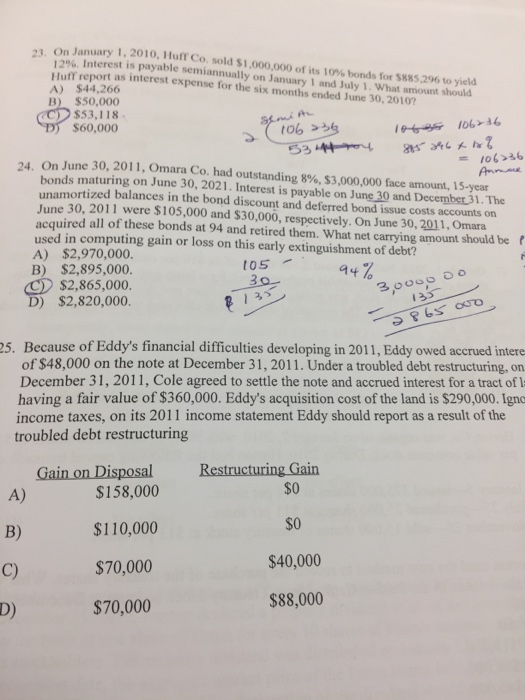

On January 1 , 2010, Huff Co. sold $1 ,000,000 of its 10% bonds for S88 5,296 to yield 2e% Interest is payable semiannually on January 1 and July 1. What amount should Huff report as interest expense for the six months ended June 30, 2010 A) $44,266 B) $50,000 23. $53,118 pt $60,000 /06 >36 24. On June 30, 2011, Omara Co. had outstanding 8%,S3,000,000 face amount 15-year bonds maturing on June 30, 2021. Interest is payable on June 30 and December 31. The unamortized balances in the bond discount and deferred bond issue costs accounts on June 30, 2011 were $105,000 and $30,000, respectively. On June 30, 2011, Omara acquired all of these bonds at 94 and retired them. What net carrying amount should be used in computing gain or loss on this early extinguishment of debt? A) $2,970,000. B) $2,895,000. t t05-44% $2,865,000. D) $2,820,000 25. Because of Eddy's financial difficulties developing in 2011, Eddy owed accrued intere of $48,000 on the note at December 31, 2011. Under a troubled debt restructuring, on December 31, 2011, Cole agreed to settle the note and accrued interest for a tract of having a fair value of $360,000. Eddy's acquisition cost of the land is $290,000. Igno income taxes, on its 2011 income statement Eddy should report as a result of the troubled debt restructuring Gain on Disposal $O $O $40,000 $88,000 $158,000 A) B) C) D) $110,000 $70,000 $70,000 On January 1 , 2010, Huff Co. sold $1 ,000,000 of its 10% bonds for S88 5,296 to yield 2e% Interest is payable semiannually on January 1 and July 1. What amount should Huff report as interest expense for the six months ended June 30, 2010 A) $44,266 B) $50,000 23. $53,118 pt $60,000 /06 >36 24. On June 30, 2011, Omara Co. had outstanding 8%,S3,000,000 face amount 15-year bonds maturing on June 30, 2021. Interest is payable on June 30 and December 31. The unamortized balances in the bond discount and deferred bond issue costs accounts on June 30, 2011 were $105,000 and $30,000, respectively. On June 30, 2011, Omara acquired all of these bonds at 94 and retired them. What net carrying amount should be used in computing gain or loss on this early extinguishment of debt? A) $2,970,000. B) $2,895,000. t t05-44% $2,865,000. D) $2,820,000 25. Because of Eddy's financial difficulties developing in 2011, Eddy owed accrued intere of $48,000 on the note at December 31, 2011. Under a troubled debt restructuring, on December 31, 2011, Cole agreed to settle the note and accrued interest for a tract of having a fair value of $360,000. Eddy's acquisition cost of the land is $290,000. Igno income taxes, on its 2011 income statement Eddy should report as a result of the troubled debt restructuring Gain on Disposal $O $O $40,000 $88,000 $158,000 A) B) C) D) $110,000 $70,000 $70,000