Question

On January 1, 2013, Piper Company acquired an 80% interest in Sand Company for $2,368,500. At that time the common stock and retained earnings of

On January 1, 2013, Piper Company acquired an 80% interest in Sand Company for $2,368,500. At that time the common stock and retained earnings of Sand Company were $1,836,600 and $668,200, respectively. Differences between the fair value and the book value of the identifiable assets of Sand Company were as follows:

| Fair Value in Excess of Book Value | ||

| Inventory | $43,800 | |

| Equipment (net) | 48,600 |

The book values of all other assets and liabilities of Sand Company were equal to their fair values on January 1, 2013. The equipment had a remaining useful life of eight years. Inventory is accounted for on a FIFO basis. Sand Companys reported net income and declared dividends for 2013 through 2015 are shown here:

| 2013 | 2014 | 2015 | ||||

| Net Income | $97,000 | $142,900 | $79,800 | |||

| Dividends | 20,200 | 30,800 | 14,700 |

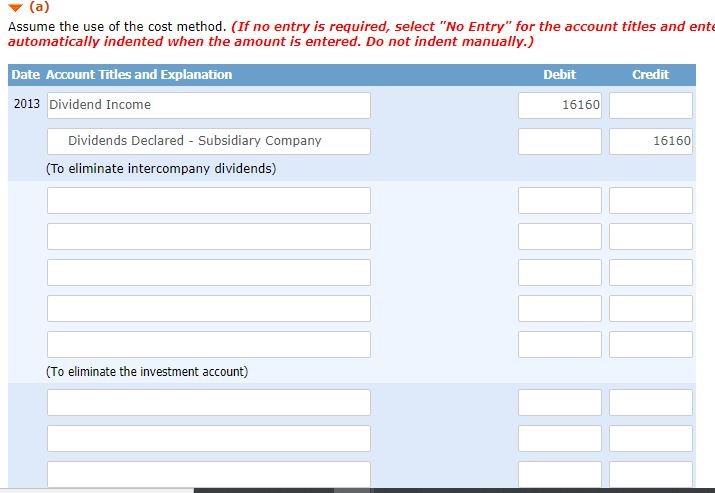

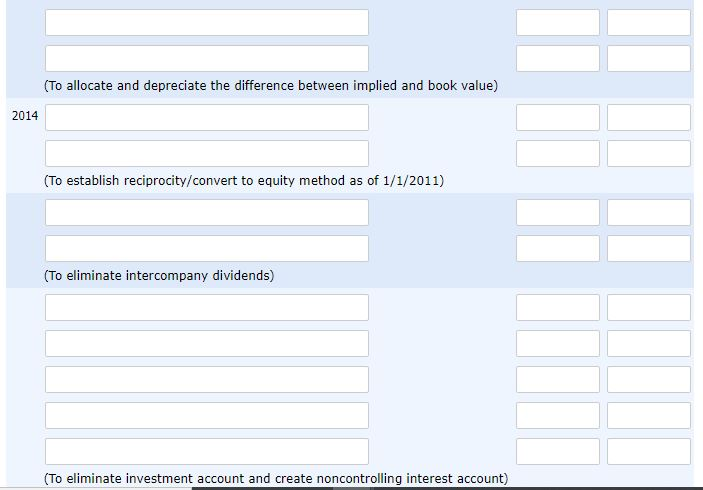

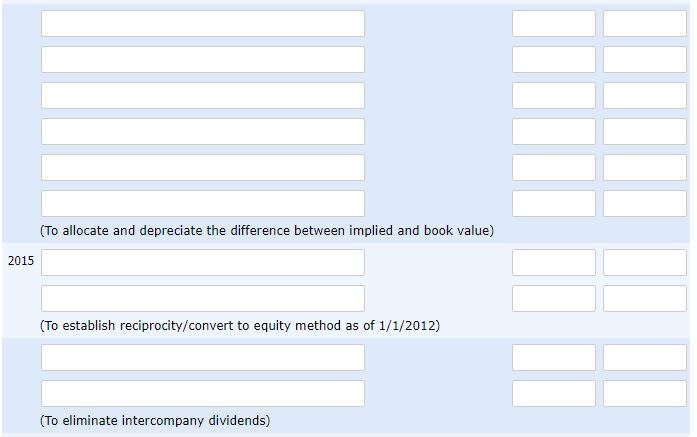

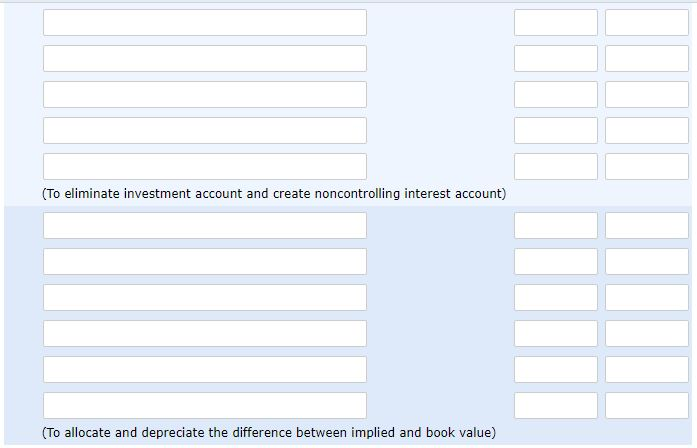

Prepare the eliminating/adjusting entries needed on the consolidated worksheet for the years ended 2013, 2014, and 2015.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started