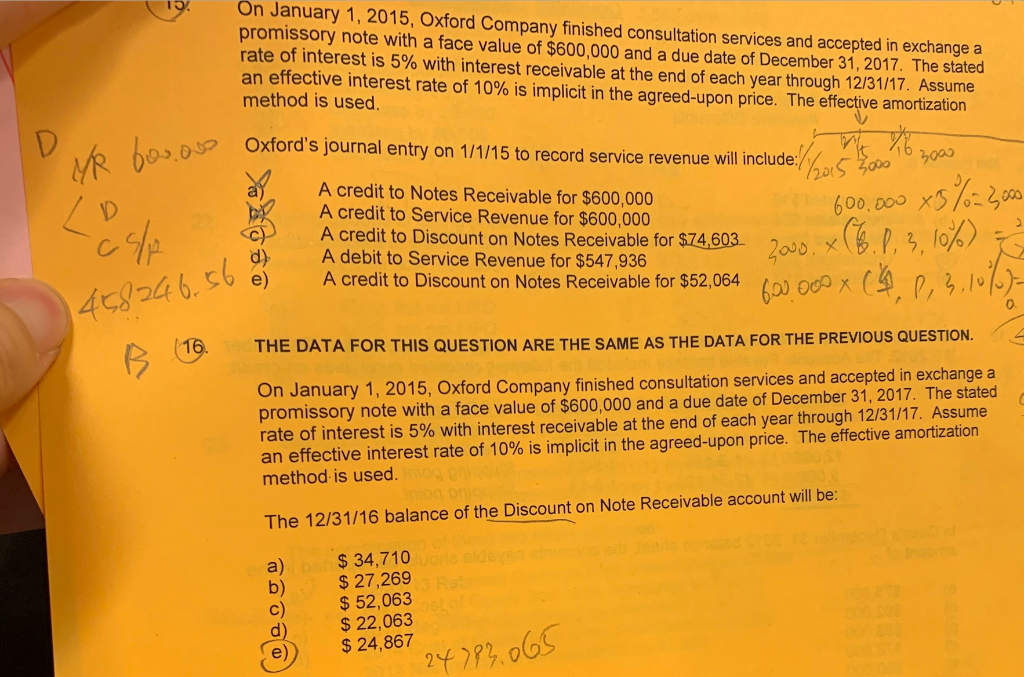

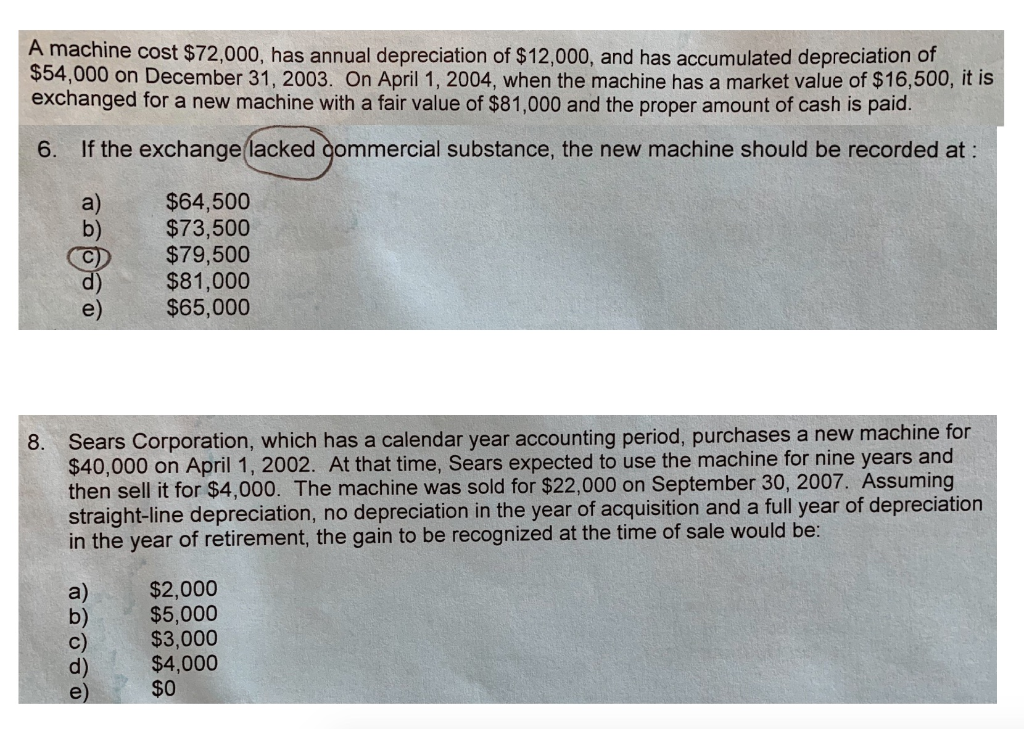

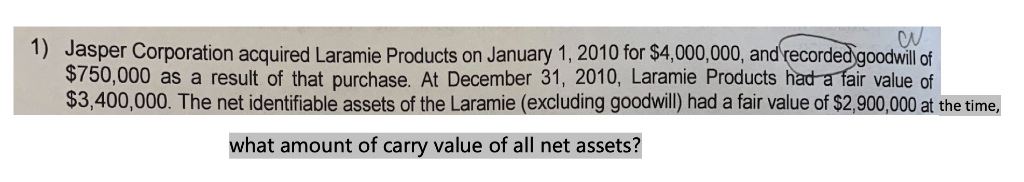

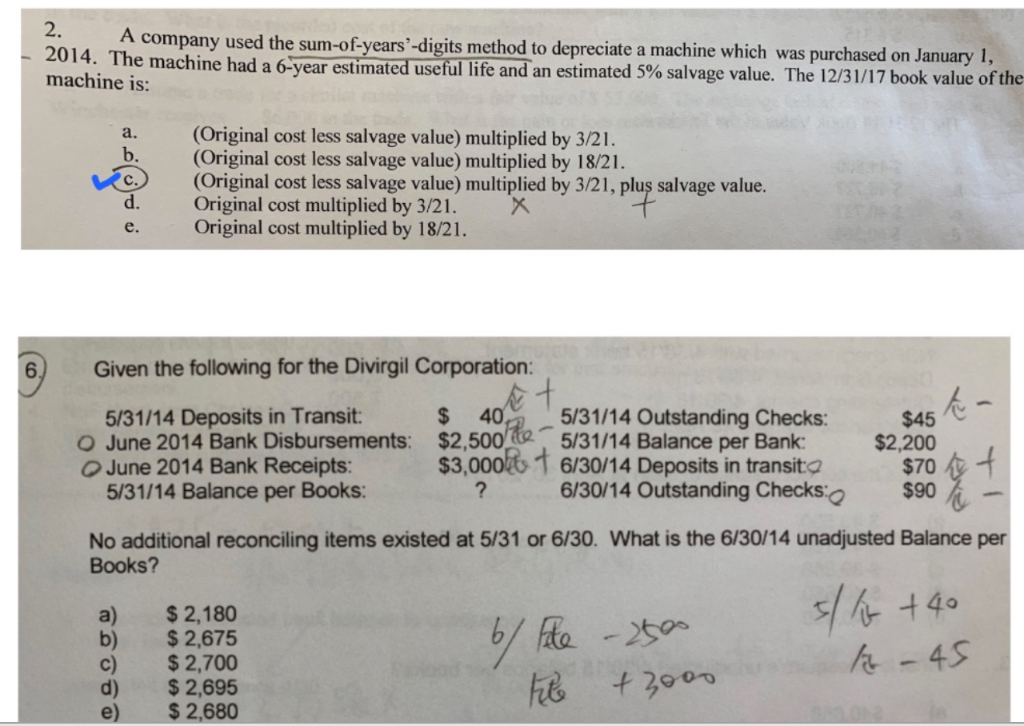

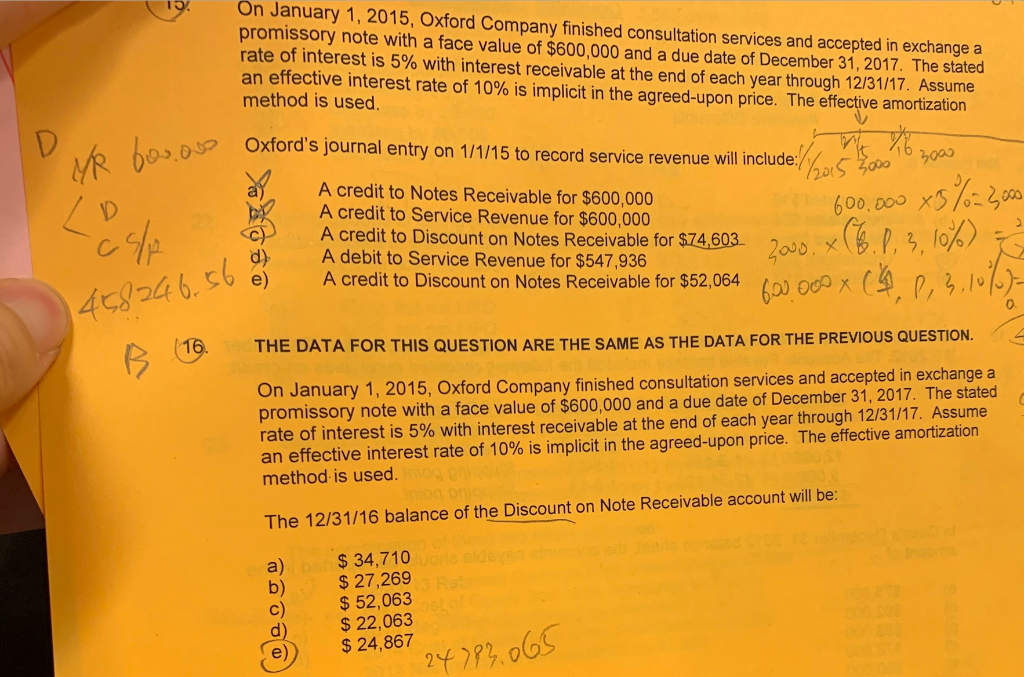

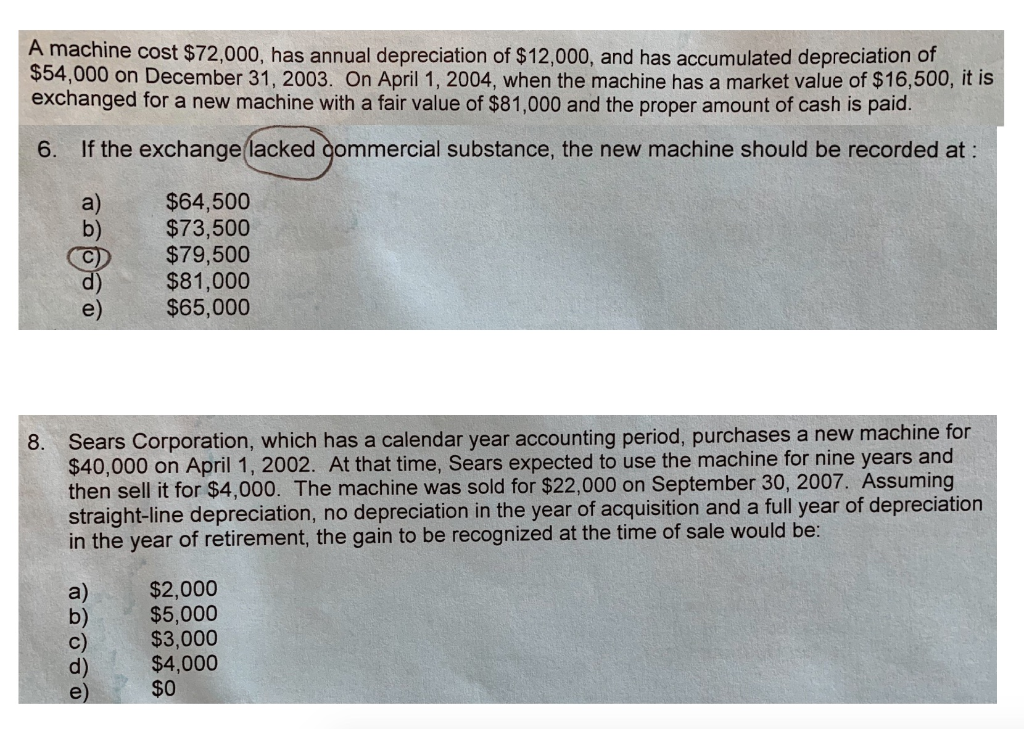

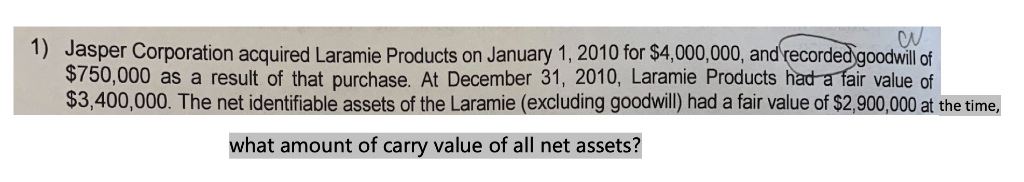

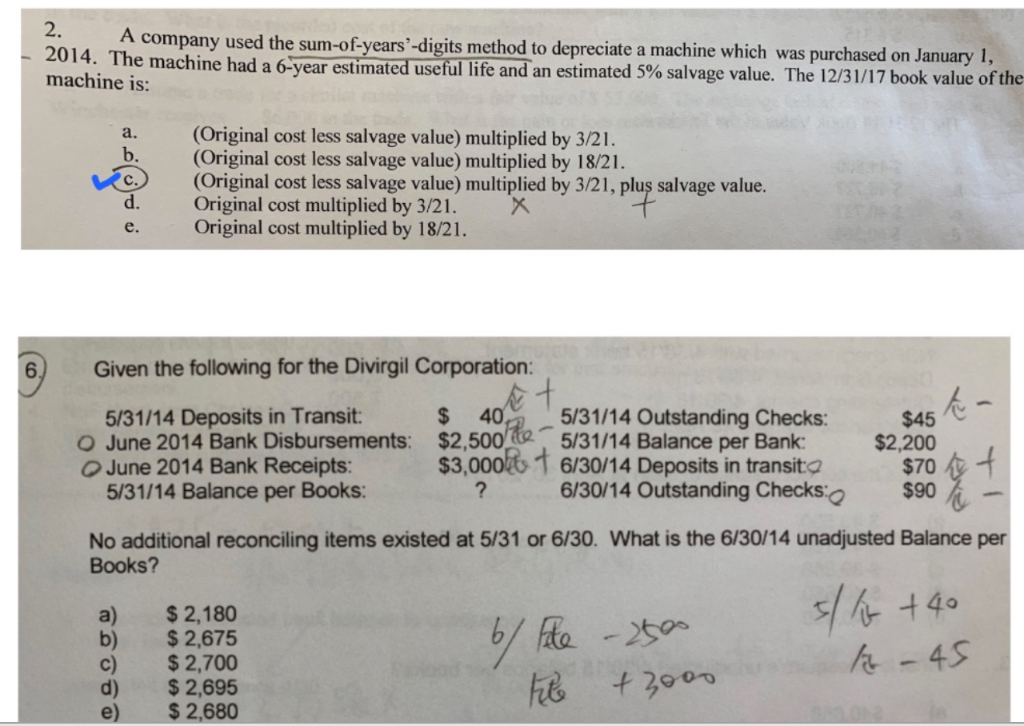

On January 1, 2015, Oxford Company finished consultation services and accepted in exchange a promissory note with a face value of $600,000 and a due date of December 31, 2017. The stated rate of interest is 5% with interest receivable at the end of each year through 12/31/17. Assume an effective interest rate of 10% is implicit in the agreed-upon price. The effective amortization method is used D R basaus Oxford's journal entry on 1/1/15 to record service revenue will include:/ 3000 A credit to Notes Receivable for $600,000 A credit to Service Revenue for $600,000 A credit to Discount on Notes Receivable for $74,603 200 xS7-200 600,000 A debit to Service Revenue for $547,936 A credit to Discount on Notes Receivable for $52,064 e) 4824 6.56 16 THE DATA FOR THIS QUESTION ARE THE SAMEAS THE DATA FOR THE PREVIOUS QUESTION. On January 1, 2015, Oxford Company finished consultation services and accepted in exchange a promissory note with a face value of $600,000 and a due date of December 31, 2017. The stated rate of interest is 5% with interest receivable at the end of each year through 12/31/17. Assume an effective interest rate of 10% is implicit in the agreed-upon price. The effective amortization method is used. d b The 12/31/16 balance of the Discount on Note Receivable account will be: $ 34,710 te oldeven etnK $27,269 st $52,063 $22,063 $24,867 a) b) A machine cost $72.000, has annual depreciation of $12,000, and has accumulated depreciation of $54,000 on December 31, 2003. On April 1, 2004, when the machine has a market value of $16,500, it is exchanged for a new machine with a fair value of $81,000 and the proper amount of cash is paid If the exchange lacked gommercial substance, the new machine should be recorded at: 6. $64,500 $73,500 $79,500 $81,000 $65,000 a Sears Corporation, which has a calendar year accounting period, purchases a new machine for $40,000 on April 1, 2002. At that time, Sea then sell it for $4,000. The machine was sold for $22,000 on September 30, 2007. Assuming straight-line depreciation, no depreciation in the year of acquisition and a full year of depreciation in the year of retirement, the gain to be recognized at the time of sale would be: 8 expected to use the machine for nine years and $2,000 $5,000 $3.000 $4,000 $0 a) 1) Jasper Corporation acquired Laramie Products on January 1, 2010 for $4,000,000, and'recorded goodwill of $750,000 as a result of that purchase. At December 31, 2010, Laramie Products had a fair value of $3,400,000. The net identifiable assets of the Laramie (excluding goodwill) had a fair value of $2,900,000 at the time, what amount of carry value of all net assets? 2. A company used the sum-of-years'-digits method to depreciate a machine which was purchased on January 1, 2014. The machine had a 6-year estimated useful life and an estimated 5% salvage value. The 12/31/17 book value of the machine is: (Original cost less salvage value) multiplied by 3/21 (Original cost less salvage value) multiplied by 18/21 (Original cost less salvage value) multiplied by 3/21, plu salvage value Original cost multiplied by 3/21. Original cost multiplied by 18/21. a. b. c. d. e. Given the following for the Divirgil Corporation: 6 5/31/14 Deposits in Transit: O June 2014 Bank Disbursements: June 2014 Bank Receipts: 5/31/14 Balance per Books: 40 $2,500 $3,000&t 5/31/14 Outstanding Checks 5/31/14 Balance per Bank 6/30/14 Deposits in transitO 6/30/14 Outstanding Checks $ $45 $2,200 $70 ? $90 No additional reconciling items existed at 5/31 or 6/30. What is the 6/30/14 unadjusted Balance per Books? $2,180 $2,675 $2,700 $2,695 $ 2,680 a Fto-25 b) h-45 d) e