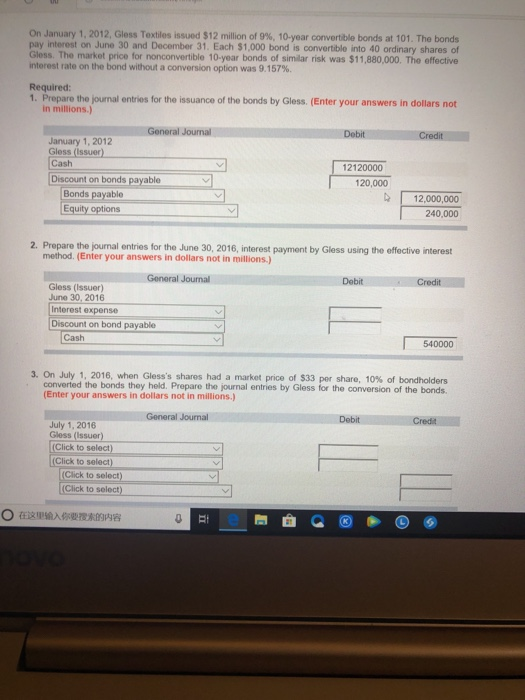

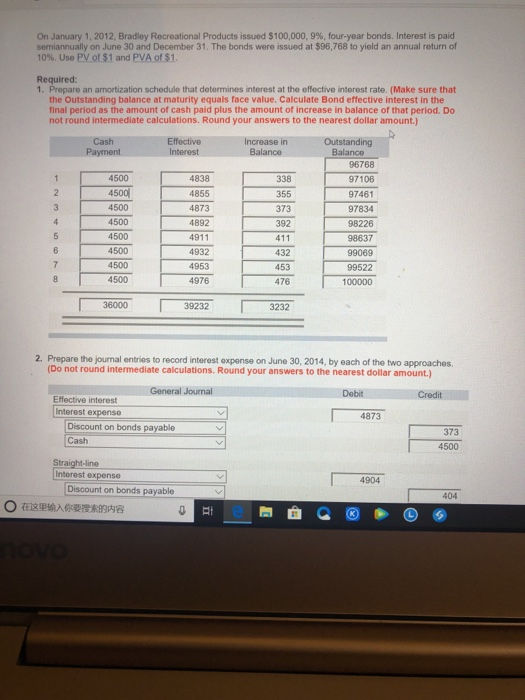

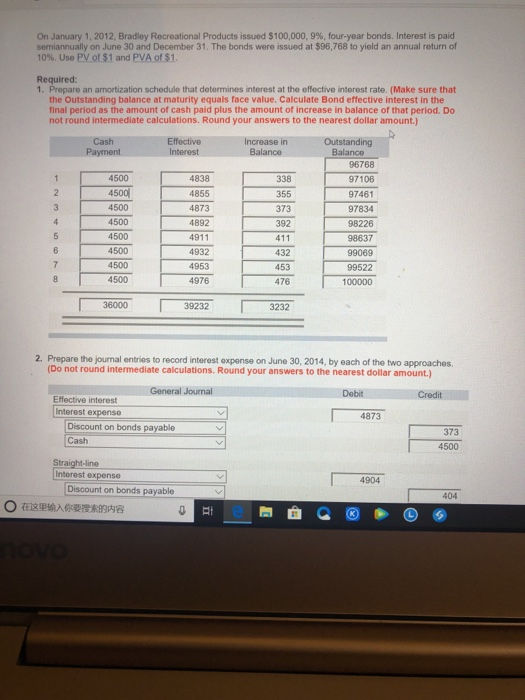

On January 1, 2012, Gless Textiles issued $12 million of 9%, 10-year convertie bonds at 101. The bonds pay interest on June 30 and December 31. Each $1,000 bond is convertible into 40 ordinary shares of Gless. The market price for nonconvertible 10-year bonds of similar risk was $11,880,000. The effective interest rate on the bond without a conversion option was 9.157%. Required 1. Prepare the journal entries for the issuance of the bonds by Gless. (Enter your answers in dollars not in millions.) General Journal Debit January 1, 2012 Gless (Issuer) Cash 12120000 Discount on bonds payable 120,000 Bonds payable 12,000,000 240,000 Equity options 2. Prepare the journal entries for the June 30, 2016, interest payment by Gless using the effective interest method. (Enter your answers in dollars not in millions.) General Journal Gless (Issuer) June 30, 2016 Interest expense Discount on bond payable Cash 540000 3. On July 1, 2016, when Gless's shares had a market pnce of $33 per share, 10% of bondholders converted the bonds they held. Prepare the journal entries by Gless for the conversion of the bonds. Enter your answers in dollars not in millions.) General Journal Debit July 1, 2016 Gless (Issuer) (Click to select) (Click to select) Click to select) (Click to select) UMAR On January 1, 2012, Bradley Recreational Products issued $100,000, 996, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $96,768 to yield an annual return of 10% Use Pyo($1 and pVAof $1 Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. (Make sure that the Outstanding balance at maturity equals face value. Calculate Bond effective interest in the final period as the amount of cash paid plus the amount of increase in balance of that period. Do not round intermediate calculations. Round your answers to the nearest dollar amount.) Cash Payment Increase in Balance Outstanding 96768 97106 97461 97834 98226 98637 99069 99522 100000 Interest 4500 4500 4500 4500 4500 4500 4500 4500 4838 4855 4873 4892 4911 4932 4953 4976 338 355 373 392 411 432 453 476 36000 39232 3232 2. Prepare the journal entries to record interest expense on June 30, 2014, by each of the two approaches. Do not round intermediate calculations. Round your answers to the nearest dollar amount.) General Journal DabitCredit Effective interest Interest expense 4873 Discount on bonds payable 373 4500 Straight-line Intorest expense 4904 Discount on bonds payable 404