Question

On January 1, 2015, Purple Rain Company acquired Sunshine Company. Purple Rain Company paid $60 per share for 80% of Sunshines common stock. The price

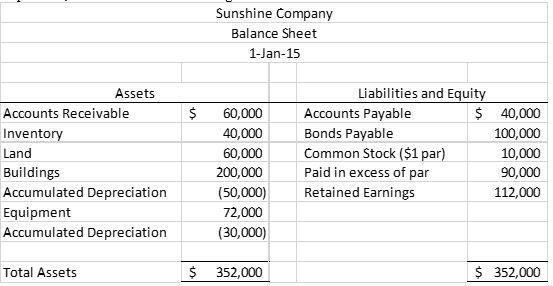

On January 1, 2015, Purple Rain Company acquired Sunshine Company. Purple Rain Company paid $60 per share for 80% of Sunshine’s common stock. The price paid by Purple reflected a control premium. The NCI shares were estimated to have a market value of $55 per share. On the date of acquisition, Sunshine had the following balance sheet:

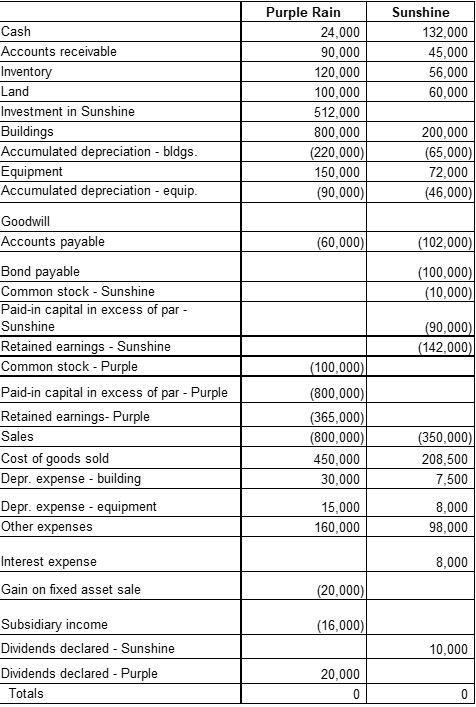

Buildings, which have a 20-year life, were understated by $120,000. Equipment, which has a 5-year life was understated by $40,000. Any remaining excess was considered goodwill. Purple used the simple equity method to account for its investment in Sunshine. January 1, 2016, Purple held merchandise sold to it from Sunshine for $12,000. This beginning inventory had an applicable gross profit of 20%. During 2016, Sunshine sold merchandise to Purple for $90,000. On December 31, 2016, Purple held $18,000 of this merchandise in its inventory (applicable gross profit rate of 25%). Purple owed Sunshine $20,000 on December 31, 2016 as a result of this intercompany sale. On January 1, 2016, Purple sold equipment with a book value of $35,000 to Sunshine for $45,000. Purple also sold assets to nonaffiliates. During 2016, the equipment was used by Sunshine. Depreciation is computed over a 5-year life, using the straight-line method. Purple and Sunshine had the following trial balances on December 31, 2016 (end of second year):

a. Prepare a value analysis and determination of distribution of excess schedule for the investment in Sunshine on January 1, 2015.

b. Write out the elimination entries (in journal form) for the December 31, 2016 consolidation.

c. Prepare the consolidated worksheet as of December 31, 2016, including the income distribution schedule. (The trial balance above is also attached in Excel format.)

Sunshine Company Balance Sheet 1-Jan-15 Assets Liabilities and Equity Accounts Receivable 60,000 Accounts Payable $ 40,000 Bonds Payable Common Stock ($1 par) Inventory 40,000 100,000 Land 60,000 10,000 Buildings Accumulated Depreciation 200,000 Paid in excess of par 90,000 (50,000) 72,000 Retained Earnings 112,000 Equipment Accumulated Depreciation (30,000) Total Assets 352,000 $ 352,000

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Blufon2 Rse Pase a valve arallysis and a detexRnaffion and dishibetion of excess schedele ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started