Question

On January 1, 2013, Locke Company, a small machine-tool manufacturer, acquired a piece of new industrial equipment for $1,260,000. The new equipment had a useful

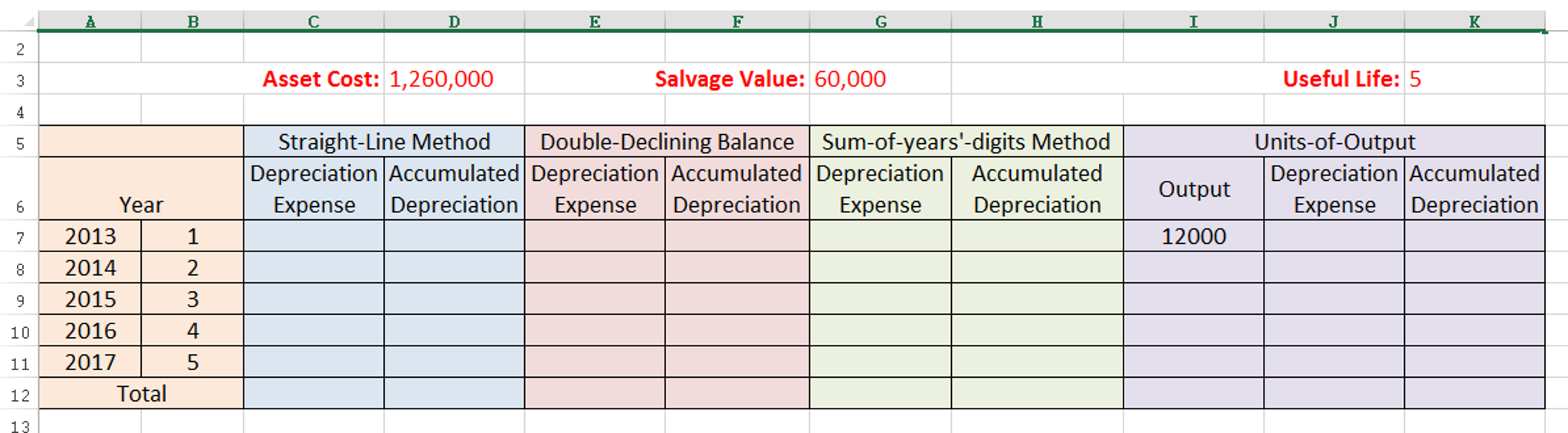

On January 1, 2013, Locke Company, a small machine-tool manufacturer, acquired a piece of new industrial equipment for $1,260,000. The new equipment had a useful life of 5 years, and the salvage value was estimated to be $60,000. Locke estimates that the new equipment can produce 12,000 machine tools in its first year. It estimates that production will decline by 1,234 units per year over the remaining useful life of the equipment. The following depreciation methods may be used: (1) Straight-line; (2) Double-declining balance; (3) Sum-of-years'-digits, and (4) Units-of-output.

Calculate (1) Straight-line; (2) Double-declining balance; (3) Sum-of-years'-digits, and (4) Units-of-output. and answer this question: Which depreciation method would maximize net income for financial statement reporting for the 4-year period ending December 31, 2016? Use the schedule above to answer the question. Ignore present value, income tax, and deferred income tax considerations.

| Note that- (1) Instead of entering raw data into Excel formulas, use cell references to refer to asset cost, salvage value, and useful life and then copy the entry to other cells. (2) Use SLN, DDB, SYD functions to calculate Depreciation Expenses for 2013~2017. (3) Excel does not provide specific functions for Units-of-Output method. Use SUM and appropriate mathematical formula to manually calculate Depreciation Expenses for each year. (4) DDB method usually fails to depreciate the book value to the salvage value. Manual adjustments may be required. (5) Use SUM and cell reference to calculate Accumulated Depreciation |

Asset Cost: 1,260,000 Salvage Value: 60,000 Useful Life: 5 Units-of-Output Straight-Line Method Double-Declining Balance Sum-of-years'-digits Method Depreciation Accumulated Depreciation Accumulated Depreciation Accumulated Depreciation Depreciation Accumulated Expense Depreciation Output Year Expense Depreciation| Expense Depreciation Expense 72013 8 2014 92015 10 2016 11 2017 12 13 1 12000 Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started