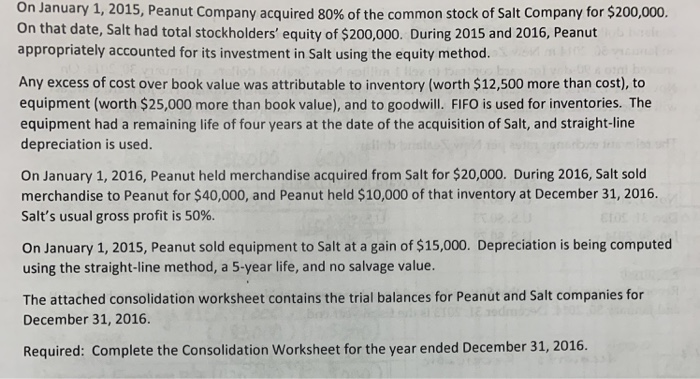

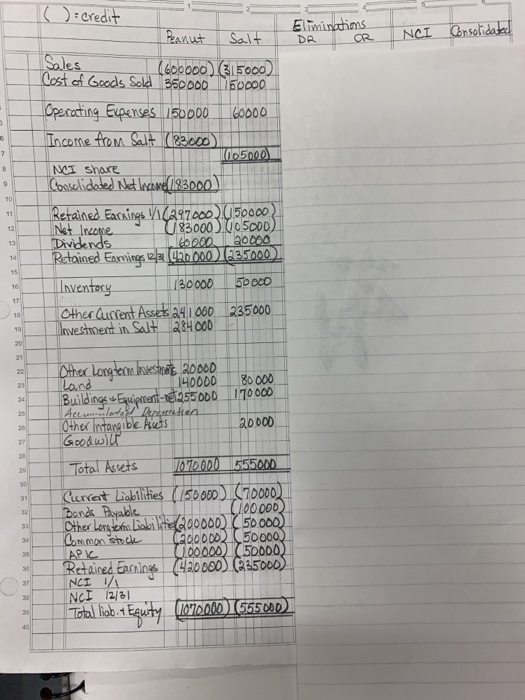

On January 1, 2015, Peanut Company acquired 80% of the common stock of Salt Company for $200,000. On that date, Salt had total stockholders' equity of $200,000. During 2015 and 2016, Peanut appropriately accounted for its investment in Salt using the equity method. Any excess of cost over book value was attributable to inventory (worth $12,500 more than cost), to equipment (worth $25,000 more than book value), and to goodwill. FIFO is used for inventories. The equipment had a remaining life of four years at the date of the acquisition of Salt, and straight-line depreciation is used. On January 1, 2016, Peanut held merchandise acquired from Salt for $20,000. During 2016, Salt sold merchandise to Peanut for $40,000, and Peanut held $10,000 of that inventory at December 31, 2016. Salt's usual gross profit is 50%. On January 1, 2015, Peanut sold equipment to Salt at a gain of $15,000. Depreciation is being computed using the straight-line method, a 5-year life, and no salvage value. The attached consolidation worksheet contains the trial balances for Peanut and Salt companies for December 31, 2016. Required: Complete the Consolidation Worksheet for the year ended December 31, 2016 1() : credit Elminctims 35OD00 160000 000 ob00 MI share Retained Eac ing V(7 00500 83000)0OSODD) 30000 5 oco er Cu Asses 841 000 235000 long H0000 80 000 255000-1 70 000 Ae 70000 555000 60000 5000 otalNets 0000) (35000 INCI On January 1, 2015, Peanut Company acquired 80% of the common stock of Salt Company for $200,000. On that date, Salt had total stockholders' equity of $200,000. During 2015 and 2016, Peanut appropriately accounted for its investment in Salt using the equity method. Any excess of cost over book value was attributable to inventory (worth $12,500 more than cost), to equipment (worth $25,000 more than book value), and to goodwill. FIFO is used for inventories. The equipment had a remaining life of four years at the date of the acquisition of Salt, and straight-line depreciation is used. On January 1, 2016, Peanut held merchandise acquired from Salt for $20,000. During 2016, Salt sold merchandise to Peanut for $40,000, and Peanut held $10,000 of that inventory at December 31, 2016. Salt's usual gross profit is 50%. On January 1, 2015, Peanut sold equipment to Salt at a gain of $15,000. Depreciation is being computed using the straight-line method, a 5-year life, and no salvage value. The attached consolidation worksheet contains the trial balances for Peanut and Salt companies for December 31, 2016. Required: Complete the Consolidation Worksheet for the year ended December 31, 2016 1() : credit Elminctims 35OD00 160000 000 ob00 MI share Retained Eac ing V(7 00500 83000)0OSODD) 30000 5 oco er Cu Asses 841 000 235000 long H0000 80 000 255000-1 70 000 Ae 70000 555000 60000 5000 otalNets 0000) (35000 INCI