Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2015, Pips Company acquired 80% of the common stock of Subs Company for exist560,000. On this date subs had total owners' equity

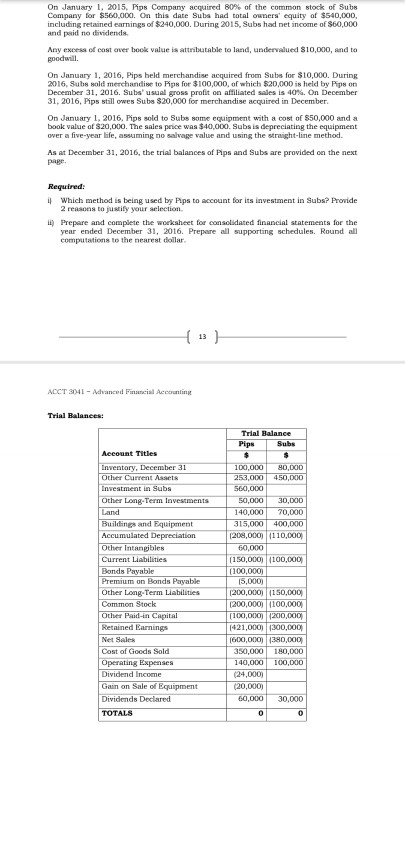

On January 1, 2015, Pips Company acquired 80% of the common stock of Subs Company for exist560,000. On this date subs had total owners' equity of exist540,000, including retained earnings of exist240,000. During 2015, Subs had net income of exist60,000 and paid no dividends. Any excess of cost over book value is attributable to land, undervalued exist10,000, and to goodwill. On January 2016, Pips held merchandise acquired from Subs for exist10,000. During 2016, Subs sold merchandise to Pips for exist100,000, of which exist20,000 is held by Pips on December 31, 2016. Subs' usual gross profit on affiliated sales is 40%. On December 31, 2016, Pips still owes Subs exist20,000 for merchandise acquired in December. On January 1, 2016. Pips sold to Subs some equipment with a cost of exist50,000 and a book value of exist20,000. The sales price was exist40,000. Subs is depreciating the equipment over a five-year life, assuming salvage value and using the straight-line method. As at December 31, 2016, the trial balances of Pips and Subs are provided on the next page. Required: i) Which method is being used by Pips to account for its investment in Subs? Provide 2 reasons to justify your selection. ii) Prepare and complete the worksheet for consolidated financial statements for the year ended December 31, 2016 Prepare all supporting schedules. Round all computations to the nearest dollar. On January 1, 2015, Pips Company acquired 80% of the common stock of Subs Company for exist560,000. On this date subs had total owners' equity of exist540,000, including retained earnings of exist240,000. During 2015, Subs had net income of exist60,000 and paid no dividends. Any excess of cost over book value is attributable to land, undervalued exist10,000, and to goodwill. On January 2016, Pips held merchandise acquired from Subs for exist10,000. During 2016, Subs sold merchandise to Pips for exist100,000, of which exist20,000 is held by Pips on December 31, 2016. Subs' usual gross profit on affiliated sales is 40%. On December 31, 2016, Pips still owes Subs exist20,000 for merchandise acquired in December. On January 1, 2016. Pips sold to Subs some equipment with a cost of exist50,000 and a book value of exist20,000. The sales price was exist40,000. Subs is depreciating the equipment over a five-year life, assuming salvage value and using the straight-line method. As at December 31, 2016, the trial balances of Pips and Subs are provided on the next page. Required: i) Which method is being used by Pips to account for its investment in Subs? Provide 2 reasons to justify your selection. ii) Prepare and complete the worksheet for consolidated financial statements for the year ended December 31, 2016 Prepare all supporting schedules. Round all computations to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started