Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2016, Raptor Electronics purchases a building for $279,000. At first, it estimated that it would last for 25 years and have

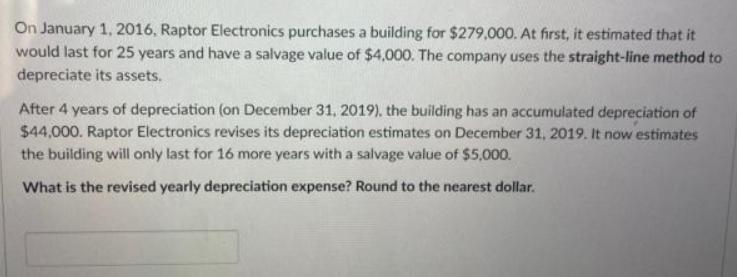

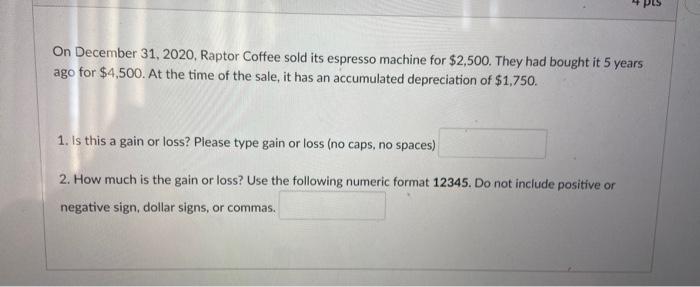

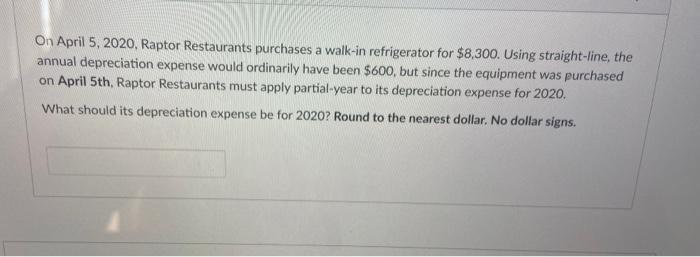

On January 1, 2016, Raptor Electronics purchases a building for $279,000. At first, it estimated that it would last for 25 years and have a salvage value of $4,000. The company uses the straight-line method to depreciate its assets. After 4 years of depreciation (on December 31, 2019), the building has an accumulated depreciation of $44,000. Raptor Electronics revises its depreciation estimates on December 31, 2019. It now estimates the building will only last for 16 more years with a salvage value of $5,000. What is the revised yearly depreciation expense? Round to the nearest dollar. m. On December 31, 2020, Raptor Coffee sold its espresso machine for $2,500. They had bought it 5 years ago for $4,500. At the time of the sale, it has an accumulated depreciation of $1,750. 1. Is this a gain or loss? Please type gain or loss (no caps, no spaces) 2. How much is the gain or loss? Use the following numeric format 12345. Do not include positive or negative sign, dollar signs, or commas. On April 5, 2020, Raptor Restaurants purchases a walk-in refrigerator for $8,300. Using straight-line, the annual depreciation expense would ordinarily have been $600, but since the equipment was purchased on April 5th, Raptor Restaurants must apply partial-year to its depreciation expense for 2020. What should its depreciation expense be for 2020? Round to the nearest dollar. No dollar signs.

Step by Step Solution

★★★★★

3.58 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

1 Depreciation Expense Cost Salvage valueUseful life Cost 279000 Salvage value 4000 Useful li...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started