Costs associated with the manufacture of miniature high-sensitivity piezoresistive pressure transducers is $81,000 per year. A clever industrial engineer found that by spending $17,000

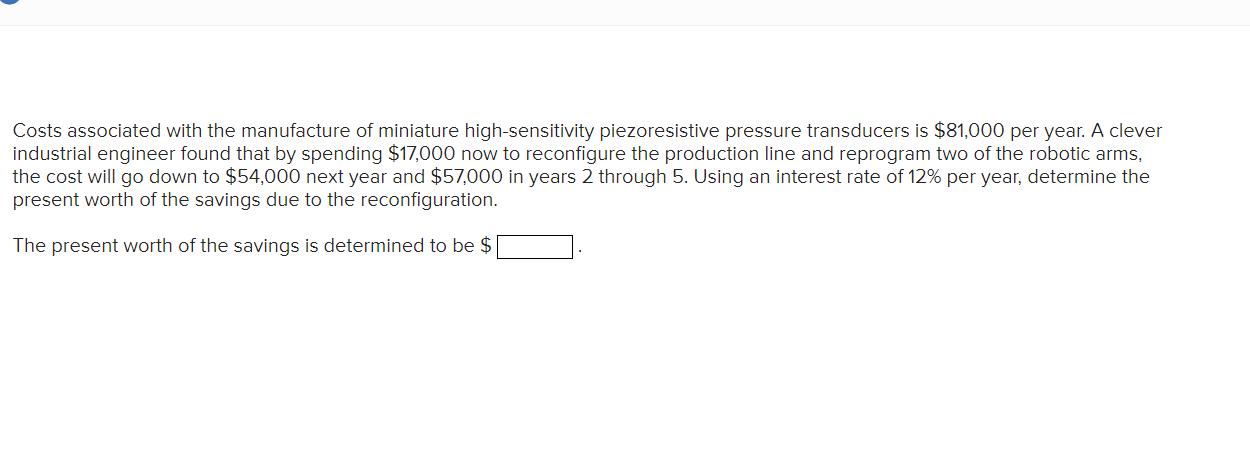

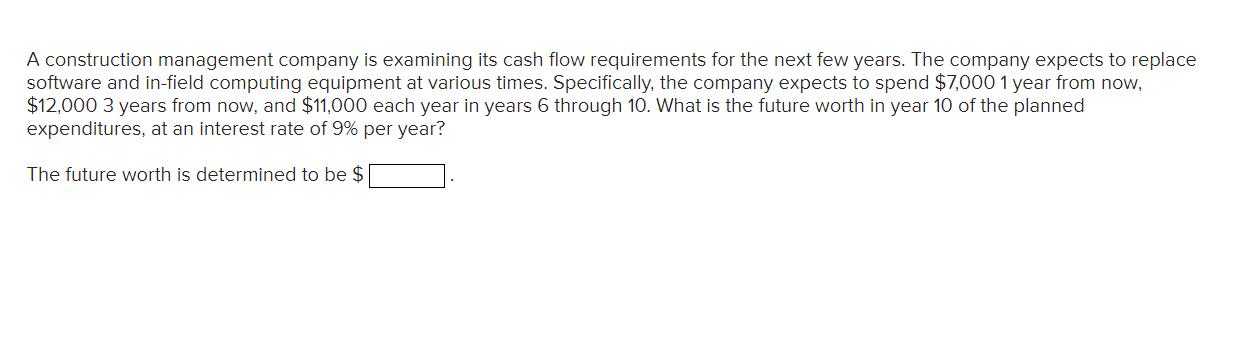

Costs associated with the manufacture of miniature high-sensitivity piezoresistive pressure transducers is $81,000 per year. A clever industrial engineer found that by spending $17,000 now to reconfigure the production line and reprogram two of the robotic arms, the cost will go down to $54,000 next year and $57,000 in years 2 through 5. Using an interest rate of 12% per year, determine the present worth of the savings due to the reconfiguration. The present worth of the savings is determined to be $ A construction management company is examining its cash flow requirements for the next few years. The company expects to replace software and in-field computing equipment at various times. Specifically, the company expects to spend $7,000 1 year from now, $12,000 3 years from now, and $11,000 each year in years 6 through 10. What is the future worth in year 10 of the planned expenditures, at an interest rate of 9% per year? The future worth is determined to be $

Step by Step Solution

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

D For year 1 81000 54000 Saving For year Saving for year 2 to 5 81000 5...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started