Question

On January 1, 2011, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for

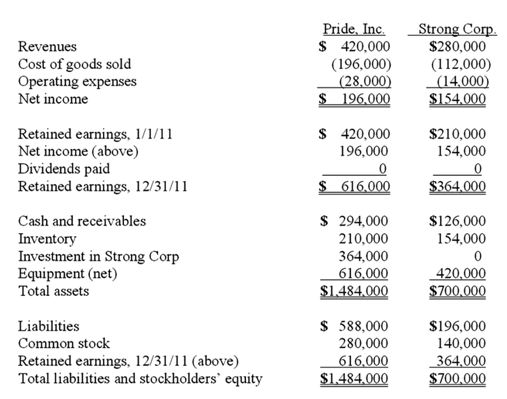

On January 1, 2011, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill which has not been impaired. As of December 31, 2011, before preparing the consolidated worksheet, the financial statements appeared as follows:

During 2011, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31. 2011.

(A) What is the consolidated total for inventory at December 31, 2011?

(B) What is the total of consolidated operating expenses?

(C) What is the consolidated total of non-controlling interest appearing in the balance sheet?

(D) What is the total of consolidated revenues?

(E) What is the consolidated total for equipment (net) at December 31, 2011?

(F) What is the total of consolidated cost of goods sold?

S 420.000 Revenues Cost of goods sold Operating expenses Net income $280,000 (196,000) 112,000) S 196,000S154.000 $210,000 Retained earnings, 1/1/11 Net income (above) Dividends paid Retained earnings, 12/31/11 S 420,000 196,000 154,000 $126,000 154,000 Cash and receivables Inventory Investment in Strong Corp Equipment (net) Total assets S 294,000 210,000 364,000 $1484000 S700,000 $196,000 140,000 Liabilities Common stock Retained earnings, 12/31/11 (above) Total liabilities and stockholders' equity S 588,000 280,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started