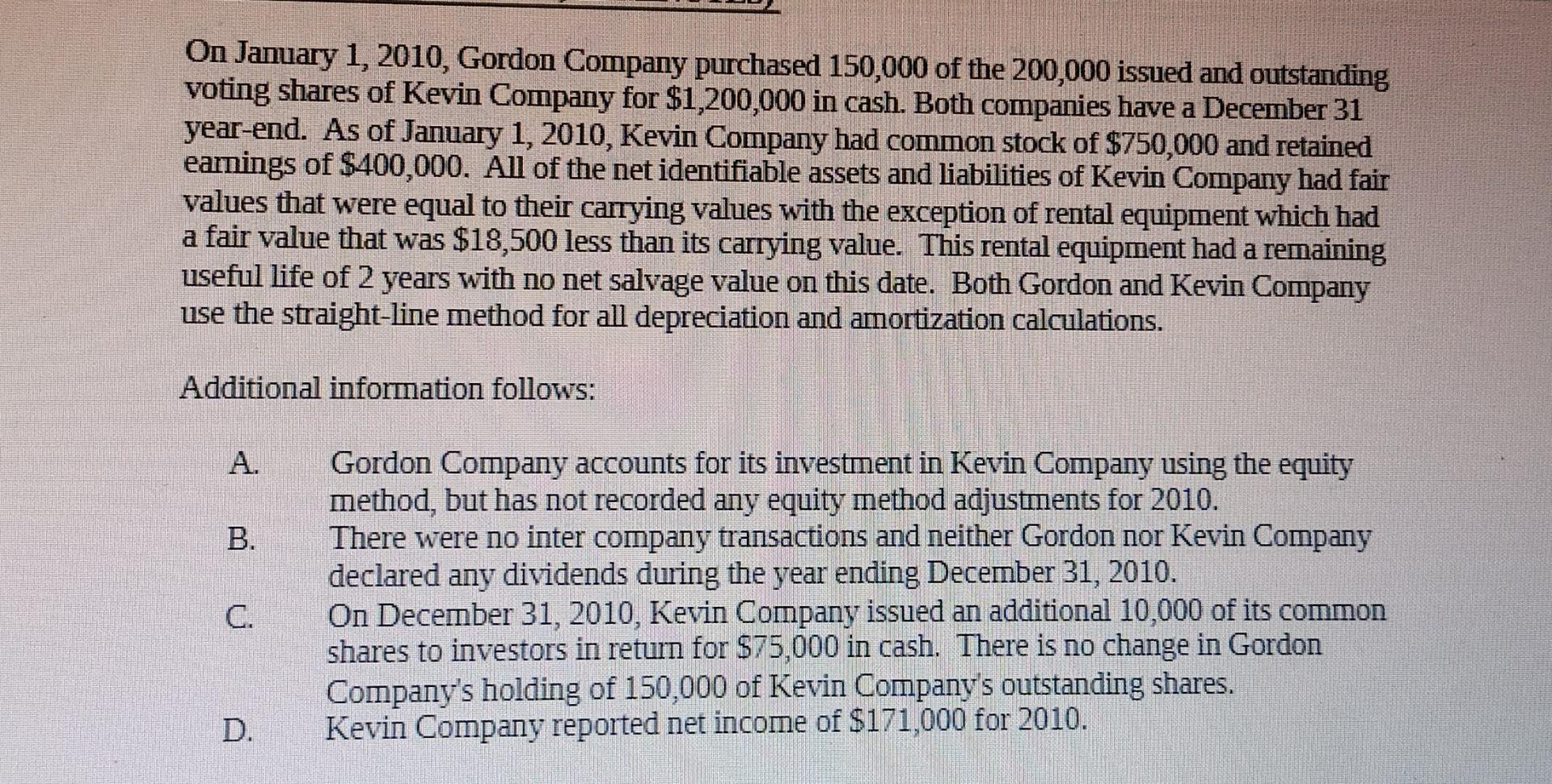

On January 1, 2010, Gordon Company purchased 150,000 of the 200,000 issued and outstanding voting shares of Kevin Company for $1,200,000 in cash. Both companies have a December 31 year-end. As of January 1, 2010, Kevin Company had common stock of $750,000 and retained eamings of $400,000. All of the net identifiable assets and liabilities of Kevin Company had fair values that were equal to their carrying values with the exception of rental equipment which had a fair value that was $18,500 less than its carrying value. This rental equipment had a remaining useful life of 2 years with no net salvage value on this date. Both Gordon and Kevin Company use the straight-line method for all depreciation and amortization calculations. Additional information follows: A. B. Gordon Company accounts for its investment in Kevin Company using the equity method, but has not recorded any equity method adjustments for 2010. There were no inter company transactions and neither Gordon nor Kevin Company declared any dividends during the year ending December 31, 2010. On December 31, 2010, Kevin Company issued an additional 10,000 of its common shares to investors in return for $75,000 in cash. There is no change in Gordon Company's holding of 150,000 of Kevin Company's outstanding shares. Kevin Company reported net income of $171,000 for 2010. C. D. On January 1, 2010, Gordon Company purchased 150,000 of the 200,000 issued and outstanding voting shares of Kevin Company for $1,200,000 in cash. Both companies have a December 31 year-end. As of January 1, 2010, Kevin Company had common stock of $750,000 and retained eamings of $400,000. All of the net identifiable assets and liabilities of Kevin Company had fair values that were equal to their carrying values with the exception of rental equipment which had a fair value that was $18,500 less than its carrying value. This rental equipment had a remaining useful life of 2 years with no net salvage value on this date. Both Gordon and Kevin Company use the straight-line method for all depreciation and amortization calculations. Additional information follows: A. B. Gordon Company accounts for its investment in Kevin Company using the equity method, but has not recorded any equity method adjustments for 2010. There were no inter company transactions and neither Gordon nor Kevin Company declared any dividends during the year ending December 31, 2010. On December 31, 2010, Kevin Company issued an additional 10,000 of its common shares to investors in return for $75,000 in cash. There is no change in Gordon Company's holding of 150,000 of Kevin Company's outstanding shares. Kevin Company reported net income of $171,000 for 2010. C. D

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started