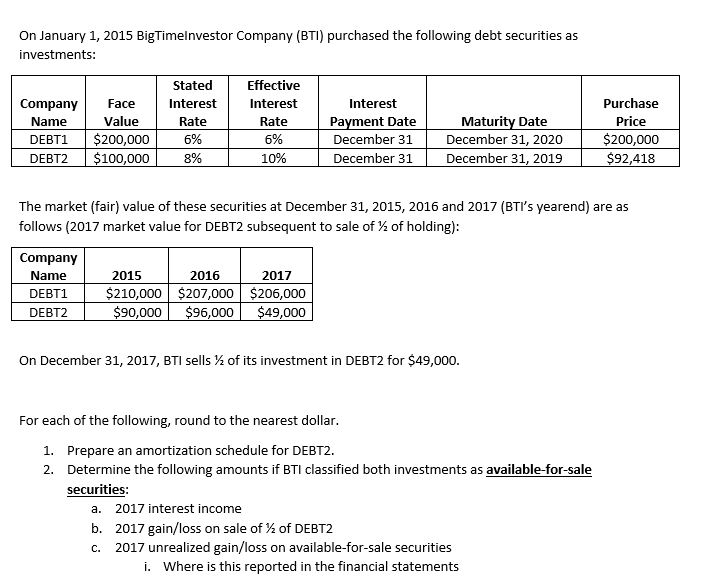

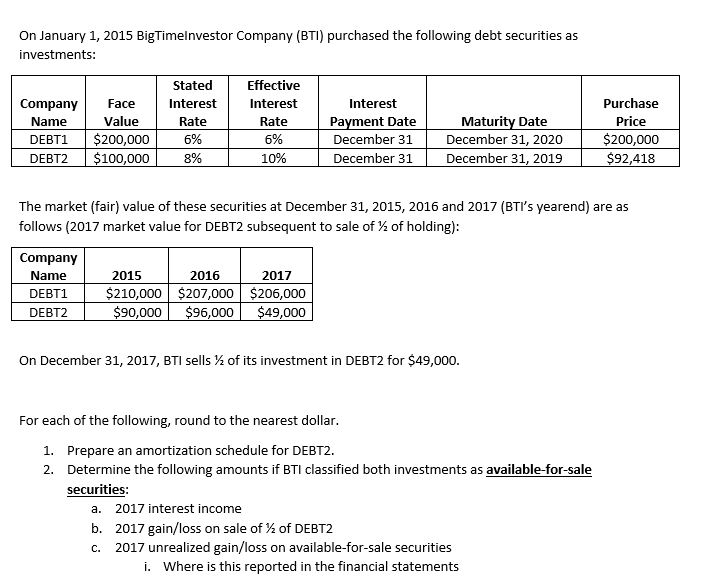

On January 1, 2015 BigTimelnvestor Company (BTI) purchased the following debt securities as investments: Company Face Name Stated Interest Rate 6% 8% Effective interest Rate 6% 10% Interest Payment Date December 31 December 31 Purchase Price $200,000 $92,418 DEBT1 DEBT2 Maturity Date December 31, 2020 December 31, 2019 $200,000 $100,000 | The market (fair) value of these securities at December 31, 2015, 2016 and 2017 (BTI's yearend) are as follows (2017 market value for DEBT2 subsequent to sale of % of holding): Company Name I 2015 $210,000 $90,000 2016 $207,000 $96,000 2017 $206,000 $49,000 | DEBT2 | On December 31, 2017, BTI sells of its investment in DEBT2 for $49,000. For each of the following, round to the nearest dollar. 1. Prepare an amortization schedule for DEBT2. 2. Determine the following amounts if BTI classified both investments as available-for-sale securities: a. 2017 interest income b. 2017 gain/loss on sale of 12 of DEBT2 C. 2017 unrealized gain/loss on available-for-sale securities i. Where is this reported in the financial statements On January 1, 2015 BigTimelnvestor Company (BTI) purchased the following debt securities as investments: Company Face Name Stated Interest Rate 6% 8% Effective interest Rate 6% 10% Interest Payment Date December 31 December 31 Purchase Price $200,000 $92,418 DEBT1 DEBT2 Maturity Date December 31, 2020 December 31, 2019 $200,000 $100,000 | The market (fair) value of these securities at December 31, 2015, 2016 and 2017 (BTI's yearend) are as follows (2017 market value for DEBT2 subsequent to sale of % of holding): Company Name I 2015 $210,000 $90,000 2016 $207,000 $96,000 2017 $206,000 $49,000 | DEBT2 | On December 31, 2017, BTI sells of its investment in DEBT2 for $49,000. For each of the following, round to the nearest dollar. 1. Prepare an amortization schedule for DEBT2. 2. Determine the following amounts if BTI classified both investments as available-for-sale securities: a. 2017 interest income b. 2017 gain/loss on sale of 12 of DEBT2 C. 2017 unrealized gain/loss on available-for-sale securities i. Where is this reported in the financial statements