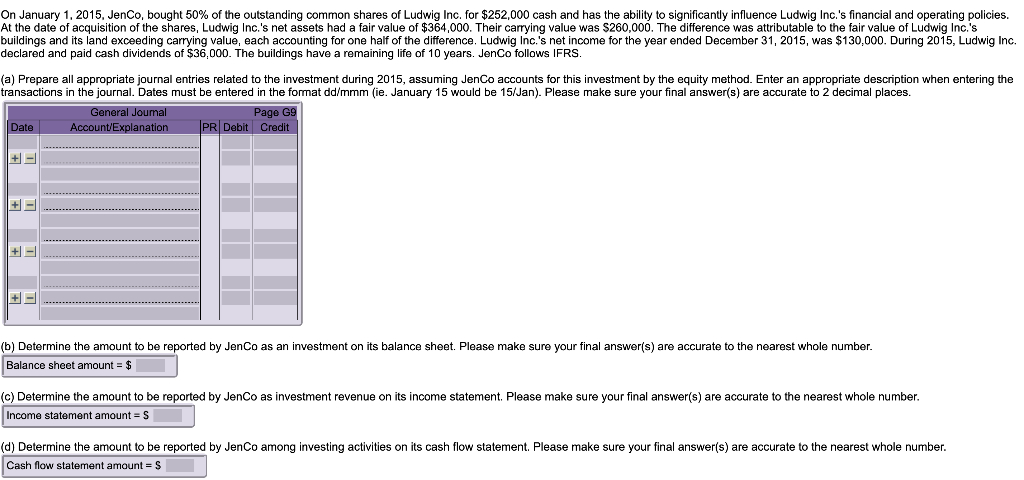

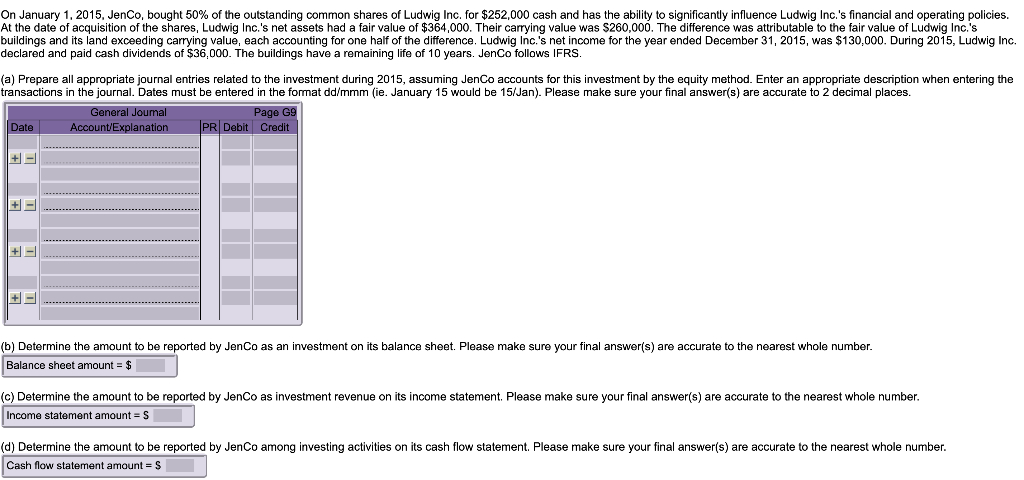

On January 1, 2015. JenCo, bought 50% of the outstanding common shares of Ludwig Inc. for $252,000 cash and has the ability to significantly influence Ludwig Inc.'s financial and operating policies. At the date of acquisition of the shares, Ludwig Inc.'s net assets had a fair value of $364,000. Their carrying value was $260,000. The difference was attributable to the fair value of Ludwig Inc.'s buildings and its land exceeding carrying value, each accounting for one half of the difference. Ludwig Inc.'s net income for the year ended December 31, 2015, was $130,000. During 2015, Ludwig Inc. declared and paid cash dividends of $36,000. The buildings have a remaining life of 10 years. JenCo follows IFRS. (a) Prepare all appropriate journal entries related to the investment during 2015, assuming JenCo accounts for this investment by the equity method. Enter an appropriate description when entering the transactions in the journal. Dates must be entered in the format dd/mmm (ie. January 15 would be 15/Jan). Please make sure your final answer(s) are accurate to 2 decimal places. General Joumal Page G9 Date Account/Explanation PR Debit Credit + 1 (6) Determine the amount to be reported by JenCo as an investment on its balance sheet. Please make sure your final answer(s) are accurate to the nearest whole number. Balance sheet amount = $ (c) Determine the amount to be reported by JenCo as investment revenue on its income statement. Please make sure your final answer(s) are accurate to the nearest whole number. Income statement amount = S (d) Determine the amount to be reported by JenCo among investing activities on its cash flow statement. Please make sure your final answer(s) are accurate to the nearest whole number. Cash flow statement amount = $ On January 1, 2015. JenCo, bought 50% of the outstanding common shares of Ludwig Inc. for $252,000 cash and has the ability to significantly influence Ludwig Inc.'s financial and operating policies. At the date of acquisition of the shares, Ludwig Inc.'s net assets had a fair value of $364,000. Their carrying value was $260,000. The difference was attributable to the fair value of Ludwig Inc.'s buildings and its land exceeding carrying value, each accounting for one half of the difference. Ludwig Inc.'s net income for the year ended December 31, 2015, was $130,000. During 2015, Ludwig Inc. declared and paid cash dividends of $36,000. The buildings have a remaining life of 10 years. JenCo follows IFRS. (a) Prepare all appropriate journal entries related to the investment during 2015, assuming JenCo accounts for this investment by the equity method. Enter an appropriate description when entering the transactions in the journal. Dates must be entered in the format dd/mmm (ie. January 15 would be 15/Jan). Please make sure your final answer(s) are accurate to 2 decimal places. General Joumal Page G9 Date Account/Explanation PR Debit Credit + 1 (6) Determine the amount to be reported by JenCo as an investment on its balance sheet. Please make sure your final answer(s) are accurate to the nearest whole number. Balance sheet amount = $ (c) Determine the amount to be reported by JenCo as investment revenue on its income statement. Please make sure your final answer(s) are accurate to the nearest whole number. Income statement amount = S (d) Determine the amount to be reported by JenCo among investing activities on its cash flow statement. Please make sure your final answer(s) are accurate to the nearest whole number. Cash flow statement amount = $