Question

On January 1, 2015, Parker Company acquired 90% of the common stock of Stride Company for $351,000. On this date, Stride had common stock, other

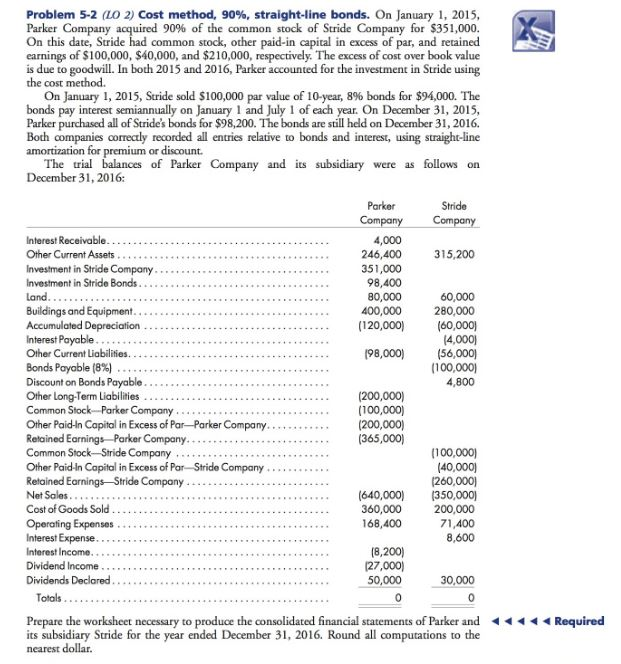

On January 1, 2015, Parker Company acquired 90% of the common stock of Stride Company for $351,000. On this date, Stride had common stock, other paid-in capital in excess of par, and retained earnings of $100,000, $40,000, and $210,000, respectively. The excess of cost over book value is due to goodwill. In both 2015 and 2016, Parker accounted for the investment in Stride using the cost method.

Required for the complete answer:

1. DETERMINATION/DISTRIBUTION OF EXCESS SCHEDULE

2. INCOME DISTRIBUTION SCHEDULE

3. CONSOLIDATED WORKSHEET

4. ELIMINATIONS AND ADJUSTMENT WORKSHEET

Problem 5-2 (LO 2) Cost method, 90%, straight-line bonds. On January 1, 2015, Parker Company acquired 90% of the common stock of Stride Company for $351,000. On this date, Stride had common stock, other paid-in capital in excess of par, and retained earnings of $100,000, $40,000, and $210,000, respectively. The excess of cost over book value is due to goodwill. In both 2015 and 2016, Parker accounted for the investment in Stride using the cost method. On January 1, 2015, Stride sold $100,000 par value of 10-year, 8% bonds for $94,000. The bonds pay interest semiannually on January 1 and July I of each year. On December 31, 2015, Parker purchased all of Stride's bonds for $98,200. The bonds are still held on December 31, 2016. Both companies correctly recorded all entries relative to bonds and interest, using straight-line amortization for premium or discount. The ial balances of Parker Company and its subsidiary were as follows on December 31,2016: Interest Receivable 246,400 315,200 Investment in Stride Company.... Investment in Stride Bonds.... 351,000 98,400 80,000 ...400,000 (120,000) Buildings and Equipment... Accumulated Depreciation Interest Payable Other Current Liabilities... Bonds Payable (8%) 60,000 280,000 (60,000! 4,000 (56,000 (100,000 4,800 98,000 Other Long-Term Liabilities (200,000) Other Paid-ln Capital in Excess of Par-Parker Company. " , (200,000) Common Stock Stride Company Other Paid-In Capital in Excess of Par Stride Company............ (100,000] (40,000) 260,000 Net Sales. Cost of Goods Sold... Operating Expenses Interest Expense.... Interest Income... 360,000 2 168,400 200,000 71,400 8,600 (8,200) 27,000 50,000 Dividends Declared.. 30,000 Totals Required Prepare the worksheet necessary to produce the consolidated financial statements of Parker and its subsidiary Stride for the year ended December 31, 2016. Round all computations to the nearest dollarStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started