Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: 1. Please provide a determination and distribution schedule. 2. Make all of the necessary elimination entries. 3. Using T-accounts, calculate the income for both

Required:

1. Please provide a determination and distribution schedule.

2. Make all of the necessary elimination entries.

3. Using T-accounts, calculate the income for both Parent and Subsidiary and then clearly indicate how much is Parent's portion of Subsidiary's income and how much is NCI.

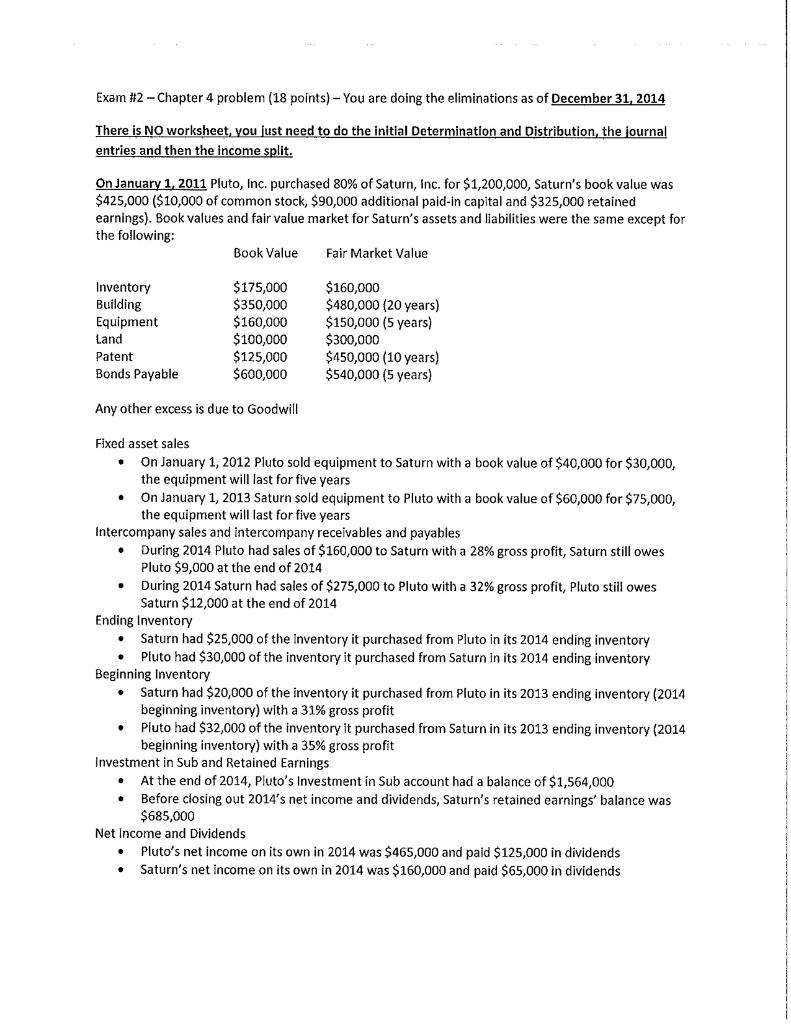

Exam #2 - Chapter 4 problem (18 points) - You are doing the eliminations as of December 31, 2014 There is NO worksheet, you just need to do the initial Determination and Distribution, the journal entries and then the income split. On January 1, 2011 Pluto, Inc. purchased 80% of Saturn, Inc. for $1,200,000, Saturn's book value was $425,000 ($10,000 of common stock, $90,000 additional paid-in capital and $325,000 retained earnings). Book values and fair value market for Saturn's assets and liabilities were the same except for the following: Book Value Fair Market Value $175,000 $350,000 $160,000 $100,000 $125,000 $600,000 $160,000 $480,000 (20 years) $150,000 (5 years) $300,000 $450,000 (10 years) $540,000 (5 years) Inventory Building Equipment Land Patent Bonds Payable Any other excess is due to Goodwill Fixed asset sales On January 1, 2012 Pluto sold equipment to the equipment will last for five years On January 1, 2013 Saturn sold equipment to Pluto with a book value of $60,000 for $75,000, the equipment will last for five years aturn a book value of $40,000 for $30,000, Intercompany sales and intercompany receivables and payables During 2014 Pluto had sales of $160,000 to Saturn with a 28% gross profit, Saturn still owes Pluto $9,000 at the end of 2014 During 2014 aturn had sales of $275,000 to Pluto with a 32% gross profit, Pluto stil owes Saturn $12,000 at the end of 2014 Ending Inventory Saturn had $25,000 of the Inventory it purchased from Pluto in its 2014 ending inventory Pluto had $30,000 of the inventory it purchased from Saturn in its 2014 ending inventory Beginning Inventory Saturn had $20,000 of the inventory it purchased from Pluto in its 2013 ending inventory (2014 beginning inventory) with a 31% gross profit Pluto had $32,000 of the inventory it purchased from Saturn in its 2013 ending inventory (2014 beginning inventory) with a 35% gross profit Investment in Sub and Retained Earnings At the end of 2014, Pluto's Investment in Sub account had a balance of $1,564,000 Before closing out 2014's net income and dividends, Saturn's retained earnings' balance was $685,000 Net Income and Dividends Pluto's net income on its own in 2014 was $465,000 and paid $125,000 in dividends Saturn's net income on its own in 2014 was $160,000 and paid $65,000 in dividends

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 of 5 A Journal entries of L company books on July 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started