Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2: The 2015 comparative income statement and the 2015 comparative balance sheet of Golf America, Inc. have just been distributed at a meeting

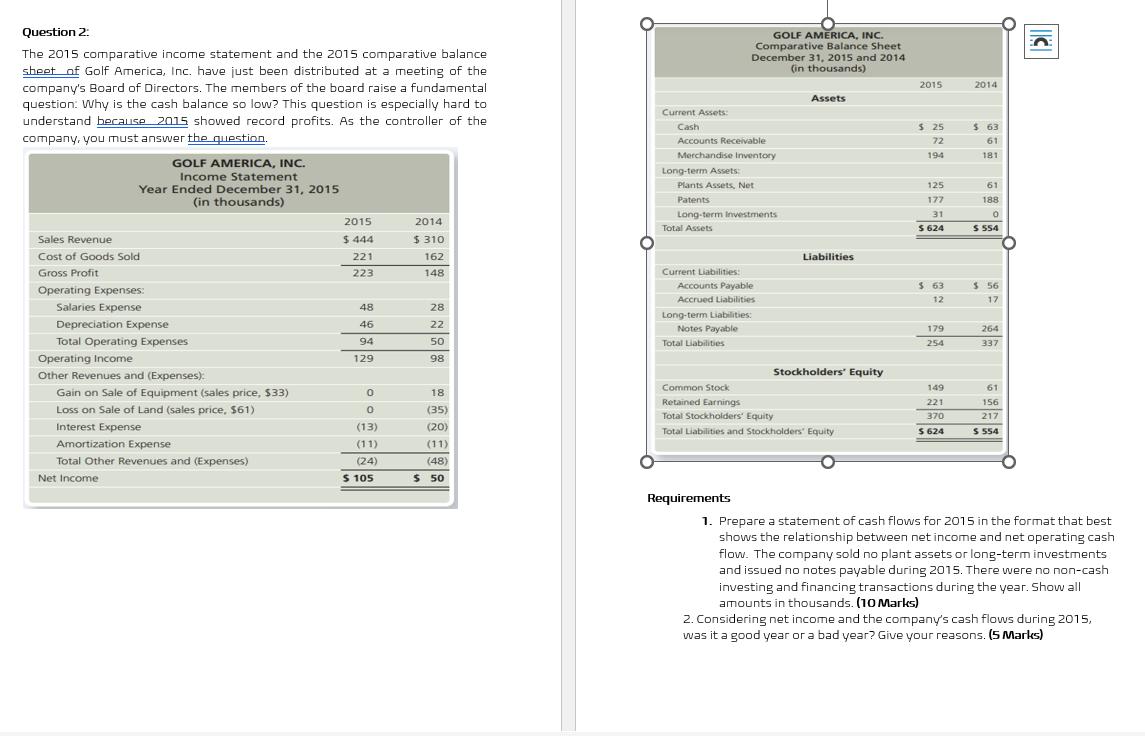

Question 2: The 2015 comparative income statement and the 2015 comparative balance sheet of Golf America, Inc. have just been distributed at a meeting of the company's Board of Directors. The members of the board raise a fundamental question: Why is the cash balance so low? This question is especially hard to understand because 2015 showed record profits. As the controller of the company, you must answer the question. GOLF AMERICA, INC. Income Statement Year Ended December 31, 2015 (in thousands) Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses: Salaries Expense Depreciation Expense Total Operating Expenses Operating Income Other Revenues and (Expenses): Gain on Sale of Equipment (sales price, $33) Loss on Sale of Land (sales price, $61) Interest Expense Amortization Expense Total Other Revenues and (Expenses) Net Income 2015 $444 221 223 48 46 94 129 0 0 (13) (11) (24) $ 105 2014 $310 162 148 28 22 50 98 18 (35) (20) (11) (48) $ 50 Current Assets: Cash Accounts Receivable Merchandise Inventory GOLF AMERICA, INC. Comparative Balance Sheet December 31, 2015 and 2014 (in thousands) Long-term Assets: Plants Assets, Net Patents Long-term Investments Total Assets Current Liabilities: Accounts Payable Accrued Liabilities Long-term Liabilities: Notes Payable Total Liabilities Common Stock Retained Earnings Requirements Assets Liabilities Stockholders' Equity Total Stockholders' Equity Total Liabilities and Stockholders' Equity 2015 5 25 72 194 125 177 31 $ 624 $ 63 12 179 254 149 221 370 $ 624 2014 $ 63 61 181 61 188 0 $ 554 $ 56 17 264 337 61 156 217 $ 554 1. Prepare a statement of cash flows for 2015 in the format that best shows the relationship between net income and net operating cash flow. The company sold no plant assets or long-term investments and issued no notes payable during 2015. There were no non-cash investing and financing transactions during the year. Show all amounts in thousands. (10 Marks) 2. Considering net income and the company's cash flows during 2015, was it a good year or a bad year? Give your reasons. (5 Marks)

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Cash flow from Operating Activities Particulars Amount in Net Income 105 Add Depreciation 46 Add Amortization 11 Less Increase in Inventory 13 Less In...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started