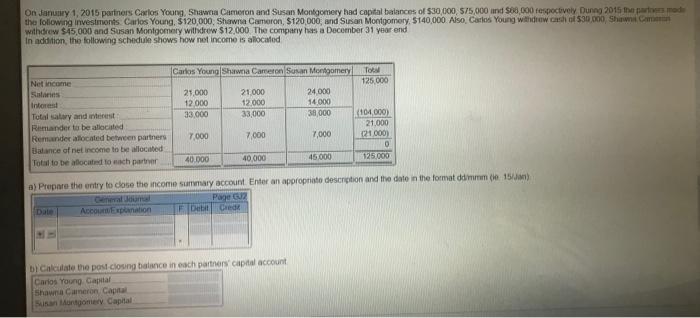

On January 1, 2015 partners Carlos Young, Shawna Cameron and Susan Montgomery had capital balances of $30,000, 575,000 and $60,000 respectively Dunna 2015 the part mode the following investments Carlos Young, $120,000, Shawna Cameron, $120,000, and Susan Montgomery, 5140,000 Also, Carlos Young withdraw cash of $30,000 Shawn withdrew $45,000 and Susan Montgomery withdrew $12,000 The company has a December 31 year and In addition, the following schedule shows how net income is located Carlos Young Shawna Cameron Susan Montgomery TORM 125.000 25.000 12 000 33.000 21000 12.000 33,000 24 000 14.000 38 000 Net income Salas Interest Total salary and interest Reinander to be allocated Remander allocated between partners balance of net income to be located Total to be alocated to each part 7.000 7.000 7,000 (104.000) 21.000 121000) 0 125.000 40.000 40.000 45.000 a) Prepare the entry to close the income summary account. Enter an appropriate description and the date in the format ddm (15) Page 2 ACCEponation Debit Crede Dal IN by calculate the post cloong balance in each partners capital account Carlos Young Capital Shawn Cameron Capital Susan ngomery Capital Question 7 [5 points) Choose the term that best matches each of the following descriptions a) select and viina LLP, people who are responsible for the management of the partnership and assume unlimited lubaty b) Select ano The distribution of the business income to the owner c) wled anwar win a LLP people who have limited liability but also limited roles in the partship as specited in the partnership agreement d) select anver A form of partnership that is permitted for professionals such as lawyers and accountants, and has limited partners with limited liabilities e) select answer A partner can commit the partnership to any contract because each partner is an authorized agent of the partnership On January 1, 2015 partners Carlos Young, Shawna Cameron and Susan Montgomery had capital balances of $30,000, 575,000 and $60,000 respectively Dunna 2015 the part mode the following investments Carlos Young, $120,000, Shawna Cameron, $120,000, and Susan Montgomery, 5140,000 Also, Carlos Young withdraw cash of $30,000 Shawn withdrew $45,000 and Susan Montgomery withdrew $12,000 The company has a December 31 year and In addition, the following schedule shows how net income is located Carlos Young Shawna Cameron Susan Montgomery TORM 125.000 25.000 12 000 33.000 21000 12.000 33,000 24 000 14.000 38 000 Net income Salas Interest Total salary and interest Reinander to be allocated Remander allocated between partners balance of net income to be located Total to be alocated to each part 7.000 7.000 7,000 (104.000) 21.000 121000) 0 125.000 40.000 40.000 45.000 a) Prepare the entry to close the income summary account. Enter an appropriate description and the date in the format ddm (15) Page 2 ACCEponation Debit Crede Dal IN by calculate the post cloong balance in each partners capital account Carlos Young Capital Shawn Cameron Capital Susan ngomery Capital Question 7 [5 points) Choose the term that best matches each of the following descriptions a) select and viina LLP, people who are responsible for the management of the partnership and assume unlimited lubaty b) Select ano The distribution of the business income to the owner c) wled anwar win a LLP people who have limited liability but also limited roles in the partship as specited in the partnership agreement d) select anver A form of partnership that is permitted for professionals such as lawyers and accountants, and has limited partners with limited liabilities e) select answer A partner can commit the partnership to any contract because each partner is an authorized agent of the partnership