Answered step by step

Verified Expert Solution

Question

1 Approved Answer

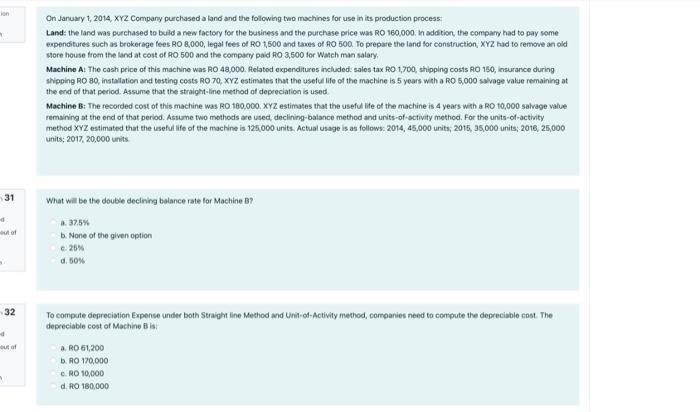

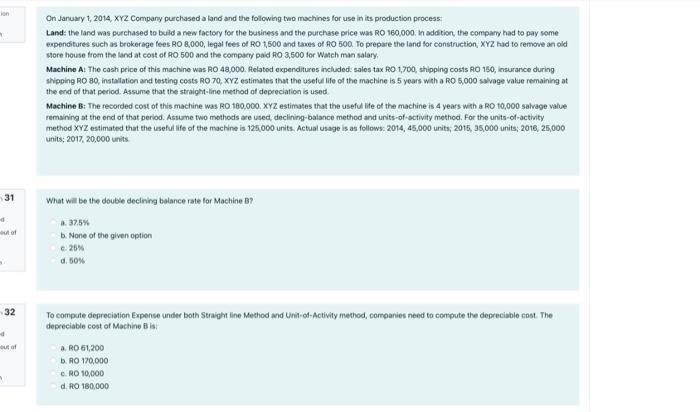

On January 1, 2014, XYZ Company purchased a land and the following to machines for use in its production process Land: the land was purchased

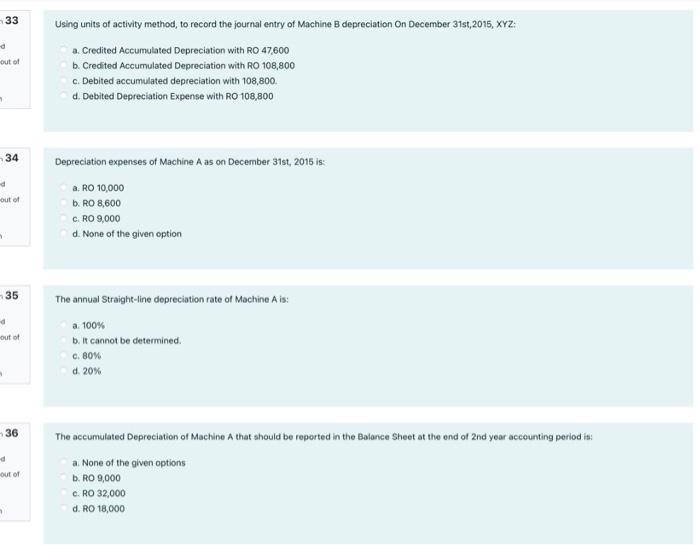

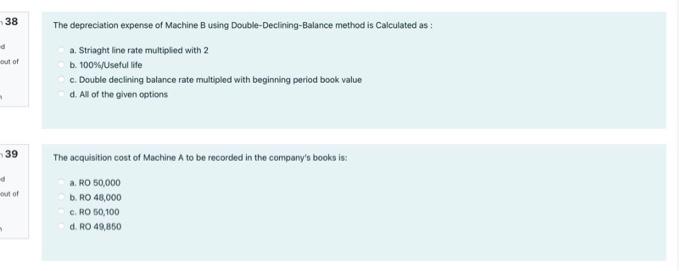

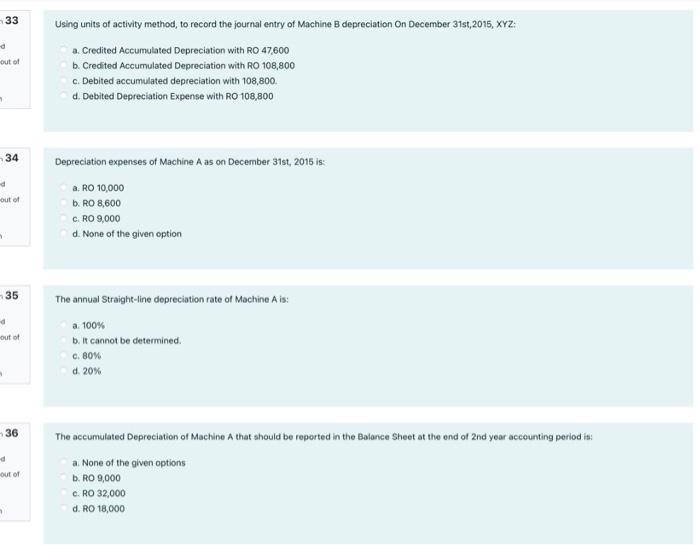

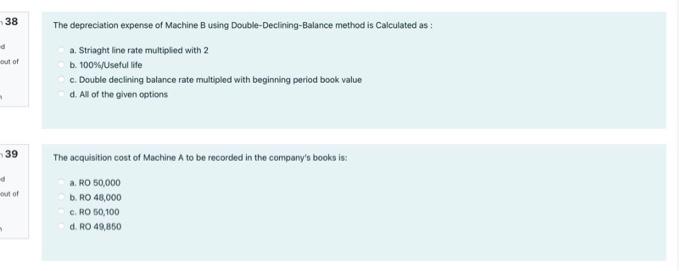

On January 1, 2014, XYZ Company purchased a land and the following to machines for use in its production process Land: the land was purchased to build a new factory for the business and the purchase price was RO 160,000. In addition, the company had to pay some expenditures such as brokerage fees RO 8,000, legal fees of RO 1500 and taxes of RO 500 To prepare the land for construction, XYZ had to remove an old store house from the land at cost of RO 500 and the company paid RO 3,500 for Watch man salary Machine A: The cash price of this machine was RO 48,000. Related expenditures included sales tax RO 1700, shipping costs RO 150, insurance during shipping RO 80, installation and testing costs RO 70, XYZ estimates that the useful life of the machine is 5 years with a RO 5,000 salvage value remaining at the end of that period. Assume that the straight-line method of depreciation is used Machine B: The recorded cost of this machine was RO 180,000. XYZ estimates that the useful life of the machine is 4 years with a RO 10,000 salvage value remaining at the end of that period. Assume two methods are used declining-balance method and units-of-activity method. For the units-of-activity method XYZ estimated that the useful life of the machine is 125,000 units. Actual usage is as follows: 2014, 45,000 units, 2015, 35,000 units; 2016, 25,000 units, 2017, 20,000 units 31 What will be the double declining balance rate for Machine B? 37.5% b. None of the given option 0.25% d. 50% 32 To compute depreciation Expense under both Straight line Method and Unit-od-Activity method, companies need to compute the depreciablo cont. The depreciable cost of Machine out of a. RO 61,200 b. RO 170,000 c. RO 10,000 d. RO 180,000 33 d out of Using units of activity method to record the journal entry of Machine B depreciation On December 31st, 2015, XYZ: a. Credited Accumulated Depreciation with RO 47,600 b. Credited Accumulated Depreciation with RO 108,800 c. Debited accumulated depreciation with 108,800. d Debited Depreciation Expense with RO 108,800 34 d out of Depreciation expenses of Machine A as on December 31st, 2015 is: a. RO 10,000 b. RO 8,600 C. RO 9,000 d. None of the given option 35 The annual Straight-line depreciation rate of Machine Ais: d out of a 100% b. It cannot be determined c. 80% d. 20% -36 d The accumulated Depreciation of Machine A that should be reported in the Balance Sheet at the end of 2nd year accounting period is: a. None of the given options b. RO 9,000 c. RO 32,000 d. RO 18,000 out of 38 d out of The depreciation expense of Machine B using Double-Declining-Balance method is calculated as: a. Striaght line rate multiplied with 2 b. 100%/Useful life c. Double declining balance rate multipled with beginning period book value d. All of the given options 39 d out of The acquisition cost of Machine A to be recorded in the company's books is: a. RO 50,000 b. RO 48,000 C.RO 50,100 d. RO 49,850

On January 1, 2014, XYZ Company purchased a land and the following to machines for use in its production process Land: the land was purchased to build a new factory for the business and the purchase price was RO 160,000. In addition, the company had to pay some expenditures such as brokerage fees RO 8,000, legal fees of RO 1500 and taxes of RO 500 To prepare the land for construction, XYZ had to remove an old store house from the land at cost of RO 500 and the company paid RO 3,500 for Watch man salary Machine A: The cash price of this machine was RO 48,000. Related expenditures included sales tax RO 1700, shipping costs RO 150, insurance during shipping RO 80, installation and testing costs RO 70, XYZ estimates that the useful life of the machine is 5 years with a RO 5,000 salvage value remaining at the end of that period. Assume that the straight-line method of depreciation is used Machine B: The recorded cost of this machine was RO 180,000. XYZ estimates that the useful life of the machine is 4 years with a RO 10,000 salvage value remaining at the end of that period. Assume two methods are used declining-balance method and units-of-activity method. For the units-of-activity method XYZ estimated that the useful life of the machine is 125,000 units. Actual usage is as follows: 2014, 45,000 units, 2015, 35,000 units; 2016, 25,000 units, 2017, 20,000 units 31 What will be the double declining balance rate for Machine B? 37.5% b. None of the given option 0.25% d. 50% 32 To compute depreciation Expense under both Straight line Method and Unit-od-Activity method, companies need to compute the depreciablo cont. The depreciable cost of Machine out of a. RO 61,200 b. RO 170,000 c. RO 10,000 d. RO 180,000 33 d out of Using units of activity method to record the journal entry of Machine B depreciation On December 31st, 2015, XYZ: a. Credited Accumulated Depreciation with RO 47,600 b. Credited Accumulated Depreciation with RO 108,800 c. Debited accumulated depreciation with 108,800. d Debited Depreciation Expense with RO 108,800 34 d out of Depreciation expenses of Machine A as on December 31st, 2015 is: a. RO 10,000 b. RO 8,600 C. RO 9,000 d. None of the given option 35 The annual Straight-line depreciation rate of Machine Ais: d out of a 100% b. It cannot be determined c. 80% d. 20% -36 d The accumulated Depreciation of Machine A that should be reported in the Balance Sheet at the end of 2nd year accounting period is: a. None of the given options b. RO 9,000 c. RO 32,000 d. RO 18,000 out of 38 d out of The depreciation expense of Machine B using Double-Declining-Balance method is calculated as: a. Striaght line rate multiplied with 2 b. 100%/Useful life c. Double declining balance rate multipled with beginning period book value d. All of the given options 39 d out of The acquisition cost of Machine A to be recorded in the company's books is: a. RO 50,000 b. RO 48,000 C.RO 50,100 d. RO 49,850

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started