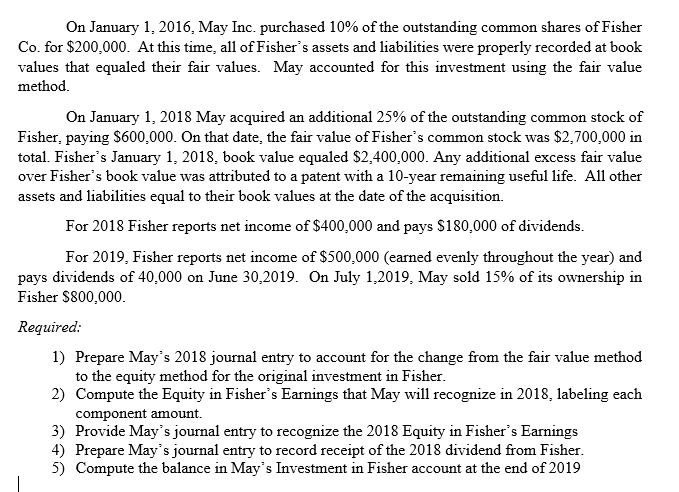

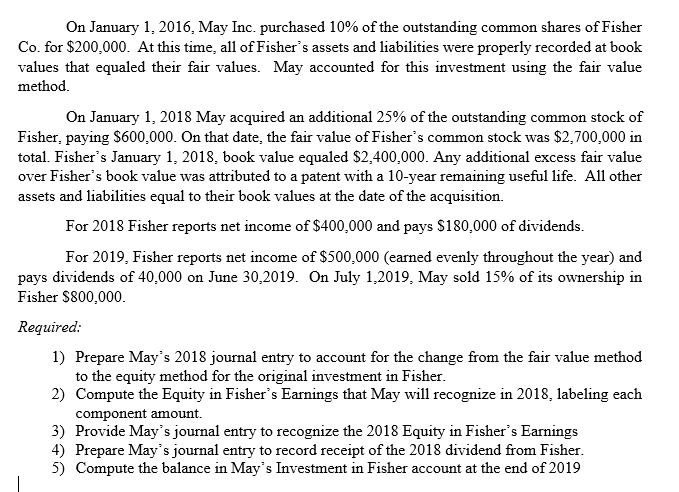

On January 1, 2016. May Inc. purchased 10% of the outstanding common shares of Fisher Co. for $200,000. At this time, all of Fisher's assets and liabilities were properly recorded at book values that equaled their fair values. May accounted for this investment using the fair value method. On January 1, 2018 May acquired an additional 25% of the outstanding common stock of Fisher, paying $600,000. On that date, the fair value of Fisher's common stock was $2,700,000 in total. Fisher's January 1, 2018, book value equaled $2,400,000. Any additional excess fair value over Fisher's book value was attributed to a patent with a 10-year remaining useful life. All other assets and liabilities equal to their book values at the date of the acquisition. For 2018 Fisher reports net income of $400,000 and pays $180,000 of dividends. For 2019, Fisher reports net income of $500,000 (earned evenly throughout the year) and pays dividends of 40,000 on June 30,2019. On July 1,2019. May sold 15% of its ownership in Fisher $800,000. Required: 1) Prepare May's 2018 journal entry to account for the change from the fair value method to the equity method for the original investment in Fisher. 2) Compute the Equity in Fisher's Earnings that May will recognize in 2018, labeling each component amount. 3) Provide May's journal entry to recognize the 2018 Equity in Fisher's Earnings 4) Prepare May's journal entry to record receipt of the 2018 dividend from Fisher. 5) Compute the balance in May's Investment in Fisher account at the end of 2019 On January 1, 2016. May Inc. purchased 10% of the outstanding common shares of Fisher Co. for $200,000. At this time, all of Fisher's assets and liabilities were properly recorded at book values that equaled their fair values. May accounted for this investment using the fair value method. On January 1, 2018 May acquired an additional 25% of the outstanding common stock of Fisher, paying $600,000. On that date, the fair value of Fisher's common stock was $2,700,000 in total. Fisher's January 1, 2018, book value equaled $2,400,000. Any additional excess fair value over Fisher's book value was attributed to a patent with a 10-year remaining useful life. All other assets and liabilities equal to their book values at the date of the acquisition. For 2018 Fisher reports net income of $400,000 and pays $180,000 of dividends. For 2019, Fisher reports net income of $500,000 (earned evenly throughout the year) and pays dividends of 40,000 on June 30,2019. On July 1,2019. May sold 15% of its ownership in Fisher $800,000. Required: 1) Prepare May's 2018 journal entry to account for the change from the fair value method to the equity method for the original investment in Fisher. 2) Compute the Equity in Fisher's Earnings that May will recognize in 2018, labeling each component amount. 3) Provide May's journal entry to recognize the 2018 Equity in Fisher's Earnings 4) Prepare May's journal entry to record receipt of the 2018 dividend from Fisher. 5) Compute the balance in May's Investment in Fisher account at the end of 2019