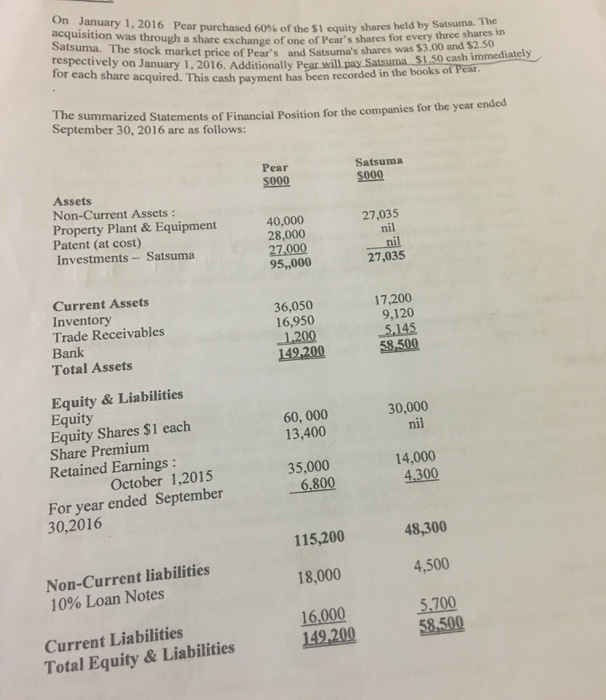

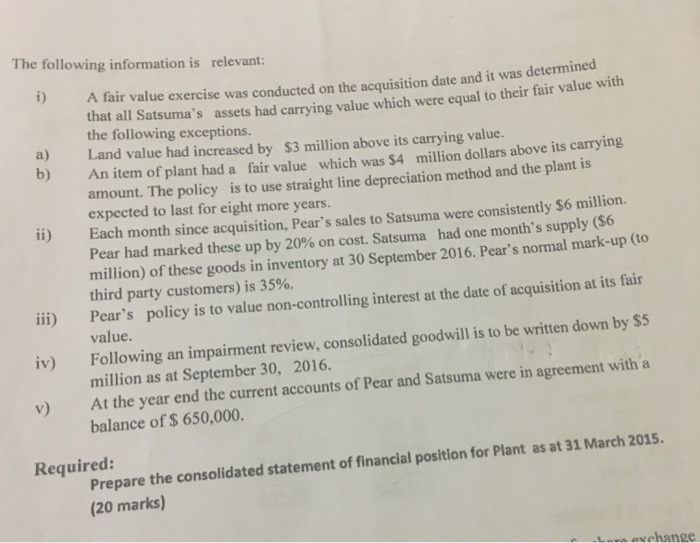

On January 1, 2016 Pear purchase of one of Pear's res was 53.00 January 1, 2016 Pear purchased 60% of the S1 equity shares held by Satsuma. by Satsuma. The acquisition was through a share exchange of one of Pear's shares for every Satsuma. The stock market price of Pear's and Satsuma's shares was of one of Pear's shares for every three shares in respectively on January 1, 2016. Additionally Pear will pay Satsuma price of Pear's and Satsuma's shares was $3.00 and $2.50 for each share acquired. This cash payment has been recorded in the books mally Pear will pay Satsuma $1.50 cash immediately summarized Statements of Financial Position for the companies for the year ended September 30, 2016 are as follows: Pear $000 Satsuma 5000 27,035 Assets Non-Current Assets : Property Plant & Equipment Patent (at cost) Investments - Satsuma nil 40,000 28.000 27,000 95,000 nil 27,035 17,200 36,050 16,950 Current Assets Inventory Trade Receivables Bank Total Assets 1.200 149.200 9,120 5.145 58,500 60,000 13,400 30,000 nil Equity & Liabilities Equity Equity Shares $1 each Share Premium Retained Earnings : October 1,2015 For year ended September 30,2016 35,000 6.800 14,000 4,300 48,300 115,200 4,500 18,000 Non-Current liabilities 10% Loan Notes 16,000 149.200 5.700 58,500 Current Liabilities Total Equity & Liabilities The following information is relevant: A fair value exercise was conducted on the acquisition date and it was detem that all Satsuma's assets had carrying value which were equal to their fair value the following exceptions. Land value had increased by $3 million above its carrying value. An item of plant had a fair value which was $4 million dollars above its carrying amount. The policy is to use straight line depreciation method and the plant is expected to last for eight more years. Each month since acquisition, Pear's sales to Satsuma were consistently $6 million. Pear had marked these up by 20% on cost. Satsuma had one month's supply (S6 million) of these goods in inventory at 30 September 2016. Pear's normal mark-up (to third party customers) is 35%. Pear's policy is to value non-controlling interest at the date of acquisition at its fair iii) value. iv) Following an impairment review, consolidated goodwill is to be written down by $5 million as at September 30, 2016. At the year end the current accounts of Pear and Satsuma were in agreement with a balance of $ 650,000. Required: Prepare the consolidated statement of financial position for Plant as at 31 March 2015. (20 marks) Lunavchange On January 1, 2016 Pear purchase of one of Pear's res was 53.00 January 1, 2016 Pear purchased 60% of the S1 equity shares held by Satsuma. by Satsuma. The acquisition was through a share exchange of one of Pear's shares for every Satsuma. The stock market price of Pear's and Satsuma's shares was of one of Pear's shares for every three shares in respectively on January 1, 2016. Additionally Pear will pay Satsuma price of Pear's and Satsuma's shares was $3.00 and $2.50 for each share acquired. This cash payment has been recorded in the books mally Pear will pay Satsuma $1.50 cash immediately summarized Statements of Financial Position for the companies for the year ended September 30, 2016 are as follows: Pear $000 Satsuma 5000 27,035 Assets Non-Current Assets : Property Plant & Equipment Patent (at cost) Investments - Satsuma nil 40,000 28.000 27,000 95,000 nil 27,035 17,200 36,050 16,950 Current Assets Inventory Trade Receivables Bank Total Assets 1.200 149.200 9,120 5.145 58,500 60,000 13,400 30,000 nil Equity & Liabilities Equity Equity Shares $1 each Share Premium Retained Earnings : October 1,2015 For year ended September 30,2016 35,000 6.800 14,000 4,300 48,300 115,200 4,500 18,000 Non-Current liabilities 10% Loan Notes 16,000 149.200 5.700 58,500 Current Liabilities Total Equity & Liabilities The following information is relevant: A fair value exercise was conducted on the acquisition date and it was detem that all Satsuma's assets had carrying value which were equal to their fair value the following exceptions. Land value had increased by $3 million above its carrying value. An item of plant had a fair value which was $4 million dollars above its carrying amount. The policy is to use straight line depreciation method and the plant is expected to last for eight more years. Each month since acquisition, Pear's sales to Satsuma were consistently $6 million. Pear had marked these up by 20% on cost. Satsuma had one month's supply (S6 million) of these goods in inventory at 30 September 2016. Pear's normal mark-up (to third party customers) is 35%. Pear's policy is to value non-controlling interest at the date of acquisition at its fair iii) value. iv) Following an impairment review, consolidated goodwill is to be written down by $5 million as at September 30, 2016. At the year end the current accounts of Pear and Satsuma were in agreement with a balance of $ 650,000. Required: Prepare the consolidated statement of financial position for Plant as at 31 March 2015. (20 marks) Lunavchange