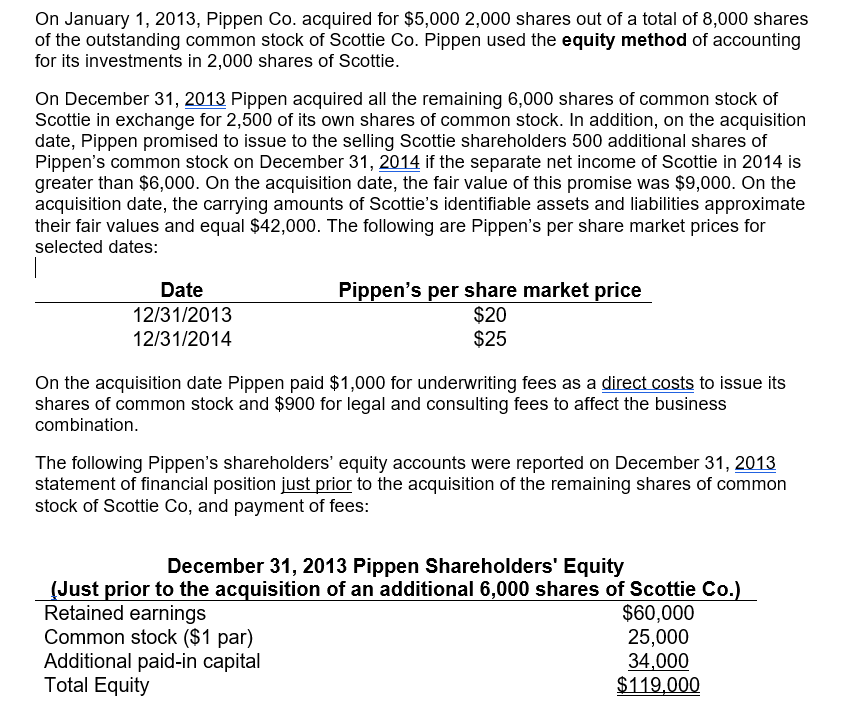

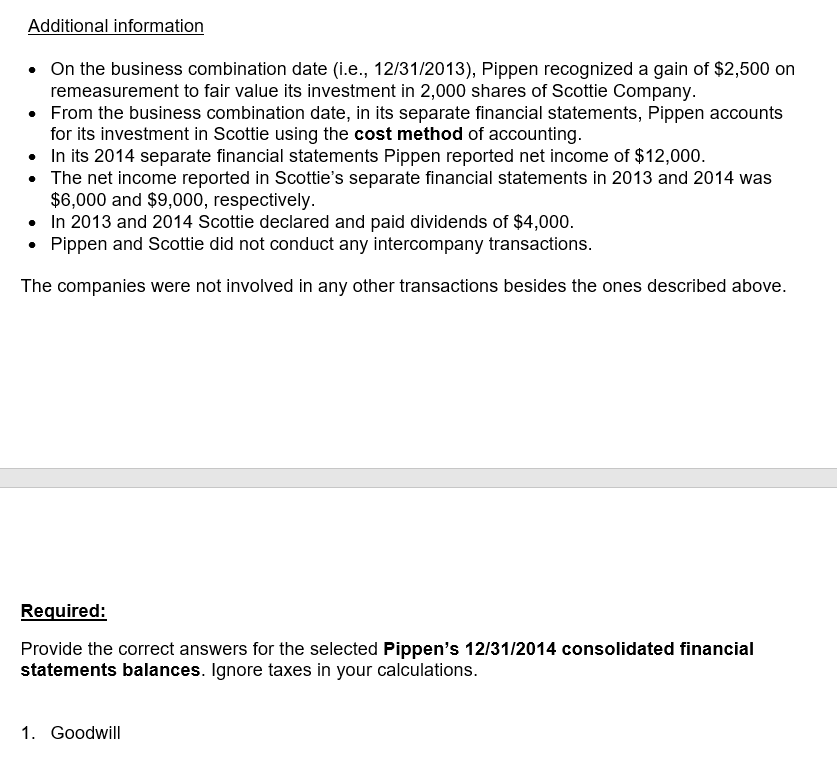

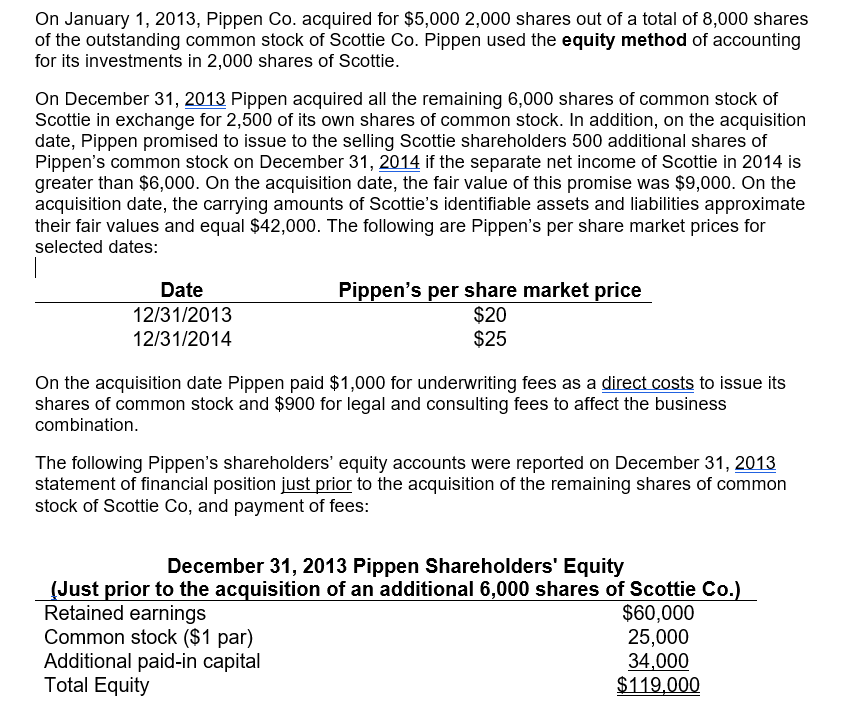

On January 1, 2013, Pippen Co. acquired for $5,000 2,000 shares out of a total of 8,000 shares of the outstanding common stock of Scottie Co. Pippen used the equity method of accounting for its investments in 2,000 shares of Scottie. On December 31, 2013 Pippen acquired all the remaining 6,000 shares of common stock of Scottie in exchange for 2,500 of its own shares of common stock. In addition, on the acquisition date, Pippen promised to issue to the selling Scottie shareholders 500 additional shares of Pippen's common stock on December 31, 2014 if the separate net income of Scottie in 2014 is greater than $6,000. On the acquisition date, the fair value of this promise was $9,000. On the acquisition date, the carrying amounts of Scottie's identifiable assets and liabilities approximate their fair values and equal $42,000. The following are Pippen's per share market prices for selected dates: 1 Date Pippen's per share market price 12/31/2013 $ $20 12/31/2014 $25 On the acquisition date Pippen paid $1,000 for underwriting fees as a direct costs to issue its shares of common stock and $900 for legal and consulting fees to affect the business combination. The following Pippen's shareholders' equity accounts were reported on December 31, 2013 statement of financial position just prior to the acquisition of the remaining shares of common stock of Scottie Co, and payment of fees: December 31, 2013 Pippen Shareholders' Equity (Just prior to the acquisition of an additional 6,000 shares of Scottie Co.) Retained earnings $60,000 Common stock ($1 par) 25,000 Additional paid-in capital 34,000 Total Equity $119.000 Additional information On the business combination date (i.e., 12/31/2013), Pippen recognized a gain of $2,500 on remeasurement to fair value its investment in 2,000 shares of Scottie Company. From the business combination date, in its separate financial statements, Pippen accounts for its investment in Scottie using the cost method of accounting. In its 2014 separate financial statements Pippen reported net income of $12,000. The net income reported in Scottie's separate financial statements in 2013 and 2014 was $6,000 and $9,000, respectively. In 2013 and 2014 Scottie declared and paid dividends of $4,000. Pippen and Scottie did not conduct any intercompany transactions. The companies were not involved in any other transactions besides the ones described above. Required: Provide the correct answers for the selected Pippen's 12/31/2014 consolidated financial statements balances. Ignore taxes in your calculations. 1. Goodwill 2. Retained Earnings, 12/31/2014 3. Common Stock 4. Additional paid-in capital On January 1, 2013, Pippen Co. acquired for $5,000 2,000 shares out of a total of 8,000 shares of the outstanding common stock of Scottie Co. Pippen used the equity method of accounting for its investments in 2,000 shares of Scottie. On December 31, 2013 Pippen acquired all the remaining 6,000 shares of common stock of Scottie in exchange for 2,500 of its own shares of common stock. In addition, on the acquisition date, Pippen promised to issue to the selling Scottie shareholders 500 additional shares of Pippen's common stock on December 31, 2014 if the separate net income of Scottie in 2014 is greater than $6,000. On the acquisition date, the fair value of this promise was $9,000. On the acquisition date, the carrying amounts of Scottie's identifiable assets and liabilities approximate their fair values and equal $42,000. The following are Pippen's per share market prices for selected dates: 1 Date Pippen's per share market price 12/31/2013 $ $20 12/31/2014 $25 On the acquisition date Pippen paid $1,000 for underwriting fees as a direct costs to issue its shares of common stock and $900 for legal and consulting fees to affect the business combination. The following Pippen's shareholders' equity accounts were reported on December 31, 2013 statement of financial position just prior to the acquisition of the remaining shares of common stock of Scottie Co, and payment of fees: December 31, 2013 Pippen Shareholders' Equity (Just prior to the acquisition of an additional 6,000 shares of Scottie Co.) Retained earnings $60,000 Common stock ($1 par) 25,000 Additional paid-in capital 34,000 Total Equity $119.000 Additional information On the business combination date (i.e., 12/31/2013), Pippen recognized a gain of $2,500 on remeasurement to fair value its investment in 2,000 shares of Scottie Company. From the business combination date, in its separate financial statements, Pippen accounts for its investment in Scottie using the cost method of accounting. In its 2014 separate financial statements Pippen reported net income of $12,000. The net income reported in Scottie's separate financial statements in 2013 and 2014 was $6,000 and $9,000, respectively. In 2013 and 2014 Scottie declared and paid dividends of $4,000. Pippen and Scottie did not conduct any intercompany transactions. The companies were not involved in any other transactions besides the ones described above. Required: Provide the correct answers for the selected Pippen's 12/31/2014 consolidated financial statements balances. Ignore taxes in your calculations. 1. Goodwill 2. Retained Earnings, 12/31/2014 3. Common Stock 4. Additional paid-in capital