Answered step by step

Verified Expert Solution

Question

1 Approved Answer

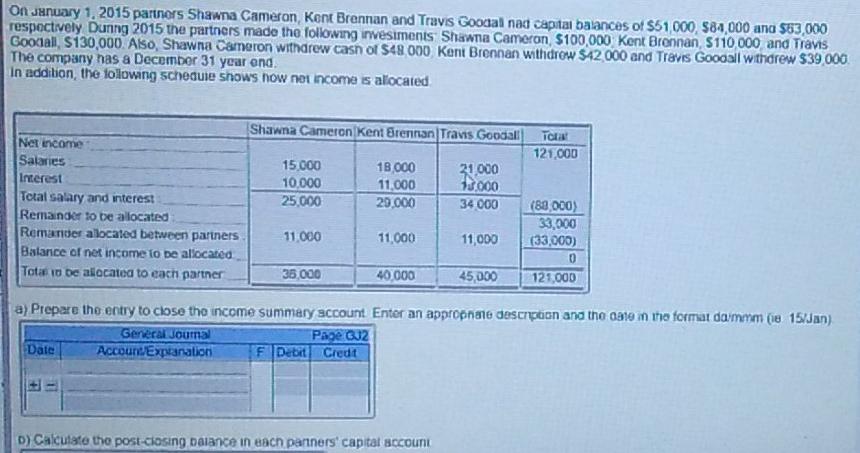

On January 1, 2015 partners Shawna Cameron Kent Brennan and Travis Goocal nad capital balances of $51.000, $84,000 ana 553,000 respectively Dunng 2015 the partners

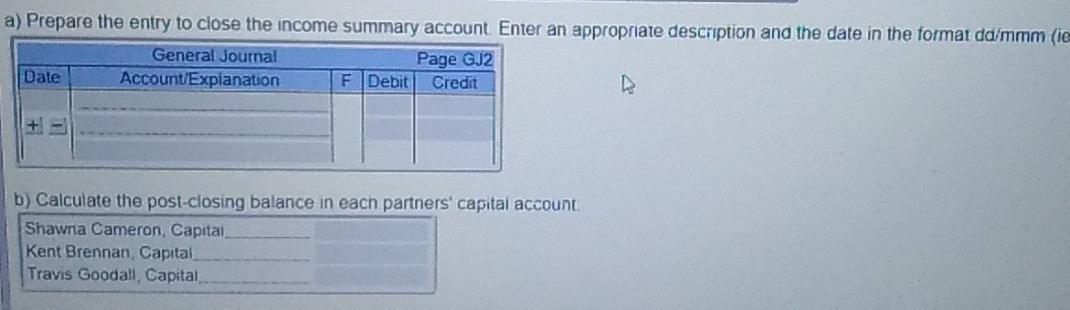

On January 1, 2015 partners Shawna Cameron Kent Brennan and Travis Goocal nad capital balances of $51.000, $84,000 ana 553,000 respectively Dunng 2015 the partners made the following invesiments Shawna Cameron $100,000 Kent Brennan S110 000 and Travis Goociall, S130,000. Also, Shawna Cameron withdrew cash or $48000 Kent Brennan withdrew $42.000 and Travis Goodall withdrew 539 000 The company has a December 31 year end In addition, the following schedule shows how net income is allocated Net income Salaries Interest Total salary and interest Remainder to be alocated Remander a located between partners Balance of net income to be allocated Totao be allocated to each partner Shawna Cameron Kent Brennan Travis Goodall TCR 121.000 15.000 18.000 21.000 10.000 11.000 11.000 25,000 20.000 34 000 (88000) 33,000 11.000 11,000 11,000 (33,000) 35,000 40.000 45,000 121,000 a) Prepare the entry to close the income summary account Enter an appropnane description and the 0910 in the format dammm (ie 15/Jan) General Jouma Page QJZ Date AccoundExplanation F Debit Credit D) Calculate the post-closing Dalance in each partners' capital account a) Prepare the entry to close the income summary account Enter an appropriate description and the date in the format dd/mmm (ie General Journal Page GJ2 Date Account'Explanation F Debit Credit b) Calculate the post-closing balance in each partners' capital account Shawna Cameron, Capital Kent Brennan Capital Travis Goodall, Capital

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started