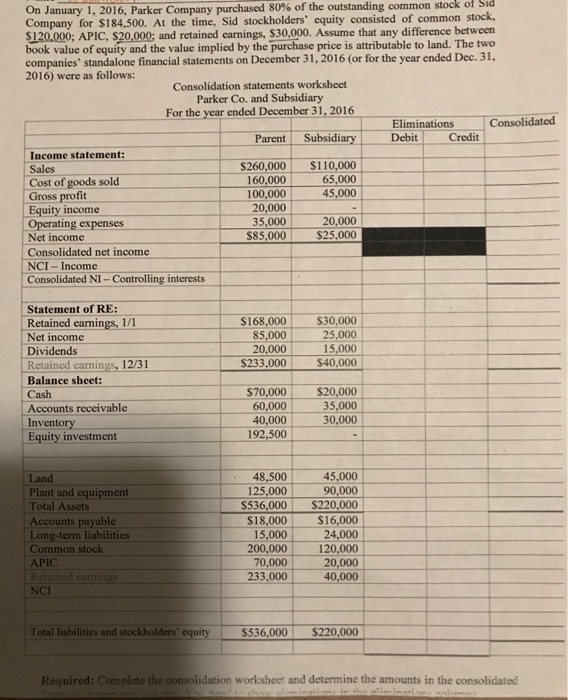

On January 1, 2016, Parker Company purchased 80% of the outstanding common stock of Sid Company for $184,500. At the time, Sid stockholders' equity consisted of common st SI 0.000; APC, $20,000 and retained earnings, $30,000. Assure that any difference between book value of equity and the value implied by the purchase price is attributable to land. The two companies' standalone financial statements on December 31, 2016 (or for the year ended Dec. 31. 2016) were as follows: Consoli Parker Co. and Subsidiary For the year ended December 31, 2016 Eliminations Consolidated Credit Parent Subsidiary S260,000 $110,000 45,000 35,000 20,000 Debit Income statement: Sales Cost of goods sold Gross profit Equity income Operating expenses Net income Consolidated net income NCI- Income Consolidated NI- Controlling interests 160,000 100,000 20,000 $85,000 $25,000 Statement of RE: Retained earnings, 1/1 Net income Dividends s168,000.-530,000 25,000 20,000 15,000 $40,000 85,000 Retained earnings, 12/31 Balance sheet: Cash Accounts receivable Inv S233,000 70,000 60,000 40,000 192,500 $20,000 35,000 30,000 Equity investment 48,500 125,000 45,000 Land Plant and equipment Total Assets Accounts payable Long-term liabilities Common stock $536,000 $220,000 $16,000 15,000 24,000 120,000 20,000 40,000 $18,000 200,000 70,000 233,000 Total liabilities and stockholders' equity $536,000 $220,000 e the consolidation worksheet and determine the amounts in the consolidated On January 1, 2016, Parker Company purchased 80% of the outstanding common stock of Sid Company for $184,500. At the time, Sid stockholders' equity consisted of common st SI 0.000; APC, $20,000 and retained earnings, $30,000. Assure that any difference between book value of equity and the value implied by the purchase price is attributable to land. The two companies' standalone financial statements on December 31, 2016 (or for the year ended Dec. 31. 2016) were as follows: Consoli Parker Co. and Subsidiary For the year ended December 31, 2016 Eliminations Consolidated Credit Parent Subsidiary S260,000 $110,000 45,000 35,000 20,000 Debit Income statement: Sales Cost of goods sold Gross profit Equity income Operating expenses Net income Consolidated net income NCI- Income Consolidated NI- Controlling interests 160,000 100,000 20,000 $85,000 $25,000 Statement of RE: Retained earnings, 1/1 Net income Dividends s168,000.-530,000 25,000 20,000 15,000 $40,000 85,000 Retained earnings, 12/31 Balance sheet: Cash Accounts receivable Inv S233,000 70,000 60,000 40,000 192,500 $20,000 35,000 30,000 Equity investment 48,500 125,000 45,000 Land Plant and equipment Total Assets Accounts payable Long-term liabilities Common stock $536,000 $220,000 $16,000 15,000 24,000 120,000 20,000 40,000 $18,000 200,000 70,000 233,000 Total liabilities and stockholders' equity $536,000 $220,000 e the consolidation worksheet and determine the amounts in the consolidated